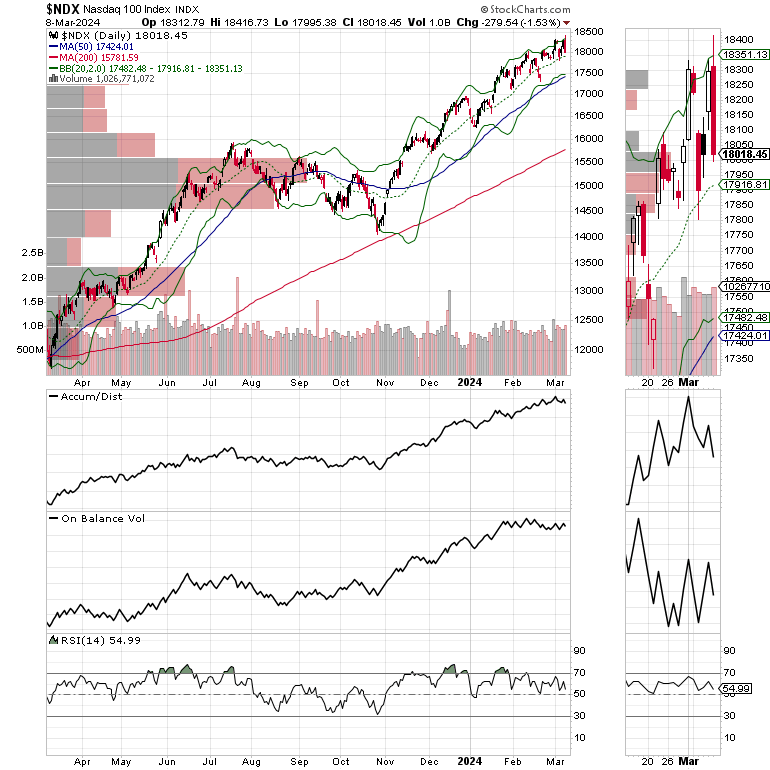

The S&P 500 (SPX) and the Nasdaq 100 (NDX) are starting to show some wear and tear. Momentum in the major indexes may be waning. At some point the momentum will fade altogether and the market will correct in some way.

Still, barring a significant external event, if the Fed continues to dangle the carrot of lower interest rates in front of the market, it’s hard to see a scenario where the entire market falls apart, especially when the ECB is forecasting a rate cut in June. The alternative, until proven otherwise is one where we experience a sector rotation.

How To Thread the Needle in this Market

We are clearly in a momentum run. Yet, some stocks in the technology sector are way ahead of themselves. As a result, the tech sector and the market’s response to any weakness there will tell us what’s next.

The poster child for the tech stocks is AI chip kingpin NVDIA (NVDA) which is now trading in what old school technical analysts describe as a parabolic pattern. That’s where the stock is rising almost vertically almost daily. The take home message is that parabolic advances are not sustainable. In the case of NVDA, the stock is $400 (80%) above its 200-day moving average, as well as recently trading above its upper Bollinger Band.

Also note the short term reversal in the Accumulation/Distribution (ADI) and On Balance Volume (OBV) lines and the rise in raw volume on NVDA during the reversal we saw on 3/8/24. Together these signs suggest a short term top is in place.

Inside the Market

Does a top in tech mean that the market will follow? We will see. Indeed, what the rest of the market does in response to the inevitable pullback in NVDA and perhaps the rest of the technology sector is likely to set the stage for what comes next.

Comparing the price chart for NVDA to that of the S&P Citigroup Pure Value Index (SPXPV) you can see that value stocks are outperforming the large cap tech stocks. Because large cap tech stocks are heavily weighted in the major indexes, their sudden weakness is distorting the price action in the indexes.

As a result, keeping one’s finger on the market’s pulse is essential. Thus, once again, I suggest keeping these simple principles in mind:

· Stick with what’s working; if a position is holding up – keep it;

· Take profits in overextended sectors;

· Consider some short term hedges;

· Look for value in out of favor areas of the market that are showing signs of life;

· Protect your gains with sell stops and keep raising them as prices of your holdings rise; and

· Trade one day at a time.

Bond Yields Test 4% Level – Push Mortgages Lower

Over the last few weeks, I’ve been describing the decline in bond yields and by extension, the bullish action in a select group of homebuilders. Of course, the U.S. Ten Year Note yield (TNX) is a widely watched benchmark for market interest rates, especially mortgage rates, and to some degree automobile loans. On 3/8/24, TNX closed just above 4%.

Previously, the key yield range for TNX had been the range between the 4.3%, at the top, and the 4.15% area at the bottom because that’s where the 20, 50, and 200 day moving averages for TNX were clustered. That’s because, this was a key decision point for the algos

Interestingly, bond yields did not rise on stronger than expected jobs numbers. That’s a major departure from recent responses to the number and suggests that bond traders are now betting on a slower economy and perhaps a faster onset of Fed rate cuts.

