Staying Focused. Watching Liquidity. And Taking an $825 Profit on RTX

Plus, an Insurance Pick in Case the Uptrend is Broken

Image courtesy of cloudfront.net

The overnight events in the Middle East have rightly rattled markets as the present is uncertain and the outcome is both unclear and unknown. But from a trading standpoint, there is only one way to manage this type of extraordinary event, by staying focused and sticking to the trading plan. Our portfolios are holding up quite well this morning with none of our positions showing any significant measurable weakness.

Certainly, I’ve been positive about the recent gains in the market, while still being cautious. Two days ago, I wrote: “Of course, things could change in a heartbeat, but for the moment, stock traders are betting that the Fed will cut interest rates, making their de facto easing via T-Bond purchases official as the Treasury continues its back door easing through T-Bill purchases and balance sheet tricks.”

If there is a positive side to this market, it’s the fact that both the Federal Reserve and the U.S. Treasury have been adding liquidity to the market behind the scenes over the last few weeks as I noted earlier this week. Moreover, if the situation in the Middle East worsens, the Fed and the Treasury along with other global central banks will likely boost liquidity in order to prevent a full market and economic meltdown.

Nevertheless, the best way to make money is not to lose money, especially on a winner. Thus, I’m recommending taking profits on a momentum portfolio stock, RTX Technologies which is rallying this morning. The rate of rise in RTX is likely unsustainable so it’s best to take the profit now and revisit the stock at some point in the future to see if it makes sense to repurchase it.

SOLD Raytheon Technologies (RTX). Bought 5/21/25: $136.25. 6/13/25 intraday price: $144.50. Return for this trade: $825/100 shares (6.05%)

In addition, always follow the trading plan:

Don’t fight the liquidity trend, which is currently positive

Let the market stop you out of positions;

If a position does not get stopped out, it’s a sign of strength and it should remain in the portfolio.

Hedge when necessary

In this issue I am updating all Sell stops and pertinent portfolio positions while adding an insurance pick in case things get worse.

Important Announcement

My new book “The Everything Guide to Investing in Your 20s and 30s” is an excellent addition to your trading library as it crafts a multistage trading plan which is useful in all markets. For more details you can listen to my recent in depth interview on the Prudent Money Radio Show for details.

In addition, I am offering a 20% discount special offer to the Smart Money Passport, which you can access here. In this market, it pays to be fully informed and tactical. Make your move soon as the offer expires on 6/17/25.

Is it worth it?

If you’re wondering whether you’ll be spending your hard earned money wisely by subscribing to The Smart Money Passport, consider what the discounted price of $152/year will buy.

In addition to the xxx profit on RTX Technologies described above, your $152 subscription offers access to trades such as these:

SOLD - Walmart (WMT). Bought 4/8/25: Bought 4/8/25: $84. SOLD 5/15/25 intraday: $94. Return for this trade: $1000/100 shares (11.9%).

SOLD Argan Inc. (AGX). Bought 4/30/25: $152.05. SOLD 5/9/25: $171.27. Return for this trade $1922/100 shares (12.64%) and

SOLD - Dutch Bros (BROS). Bought 12/24/2024: $53.80. SOLD 02/13/25 intraday price: $83.45. Return for this trade: $2965/100 shares (35.5%%). Your results may differ.

Those three trades produced $5887 in profits. That’s almost a 40X multiple on your discount subscription price. There aren’t too many places these days where $1 turns into $40.

But those are only some of the outstanding results. Consider these whopper trades below:

Here are some more huge results, with these trades delivering over $10,000 in profits:

SOLD Palantir (PLTR)– Bought 4/7/25: 75.05. SOLD 5/5/25 intraday $125 when price target was hit. Return $5000/100 shares (67%).

SOLD Palantir (PLTR) Above $75 – Bought 4/7/25: 75.05. SOLD 5/6/25 intraday price: $118. Return $4300/100 shares (57%).

SOLD - Palantir (PLTR) Above $85 – Momentum Approach. Bought 4/9/25: $85.05. SOLD 4/14/25: $93.75. Return for this trade: $870/100 shares (9.28%).

SOLD - Palantir (PLTR). Bought 3/17/25: $85.75. SOLD 3/27/25: $91. Return for this trade: $625/100 shares (6.87%).

