Stealth Money Update: A Closely Held Secret in the Housing Market May Turn into Big Bucks.

Stealthy M&A activity bodes well for big players in the homebuilder sector.

There is a lot of handwringing on Wall Street about the homebuilders. But under the surface, likely crafted in secretive meetings held late at night, there’s a lot of activity unfolding which bodes well for the big players in the sector once bond yields and mortgage rates fall.

For now, because of interest rate fluctuations, it’s going to be a bumpy ride for the housing market. But, barring another resurgence in bond yields, we may have seen the worst in the homebuilder stocks. Moreover, under the surface, a quiet but intense dynamic is taking hold and may provide big returns for patient investors in the future.

Late night meeting image courtesy of wallpaperaccess.com

The Lay of the Land

First, the big picture. Market timing is alive and well in the housing market as potential buyers are closely following the gyrations in mortgage rates.

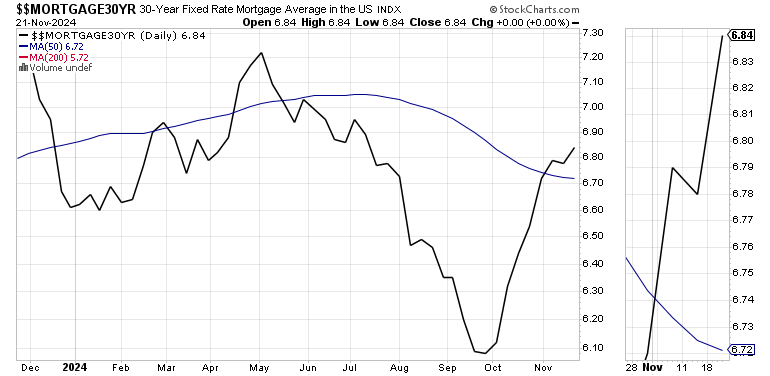

It’s obvious that current mortgage rates are too high for most potential homebuyers. It’s also obvious that mortgage rates are high because bond traders are not pleased with central bank efforts to reduce inflation. This unhappiness is reflected in rising bond yields which then translate into rising mortgage rates.

Yet, as I noted above, potential home buyers are becoming excellent market timers as they increase their activity when rates drop.

The most recent macro housing data bears this out. When mortgage rates ease people come into the market, as we saw in October with the first rise in existing home sales since 2021. On the other hand, single family home starts fell as rates rose by month’s end, while multifamily starts rose on a month over month basis.

There are some other wrinkles as well. This week we saw a pickup in mortgage applications. The most recent weekly mortgage data showed a slight uptick as some homebuyers are taking advantage of lower FHA loan rates and a slight increase in inventories. Refinancings also ticked up a bit, also influenced by FHA rates.

That’s the present. Now, let’s look into the future.

