NVDA’s Racks Heat Up as the Stock Cools Off. Plus Update on New Sector Wide Bet on Housing and a New Trade

Stocks Want to Rally Even as Bond Yields Refuse to Roll Over

The stock market wants to rally during the traditional bullish end of year seasonality period. Let’s see if they can pull it off.

In this issue I am adding a new stock trade along with updates on existing positions in the Momentum Monday Portfolio. Special attention goes to two newly added stocks in our Homebuilder Sector Portfolio which are courting breakouts.

Burning Servers image courtesy of freepik.com

NVDA’s Racks Heat Up as the Stock Cools Off.

Shares of chip maker Nvidia (NVDA) took a tumble this morning after news reports that its latest AI chip (Blackwell) is having more problems. This time it seems the racks that hold the chips are overheating. NVDA is due to report earnings on 11/20/24. This report may be either a prelude to a buying opportunity if the earnings dazzle analysts or it could set the state for more selling. We were stopped out of our recent NVDA long position via the Granite Shares 2X Long NVDA Daily ETF (NVDL), ahead of the news, with a $500 (6.7%) gain in 9 days.

• SOLD - Granite Shares 2X Long NVDA Daily ETF (NVDL) above $75. Bought 11/6/24: $78.39. 11/15/24 intraday price: $80. Return for this trade: $500/100 shares (6.7%).

Market Update

The markets are trying to rally even with last week’s worse than expected inflation news and the Fed pulling back on the promise to ease interest rates in December. Of course, as I recently noted, the stock market’s issues are directly related to the bond market, which I will discuss directly below. On the other hand, if stock trades can pull off a win by the end of the day, we may be on our way for the rest of the year.

The New York Stock Exchange Advance Decline line (NYAD) continues to test its 50-day moving average while VIX is still below 20. On the bullish side, NYAD is still within striking distance of a new high which would signal that the bullish November-January period in the stock market is in business.

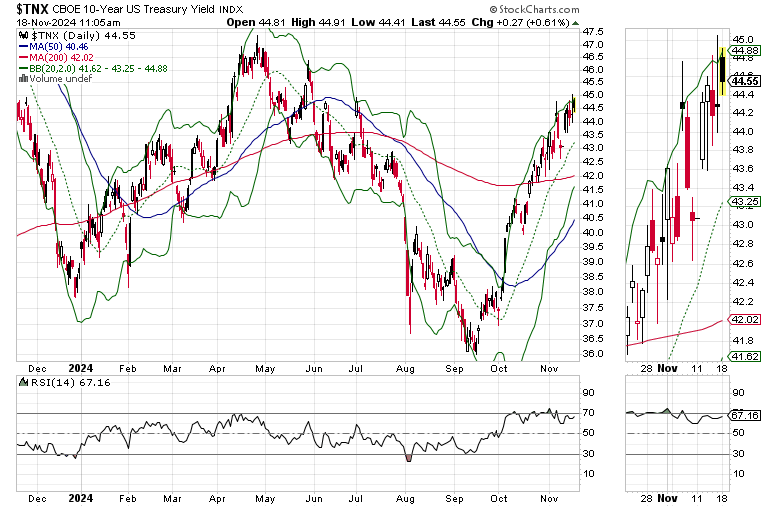

Bond yields look tired and ready to roll over. But, no matter how tired they look, they are still stubbornly near 4.5% on the U.S. Ten Year Note (TNX). A move below 4.3% level would be bullish for stocks. Fingers crossed.

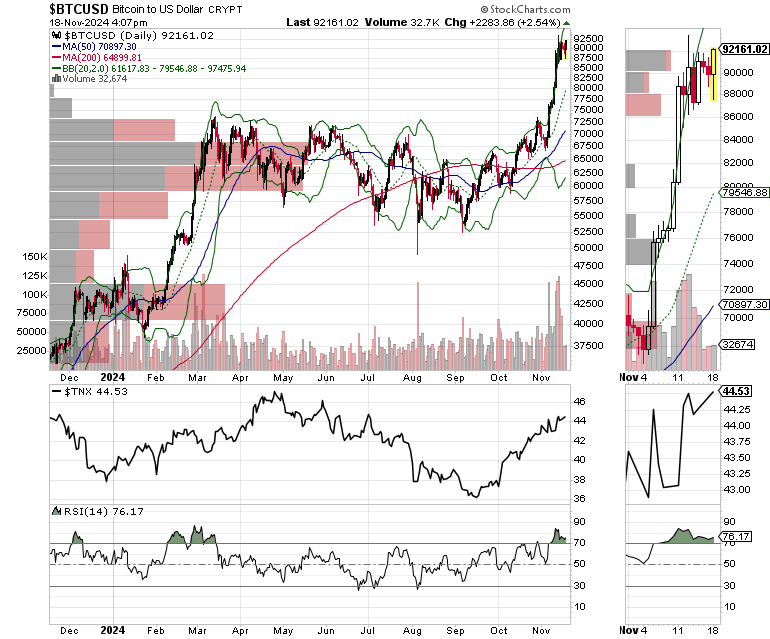

Bitcoin’s price chart closely resembles the TNX chart, which makes me wonder what may happen to BTC if bond yields finally roll over. Bitcoin has been a dazzling money magnet but is overdue for a consolidation. Our Extended Stay Portfolio still has an active BTC play which has done well.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

If you’re thinking about day trading, my new book – Day Trading 101 – will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.