SOLD Advanced Microdevices above $171. Bought 7/5/24: $171.05. 7/11/24 intraday price: $174.43. Return for this trade: $1470 (8.59%).

Time’s ticking away on this offer. Subscribe now.

Market Update

The stock market is understandably pulling back this morning as events in the Middle East unfold. Yet, there is no point in panicking. Instead, stick to the plan.

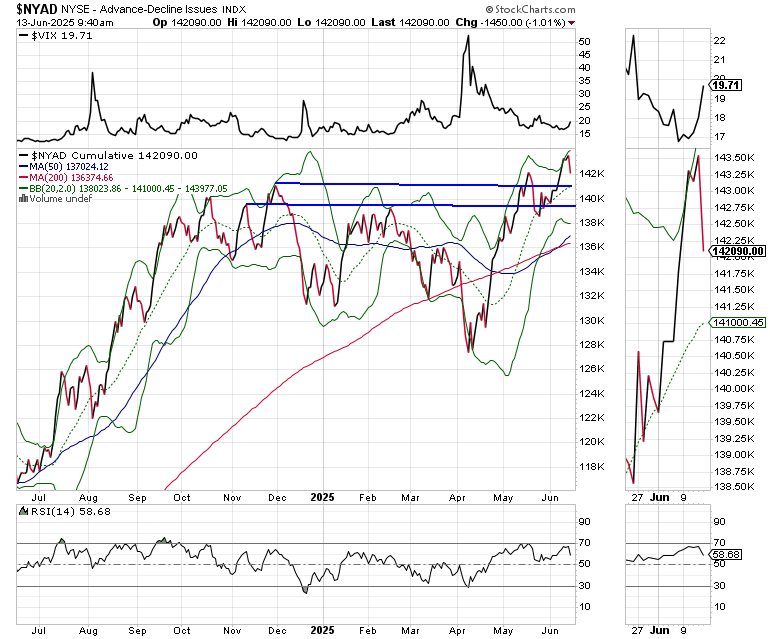

The New York Stock Exchange Advance Decline line (NYAD) has hit a new high recently. Now, it’s all about whether it holds support. Keep an eye on the 20 and 50-day moving average and the action in the RSI which will tell us whether the market is overbought or oversold. The first RSI level to watch is 50. If NYAD holds above the key moving average support levels and does not fall below 50, the odds of a rebound are good. Also, keep an eye on the dip buyers. If they materialize as the news shifts, the bullish trend will have a chance.

The S&P 500 (SPX) has support at 5850-5950 and resistance at 6000-6100 area. A breach of either end of the trading range will tell us what’s next.

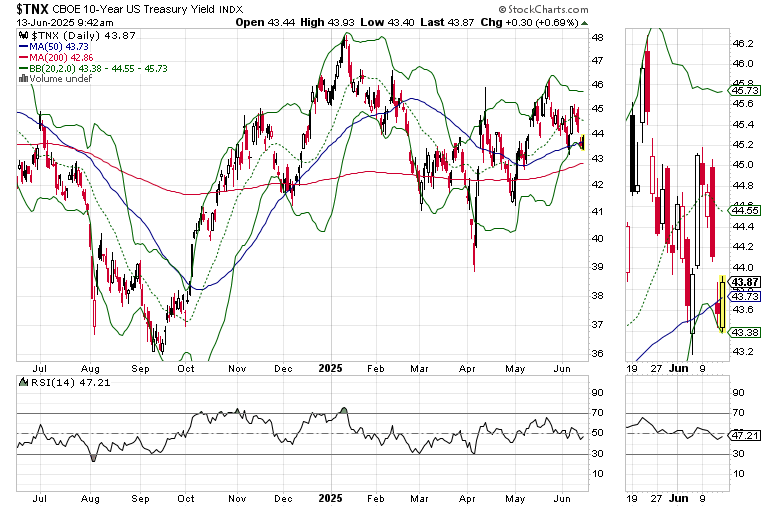

The U.S. Ten Year Note yield (TNX) fell overnight, but did not break below 4.3%. This morning it continues to trade within a narrow and yet volatile range between 4.3 and 4.6%. A breakout above or below this range will likely have significant effects on stocks and other markets.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.