A Quiet Wave of Mergers and Acquisitions

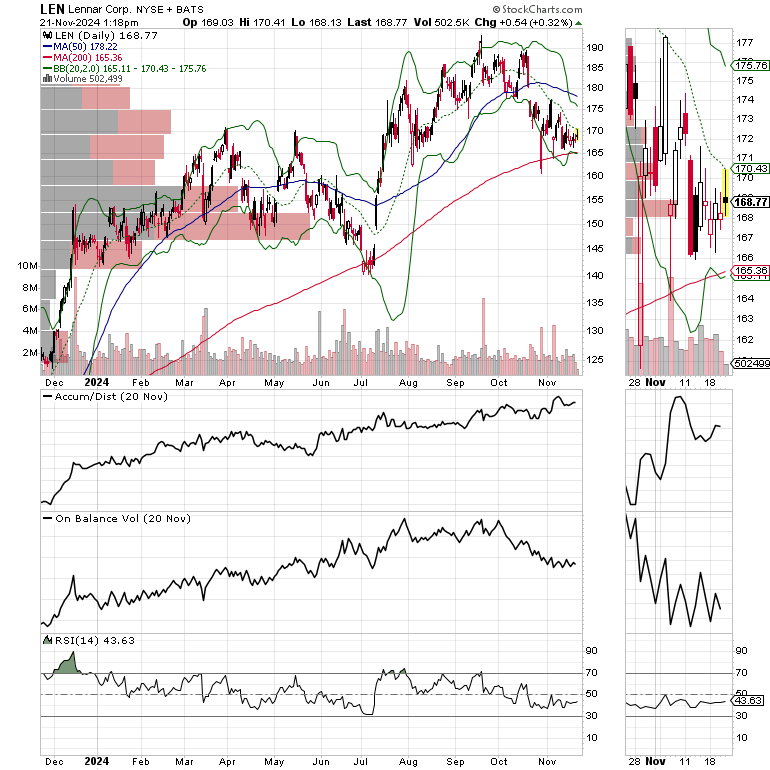

I recently issued a sector wide BUY signal on the homebuilders. So far, not much has happened. But I’m staying patient because of what the future may hold for the sector.

When it comes to single family homes, supply and demand is on the side of builders. But something more interesting is developing which will likely translate into profit growth once interest rates turn lower for an extended period of time.

You see, big builders are slowly gobbling up market share by buying smaller privately held builders with profitable niches. That means that while investors fret about interest rates, the big guys are putting their deep pockets to work as they prepare for the eventual return of lower interest rates.

Indeed, large, publicly traded homebuilders with deep pockets are in the driver’s seat if they can withstand the headwinds from higher rates. In fact, we may be in the early stages of a consolidation phase as big homebuilders begin to gobble up struggling privately held builders. And if history repeats, once the big guys are through gobbling up small players, they are likely to go after each other.

What that means for patient investors is that the potential for M&A related paychecks in the future may be lurking.

Here are some examples of what’s going on under the radar. Lennar (LEN), in which I own shares, and on which I recently issued a BUY signal, see link above, recently bought Arkansas based Rausch Coleman Homes for an undisclosed amount. Rausch Coleman was ranked as the 21st largest builder in the U.S. with over $1 billion in closings in 2023. Its footprint is in the Southern U.S. and the sunbelt. Lennar bought Atlanta based WCH homes in August 2024.

Other recent acquisitions involve Century Communities (CCS) buying Houston based Anglia Homes and Meritage (MTH) buying Elliott Homes.

On the Ground

That huge project that I’ve been watching and have noted was difficult to figure out is a warehouse. It may be a data center. It’s still too early to tell what it’s going to be right now, other than it’s a commercial build; and it’s huge. And while construction, which started a few weeks ago in a gated community is progressing, there are no other single housing projects springing up anywhere in my regular haunts.

Meanwhile, restaurants and commercial venues are popping up everywhere in my area. Some recently completed ones are across the street from a new upscale apartment complex which is due to open soon. They have some traffic. Other newly completed apartment complexes with “Leasing Now” signs aren’t seeing much activity as the parking in front of their leasing offices are empty every time I drive by.

Bonds, Homebuilders, and Mortgages

The recent climb in the U.S. Ten Year Note Yield (TNX) may be stalling with 4.5% proving to be tough resistance, while 4.3% has been equally tough support. Currently TNX is pulling back from its recent highs. A move below 4.3% should translate into lower rates, which could spur another surge in home buying.

Homebuilder stocks, as in the iShares Home Construction ETF (ITB) are still range bound. A move above the 50-day moving average would signal a potential recovery. Lower bond yields will help.

Mortgage rates continue to closely follow TNX and may have formed a short term top.

Bottom Line

With supply and demand in favor of homebuilders, it’s all about interest rates. As the increase in FHA mortgage activity shows, even a small discount in rates can be enough to get potential buyers off the fence.

Commercial real estate is concentrating on apartments with nearby entertainment and restaurants as a drawing card. Moreover, incentives such as two months of free rent with a year’s lease are starting to pop up in newly developed complexes. This is likely to increase traffic toward new properties but is also likely to create a glut in so called “B properties,” which will eventually lead to lower rents.

But the quiet and bullish news is that large publicly traded homebuilders are steadily gobbling up mid-size privately held builders in key market niches; expanding their market share and preparing for when interest rates turn lower and the pent up demand is unleashed. Patient investors are likely to be well rewarded.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading and the newly established Extended Stay Portfolio featuring long term trades and option strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me at the link above.

And if you’re thinking about day trading, start on the right foot with my new book “Day Trading 101,” which has already clocked in as a #1 on the New Release charts.