Something has changed dramatically in the homebuilder sector this week and it’s making me uncomfortably bullish. Maybe it’s something I heard, as I describe below.

I’ve been bullish on this sector for quite a long time but have pulled back my horns of late after D.R. Horton’s earnings miss and what I found after digging into their earnings report, as I noted here. Other homebuilders have somewhat echoed Horton’s earnings to some degree with the unifying factor being that sales have slowed and building activity has also slowed as illustrated by a slowing in permits. The existing home sales data is also fairly bleak.

All of which adds up to a continuation of the long term bullish setup for housing; low supplies and steady to rising demand.

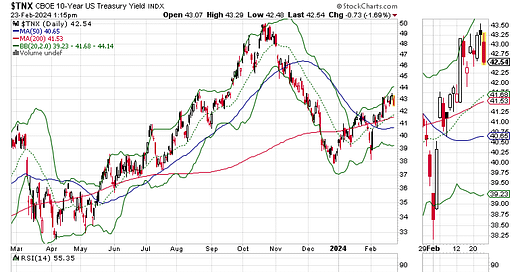

An equally troubling roadblock, of course, has been the Fed’s interest rate hikes and the bond market’s volatility. Most recently, the U.S. Ten Year Note yield (TNX) has rebounded and is trading above 4.25%. The important level remains 4.15% where the 20, 50, and 200 day moving averages are clustered. A move below that chart point could lead to an acceleration in the homebuilder rally.

The rise in TNX has bled into the mortgage market where the average rates have now crept back up to nearly 7%. But if TNX breaks below 4.15%, we will see a decline in mortgage rates next week.

Something’s Changed Recently

So why are the homebuilder stocks suddenly moving higher? The answer is I don’t really know, although I recently ran into a fellow who’s behavior made me wonder about the sudden bid under the homebuilders.

Here’s what happened. I live in an area where there is ongoing new home construction. Over the past few years, every time interest rates have dropped, the traffic increases as potential home buyers drive past the new builds and ponder their next move. The new homes have not stayed vacant for long during those periods.

Last year, things slowed down dramatically as the Fed’s rate hikes led to higher mortgage rates. Subsequently, the builders slowed their activity and the traffic died. In the fall of 2023, as interest rates fell, the builders picked up their activity and the traffic increased slightly but was not as it was during the previous boom times. One of the reasons was that prices for the new homes rose, quite significantly.

During those previous boom times, when I was outside working int the garden or walking the dog, inevitably someone would drive up and ask me questions about the neighborhood, the builder, and so on. This type of activity just died when the Fed hit ludicrous speed on its rate hikes and mortgage rates soared.

Until yesterday. When I was walking to my mailbox, a young man, accompanied by his wife, pulled up next to me and began to feverishly pepper me with questions. The more I fielded them, the more questions he seemed to come up with. While talking he did mention that he thought the new houses were too expensive and he bantered about what his best offer might be – some 10-20% below the asking price for the new builds, which had already appreciated well over 30% from the 2020 asking price.

Underlying his questions was a certain fear factor. He told me he was concerned about finding a safe home for his family, and his new baby. And he was concerned about whether there were other people of his heritage in the neighborhood.

I couldn’t help but get the feeling that this poor guy was downright scared and that he was going to find a way to get that new house, in my neighborhood, or somewhere where he could feel safe.

Homebuilder Stocks Perk Up

Meanwhile, the S&P SPDR Homebuilders ETF (XHB) just broke out to a new high. What makes this more remarkable is that it comes on the heels of a huge uptick in mortgage rates. Meanwhile, Accumulation/Distribution (ADI) and On Balance Volume (OBV) are pointing to the ETF moving higher.

Bottom Line

Something’s changed in the homebuilder sector. It is possible that we may be in the early phases of what could be an NVDA like blow-off in homebuilder stocks as the last wave of panic buyers finally throw caution to the wind.

Thanks to everyone for your support. I really appreciate it.

Special thanks to everyone who’s subscribed to my new active trader pub – Joe Duarte’s Smart Money Passport. I will have a new trade at Substack on Monday.

I also appreciate cups of coffee, which you can buy me here.

I have multiple homebuilder stocks in my model portfolios which will likely respond to any positive developments. To subscribe to my other premium service designed for longer term trading strategies, Joe Duarte in the Money Options.com, click here.