Momentum Monday/ESP Tuesday Combo: Market Closes in on All Clear

Plus a new pick on stock which is undergoing a stealthy accumulation.

The stock market is nearing an “all clear” signal as the New York Stock Exchange Advance Decline line (NYAD) is closing in on its 50-day moving average. Of course, there are no guarantees and the choppy trading pattern could return at any time. Yet, as I’ve noted repeatedly, the market’s sentiment has been so bearish that any hint of good news could trigger a short covering rally. If you have enough short covering rallies, they eventually spark a new uptrend. Let’s see if we’re there.

Yesterday I noted that a positive divergence in the markets was developing, as the New York Stock Exchange Advance Decline line (NYAD) was outperforming the S&P 500 (SPX). This morning, as I describe below, the pattern remains.

Image courtesy of newtraderu.com

Here’s a quick recap of the action. The S&P 500 (SPX) recently fell to its lower Bollinger Band, which stood four standard deviations below the 200-day moving average (4SD, purple line), signifying a major inflection point for the markets. That point, SPX just below 4850, has held and until proven otherwise is likely to be the bottom for the cycle.

What we saw after the last 4SD tag (March, April 2020) was a major market turnaround and a rally whose first leg lasted until October 2022. The catalyst for the rally was the Fed’s massive lowering of interest rates and QE.

In other words, what we recently saw was similar to what we saw during the pandemic. And if history repeats, and we have seen the bottom, then the odds of a rally rise each day there is no new low. As a result, I am slowly deploying my shopping list. If conditions remain favorable, you can expect new picks added to both the Momentum Monday and ESP portfolios.

Market Update

The S&P 500 (SPX) is back inside the 2SD line (green line) but is struggling to get above 5450. If SPX is going to rally meaningfully, it needs to move above 5450.

In contrast, the New York Stock Exchange Advance Decline line (NYAD) is now testing its 50-day moving average. A steady rise in NYAD, even if SPX lags, is bullish.

The U.S. Dollar remains below long term support at the $100 area for the U.S. Dollar Index. But it is trying to mount a rebound. A failure at $100 would be bearish for USD.

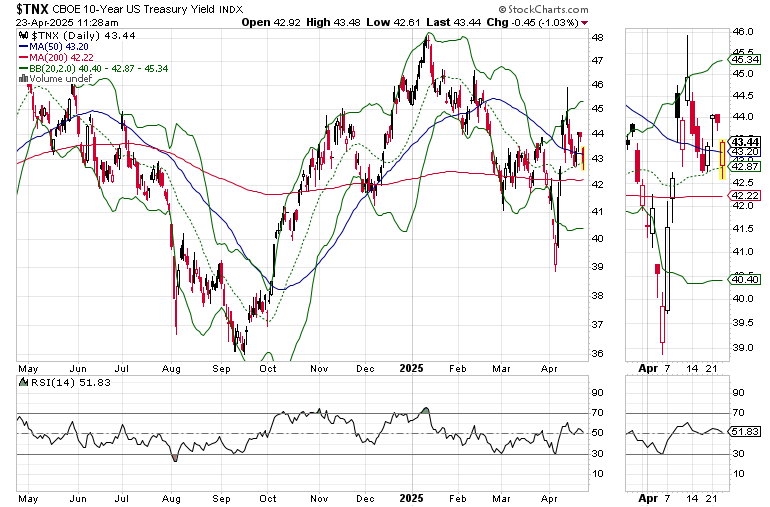

The U.S. Ten Year Note yield (TNX) remains stable, just above its 200-day moving average, suggesting that bond traders are less convinced of a recession than they were a few weeks ago and that foreign selling in U.S. bonds has also slowed.

Bitcoin is trading above $90,000 and its 200-day moving average but running into some resistance at $95,000. We could see a consolidation in the short term. I recently posted a new Bitcoin trade in the Momentum Monday portfolio.

This morning, I am adding a new Momentum trade in a stock with some excellent stealth accumulation characteristics and updating both the latest holdings in our Momentum Monday and ESP Tuesday portfolios.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

SPECIAL PROMOTION! - In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. As a special bonus, you will receive a Free one month subscription to the Weekender portfolio with your first health purchase.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.