ESP Tuesday: A Positive Divergence May be Developing.

Going Out on a limb with a perfect chart setup on a quirky company which is quietly turning around.

Stocks, as measured by the major indexes continued their wild swings, rebounding this morning after yesterday’s decline. Yet, while the megacap weightings distort the widely followed benchmarks, the market’s breadth is acting much better. If this continues, we could be entering a stealthy and selective bullish period where the rank and file stocks outperform the megacap names.

Image courtesy of jtrader.co

All of which leaves us in a similar place to where we’ve been for the past couple of weeks when it comes to the indexes. The S&P 500 (SPX) recently fell to its lower Bollinger Band, which stood four standard deviations below the 200-day moving average (4SD, purple line), signifying a major inflection point for the markets.

What we saw after the last 4SD tag (March, April 2020) was a major market turnaround and a rally whose first leg lasted until October 2022. The catalyst for the rally was the Fed’s massive lowering of interest rates and QE.

So, what’s next? Much depends on how the so called “average” stock performs in contrast to the usual Mag 7 and megacap names.

Market Update

The S&P 500 (SPX) is straddling the 2SD line (green line) near 5250. If SPX is going to rally meaningfully, it’s going to have to pick up some strength and find a way to close inside that 2SD line consistently before ramping up. Otherwise, trading conditions will likely continue to be very messy.

In contrast, the New York Stock Exchange Advance Decline line (NYAD) is moving steadily higher now testing the resistance of 20-day moving average as it closes in on its 200-day moving average. A move above the 200-day line, which holds, would be a major positive.

The U.S. Dollar is below long term support at the $100 area for the U.S. Dollar Index. It is very oversold and should bounce at some point. However, a failure of any bounce here would likely have some major repercussions throughout the financial markets.

The U.S. Ten Year Note yield (TNX) remains range bound, just above its 200-day moving average, suggesting that bond traders are less convinced of a recession now.

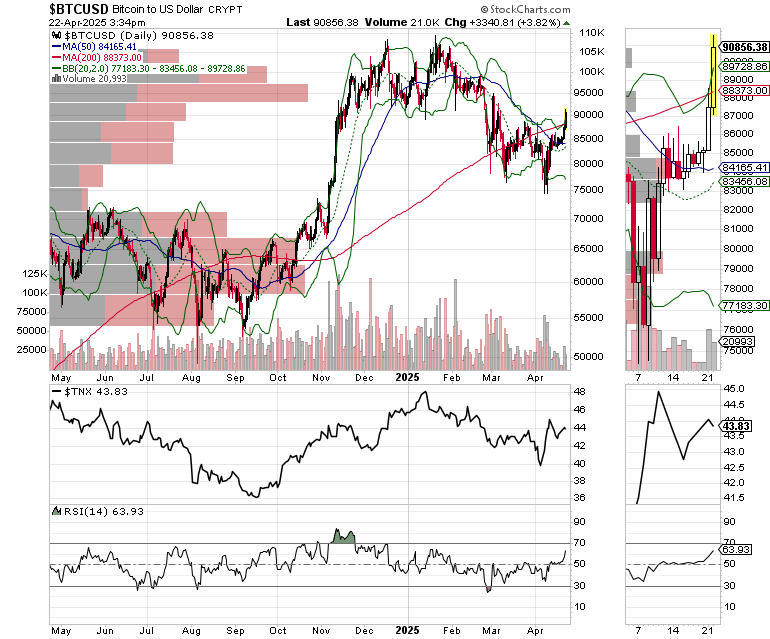

Bitcoin is starting to gain some upward momentum, trading above $90,000 and its 200-day moving average. I posted a new Bitcoin trade yesterday in the Momentum Monday portfolio.

This morning, I am adding a new trade in a stock with a nearly perfect chart setup.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

SPECIAL PROMOTION! - In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. As a special bonus, you will receive a Free one month subscription to the Weekender portfolio with your first health purchase.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.