Momentum Monday: Stocks Roll Over. Keeping a Watchful Eye on Developments.

Hang on to what’s working. Let the market sort itself out. Plus, a new Bitcoin Trade.

I remain on high alert for an all clear sign on the stock market. But as today’s action shows, it’s not here yet.

Last week ended on a hopeful note. But the long weekend has reignited the bears’ fervor and the selling has resumed. The silver lining is that with each selling spree there seems to be a higher number of stocks which hold up better than the market. That certainly bodes well for the future, but it’s clearly no help in the present.

Our current approach which is to hold lots of cash and only invest in stocks which are showing clear signs of bullish behavior continues to pay off. Our Momentum portfolio currently has two holdings which both meet these criteria, while featuring a newly added Bitcoin trade. And while I am compiling a growing Buy list, and remain on the lookout for more stocks, current market conditions are not worth the risk.

Image courtesy of johnlothiannews.com

Market Update

The market has rolled over once again, with key support failing to hold.

This morning, the S&P 500 (SPX) broke the lower Bollinger Band placed two standard deviations (2SD, green line) below the 200-day moving average. This is important because it signals a failure of what I described this weekend as a return to the “normal” trading pattern and perhaps a return to the helter skelter volatile market of the prior few weeks. Moreover, the failure at the lower 2SD band followed a failure of the index to rise above SPX 5450, which was a critical resistance level.

Remember, we are still sorting out what comes next after the recent and dramatic tag of the 4SD Bollinger Band (pink line), similar to the 4SD tag in March 2020, followed by a “death cross” of the 50-day moving average below the 200-day moving average. A similar occurrence developed in March 2020 (tag of 4SD and 50/200 death cross), which was inconsequential as the market continued to recover. The one factor that spurred the rally’s continuation was the Fed’s massive QE, which in this case is less likely barring something truly extraordinary since the Fed and the White House are now in an open feud regarding policy.

The New York Stock Exchange Advance Decline line (NYAD) has reversed after failing to rise above its 20-day moving average, yet another negative.

Bitcoin is showing signs of life as it tests the resistance of its 200-day moving average. A move above the 200-day could ignite a buying panic. I’ve just added a new Bitcoin trade, which you can check out below.

The U.S. Dollar, continues to fall despite being oversold. A rebound, whenever it occurs, will be tested at the $100 level.

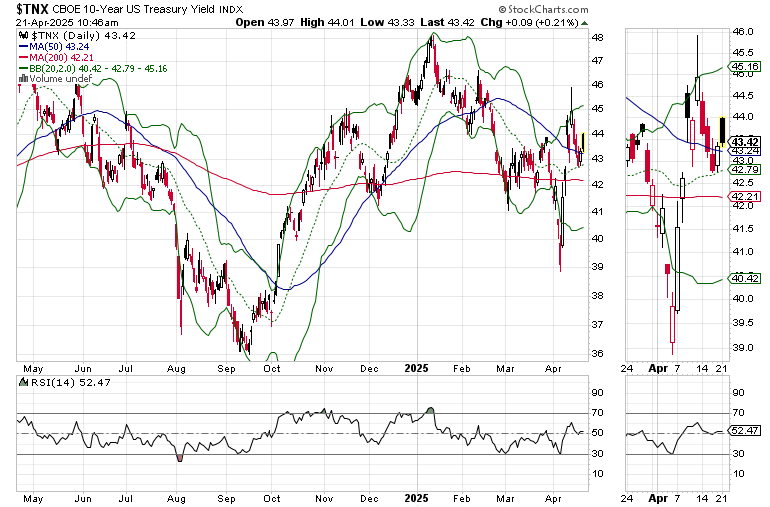

The U.S. Ten Year Note yield (TNX) remains range bound between 4.2 and 4.5%.

This morning, I am posting a new Bitcoin ETF trade.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

SPECIAL PROMOTION! - In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. As a special bonus, you will receive a Free one month subscription to the Weekender portfolio with your first health purchase.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.