The Rally Stretches its Legs. Stealth Liquidity Boosts Stocks as Inflation Flattens Out

Plus a New ESP Pick Which Is Just Getting Started.

Image courtesy storyblocks.com

In this issue, I am offering a new ESP portfolio BUY recommendation while providing key updates on recent purchases in both the Momentum Monday and ESP portfolios. But first, I want to share some exciting news.

Special Announcement

This is a special week as my new book “The Everything Guide to Investing in Your 20s and 30s” hits the shelves. If you want to know more about the book, now in its 3rd edition, you can listen to my recent in depth interview on the Prudent Money Radio Show for details.

But there’s more. To celebrate the release of the book, I am offering a 20% discount special offer to the Smart Money Passport, which you can access here. Make your move soon as the offer expires on 6/17/25.

Is it worth it?

If you’re wondering whether you’ll be spending your hard earned money wisely by subscribing to The Smart Money Passport, consider what the discounted price of $152/year will buy.

That’s $152 for trades such as these:

SOLD - Walmart (WMT). Bought 4/8/25: Bought 4/8/25: $84. SOLD 5/15/25 intraday: $94. Return for this trade: $1000/100 shares (11.9%).

SOLD Argan Inc. (AGX). Bought 4/30/25: $152.05. SOLD 5/9/25: $171.27. Return for this trade $1922/100 shares (12.64%) and

SOLD - Dutch Bros (BROS). Bought 12/24/2024: $53.80. SOLD 02/13/25 intraday price: $83.45. Return for this trade: $2965/100 shares (35.5%%). Your results may differ.

Those three trades produced $5887 in profits. That’s almost a 40X multiple on your discount subscription price. There aren’t too many places these days where $1 turns into $40.

But those are only some of the outstanding results. Consider these whopper trades below:

Here are some more huge results, with these trades delivering over $10,000 in profits:

SOLD Palantir (PLTR)– Bought 4/7/25: 75.05. SOLD 5/5/25 intraday $125 when price target was hit. Return $5000/100 shares (67%).

SOLD Palantir (PLTR) Above $75 – Bought 4/7/25: 75.05. SOLD 5/6/25 intraday price: $118. Return $4300/100 shares (57%).

SOLD - Palantir (PLTR) Above $85 – Momentum Approach. Bought 4/9/25: $85.05. SOLD 4/14/25: $93.75. Return for this trade: $870/100 shares (9.28%).

SOLD - Palantir (PLTR). Bought 3/17/25: $85.75. SOLD 3/27/25: $91. Return for this trade: $625/100 shares (6.87%).

SOLD Advanced Microdevices above $171. Bought 7/5/24: $171.05. 7/11/24 intraday price: $174.43. Return for this trade: $1470 (8.59%).

Time’s ticking away on this offer. Subscribe now.

Market Update

The stock market’s gains are picking up speed this morning as the CPI numbers came in below expectations and the trade game is steadily improving, leaving geopolitics and other Washington related issues as the main worries for the moment. Of course, things could change in a heartbeat, but for the moment, stock traders are betting that the Fed will cut interest rates, making their de facto easing via T-Bond purchases official as the Treasury continues its back door easing through T-Bill purchases and balance sheet tricks.

The New York Stock Exchange Advance Decline line (NYAD) is extending its rally hitting a new high after yesterday’s bullish closing high. So far, the new highs, as expected, are bringing new buyers into the market as investors who’ve missed the rally from the April bottom, a development which we predicted here, are forced to move in more aggressively.

The S&P 500 (SPX) looks headed for 6100. This is encouraging. As with NYAD a move above the 6000-6100 area is likely to bring in money from the sidelines, possibly extending the rally.

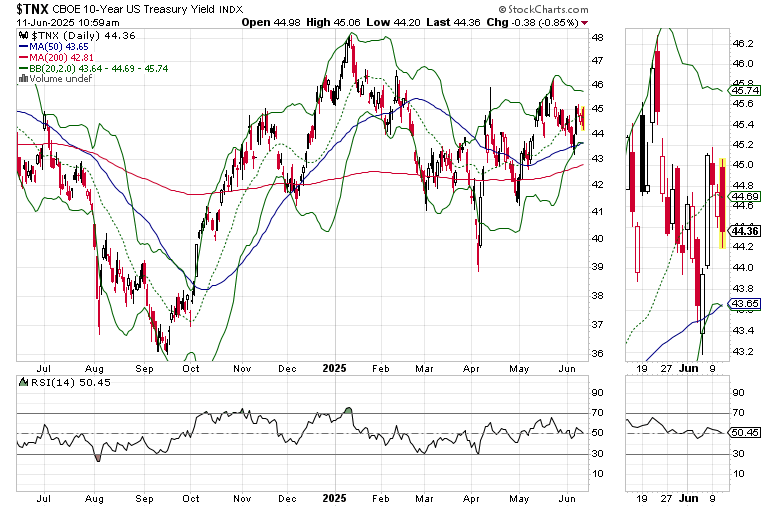

The U.S. Ten Year Note yield (TNX) continues to trade within a narrow and yet volatile range between 4.3 and 4.6%. A breakout above or below this range will likely have significant effects on stocks and other markets.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.