Words matter. As I noted in my recent post, whatever Fed Chair Powell said at Jackson Hole this morning would likely move the market. And what he said was good enough to, at least, keep a floor under stocks.

The basic message was interest rates are coming, unless the data changes. Given the recent reduction in the number of jobs created (-818,000 compared to what was originally reported) and the steady rise in continuing jobless claims, it looks as if the Fed is now concerned about the jobs market, and is willing to drop rates to keep things from getting worse.

The New York Stock Exchange Advance Decline line (NYAD), the most accurate indicator of the market’s trend since 2016, is making a new high this morning, once again proving what I’ve been saying – there are no bear markets when NYAD makes new highs.

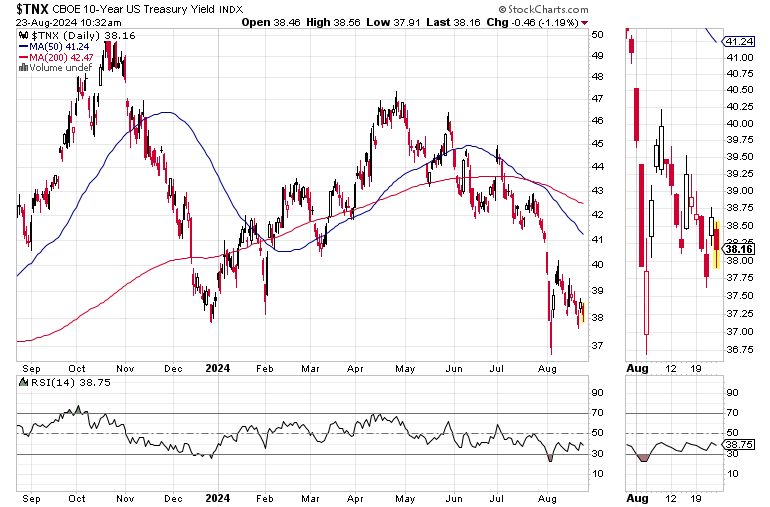

The U.S. Ten Year Note (TNX) is holding steady, well below 4%, which is comforting as it suggests bond traders agree with Powell.

This morning, I am adding a new trade where the setup suggests that a breakout is imminent.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.