So, with money looking as if it’s ready to come out of technology, the next move in the bond market is worth watching.

Have Mortgage Rates Topped Again?

Way back in November 2023, I suggested mortgage rates had topped out. I was correct, at least in predicting an intermediate term top which has so far held in place, even if rates have climbed back above 7% recently. Back in November 2023, mortgages were running above 8%.

The recent backup on bond yields led to a rise in mortgages back above 7%, which has now reversed. Thus, if bond yields don’t back up in the next few days, and TNX breaks below the 4% yield in TNX, it would likely translate to an average 30 year mortgage nicely below 7%.

All of which, makes my recent posts about the recent rally in the homebuilders, here and here more prescient.

The S&P SPDR Homebuilders ETF (XHB) look set to take a breather after its recent breakout. This may be a buying opportunity depending on how interest rates play out in the short term. You can check out my latest homebuilder picks with a Free Two Week trial to my service, here.

Inflation is hurting everyone, but there is a solution. If you’re looking for a to generate a paycheck via actively trading stocks, check out my active trader focused Substack page here.

For ideas on how to hedge against risk, my latest video offers details on the successful use of put options in real time. Check it out here.

Energy Stocks Gain Ground

Last week, in this space I noted that a bullish trading set up was developing in the energy sector as West Texas Intermediate Crude (WTIC) was testing the $80 resistance area, which remains a tough barrier.

Traditionally, a rally in the energy stocks is a reliable prelude to a move in oil. The Oil Index (XOI), home to the large multinationals continues to inch higher and is approaching the 2000 price point. A move above that would signal that traders are betting on large supply problems for the next few months.

We recently closed out nifty oil sector active trade including an option winner. Check the results out here. In addition to active trades, I have several open positions in the energy sector, including options trades. You can review them with a Free Two Week trial to my service, here.

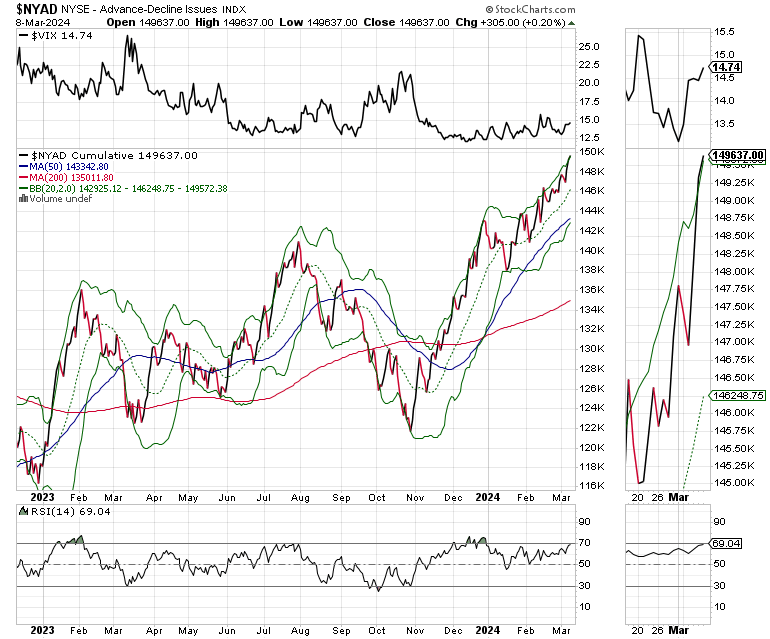

Mixed Technicals Unfold. NYAD makes New Highs. Wear and Tear Appears in the Major Indexes

The NYSE Advance Decline line (NYAD) made another decisive new high on 3/8/24, while the S&P 500 (SPX) and the Nasdaq 100 (NDX) rolled over. This, as I described above suggests that a shift away from large tech stocks may be in the offering.

The Nasdaq 100 Index (NDX) may have made a short term top and a move back to 17,500 could be in the cards. The index closed above its upper Bollinger Band last week, which usually leads to a reversal toward the 20-day moving average in the short term.

The S&P 500 (SPX) made a new on 3/9/24 but delivered a concerning reversal on 3/10/24 with a nasty looking negative engulfing candlestick pattern suggesting short term weakness may follow. The ADI line rolled over as short sellers dug in and OBV is looking a bit tired.

VIX is Testing the 15 Area

The CBOE Volatility Index (VIX), once again remained below 15, but is trying to move higher. If VIX remains subdued more upside is possible. A sustained move above 15 will turn things bearish.

A rising VIX means traders are buying large volumes of put options. Rising put option volume from leads market makers to sell stock index futures to hedge their risk. A fall in VIX is bullish as it means less put option buying, and it eventually leads to call buying which causes market makers to hedge by buying stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

#1 Best Seller in Options Trading –

Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition) Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)

4.5 out of 5 stars

#1 Best Seller in Options Trading