Will We Get a Holiday Housing Boom? Focus on the Homebuilder Stocks and Interest Rates.

When in doubt look at the present and compare it to the outdated data.

The doom and gloom on housing is so thick now that it seems you can cut it with a knife. Yet, as I often say, it’s often darkest before the dawn.

Recently the headlines blared, “New Home Sales Crashed in October.” By mid-week, things had improved as October pending home sales beat estimates for the second straight month while the Fed’s favorite inflation gauge, the Personal Consumption and Expenditures index (PCE) came in lower than expected. Also, better than expected was the Mortgage Purchase index which rose from the prior month’s level.

The better than expected numbers moved bond yields decidedly lower and raised the odds of another rate cut at the FOMC meeting on December 18.

As a result, the housing stocks are suddenly in better shape than the majority expected. Good thing I issued a Sector Wide BUY Alert a few weeks ago.

Image Courtesy of: harrisonburghousingtoday.com

This better than expected turn of events suggests that astute investors, and the newly hatched market timers of the housing market, may be in for a pleasant holiday surprise. Moreover, if I’m right and there is a burst of activity in December, we can expect better than expected housing numbers in the near future, as I’m starting to see movement in homes which have been on the market for months.

Of course, there are no guarantees. And things could turn south in an instant. But, then why would there be buying on the dips every time homebuilders fall in price? And why would public homebuilders be buying up their private competitors at a steady pace?

The answer, until proven otherwise, is that we are more likely seeing a pause that refreshes than a collapse of the housing market.

How Bad was the Data?

The October new home sales numbers were nowhere near good as new home sales collapsed 17.3% month over month and 9.4% year over year. These were the worst numbers since July 2013. Moreover, June, July, August, and September’s numbers were all revised lower. If there is an asterisk, and for once a reasonable one, the effects of hurricanes Milton and Helene played havoc with starts and sales. The Southeast region took the biggest hit while the West was also down. The Northeast and the Midwest showed higher sales. Rising bond yields from September to mid-November didn’t help either.

But that was then. Bond yields have dropped radically over the last few days, which will set up the next flurry of buyers.

On the Ground – Short Term Bump with Ongoing Structural Changes

Certainly, October’s data was lackluster, especially when the hurricane effects are factored in. Of course, there was plenty of election anxiety in the air as well. But that was in the past.

Currently there are some hopeful signs on the ground. For example, a good friend who’s had his house on the market for several months is on the verge of closing a deal. It so happens the person is moving from the West coast to reconnect with family. As I often note, I still see plenty of out of state license plates every time I go somewhere. And my friend’s buyer is from the West Coast, where there were no hurricanes but October sales were lower.

This is yet another confirmation of the ongoing demographic changes in the U.S. A recent study from the National Association of Realtors confirms this ongoing dynamic, which is seemingly structural.

In addition, I’m seeing more frequent visits from potential buyers to homes I’m keeping an eye on – both existing and newly built. I’ve seen more sales over the last few weeks as well.

Bond Yields Test Long Term Support

The supply and demand side of housing still favors homebuilders. But the market is changing as savvy potential buyers are now waiting for declines in mortgage rates before making their move.

All of which puts the U.S. Ten Year Note yield (TNX) at the center of what happens next. As the price chart shows, TNX has put in what looks to be at least a short term top as it has failed to cross above 4.5% convincingly. However, the more important chart point is 4.2% and the 200-day moving average, which is currently being tested. A move below this chart area would likely take TNX to a test of 4%.

Given that mortgage rates closely follow the trend in TNX, it’s reasonable to expect that the recent decline in TNX will translate into a decent decline in mortgage rates this week. It may have already started as this week’s rates are below last week’s. This drop and expectations of further drops is likely to move savvy potential buyers off the sidelines.

Given that it’s a holiday week, we may not see the data reflected in the numbers until December. But, if I see moving trucks in homes that I’ve been watching for a while, I’ll let you know. The truth is that I wouldn’t be surprised to see them.

Homebuilders and REITs Find a Bid

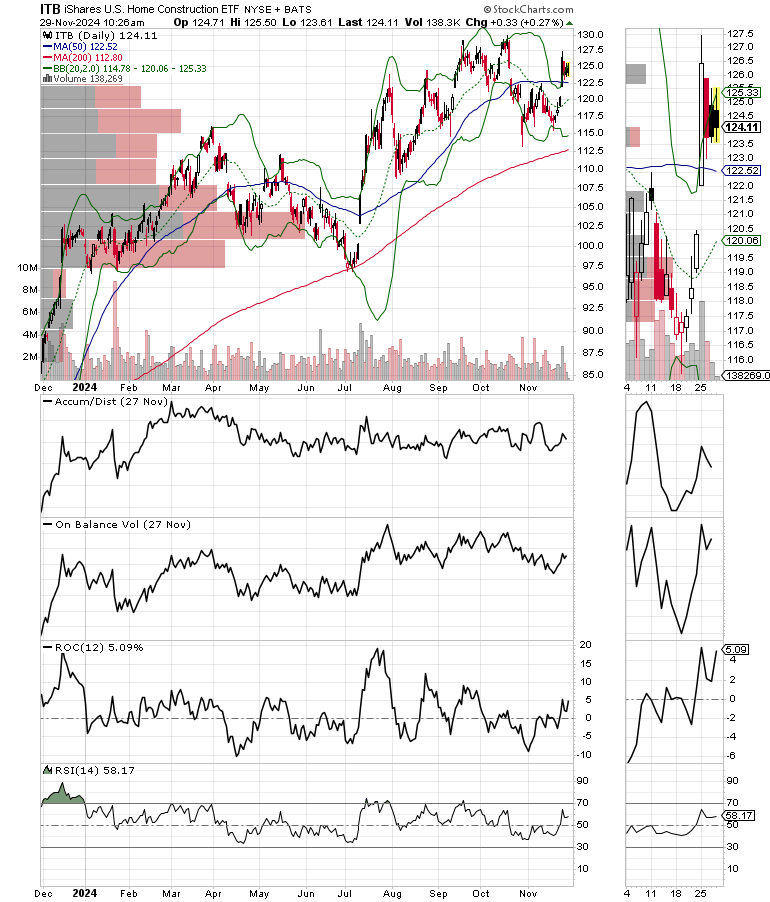

The iShares Home Construction ETF (ITB) is back above its 50-day moving average, a bullish development. The rally was built on the recent decline in TNX, which cements the relationship between bond yields and homebuilder stocks. From a trading standpoint, it makes sense to own homebuilders when bond yields are falling.

The iShares U.S. Real Estate ETF (IYR) is working its way to a breakout. As with ITB, IYR is very sensitive to the trend in TNX.

Bottom Line

Supply and demand rule the roost in the housing market. Tight supplies are structural, which means they will remain in place for some time. This favors homebuilders and well positioned apartment REITs.

There are now indications that the relocation theme from the West Coast to the Southern U.S. is once again revving up.

Publicly traded homebuilders are expanding their market share via purchases of well placed private homebuilders. Soon enough, they may start going after each other.

Every dip in the U.S. Ten Year Note yield (TNX) is almost guaranteed to trigger a surge in homebuilder stocks.

Sustained lower interest rates will likely fuel a steady rally in homebuilder stocks.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

IYR and ITB are very interest rate sensitive. As long as TNX keeps falling, the odds are in favor of ITB and IYR rising.

The market timers are going to create an interesting December if TNX keeps falling.