What Happened to the Summer House Buying Spree? Powell May Hold the Key.

Bullish talk in Jackson Hole May Lead to Late Summer Pickup in Housing.

I was talking to a homebuilder a few days ago. He runs a small shop whose business was booming until interest rates pushed higher. Since 2022, he’s been holding on. Now, he’s a bit haggard, looks worried, and admits that business is “hard.” I noticed he’s driving a much smaller car, having traded in his Lexus.

He’s hoping for interest rates to drop further.

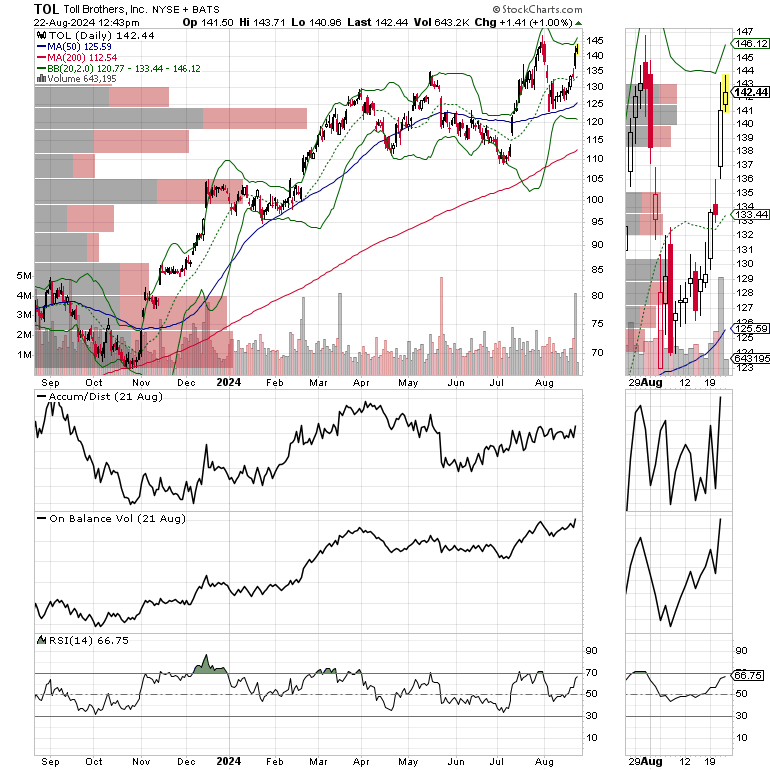

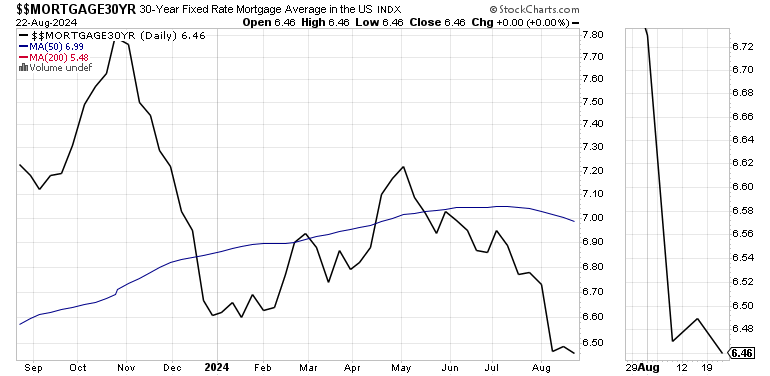

This week’s housing data retraced familiar grounds as existing home sales remained flat while upscale homebuilder Toll Brothers (TOL) beat expectations and raised its forward guidance. Meanwhile, mortgage rates remain below 6.5%.

The summer is all but gone. The kids are back or close to returning to school. And the Federal Reserve’s annual confab in Jackson Hole, Wyoming will hit its climactic moment on the morning of 8/23/24. That’s when Fed Chairman Jerome Powell will likely address what the central bank’s next interest rate move will be.

If the summary of the Fed’s most recent FOMC meeting offers any hint, the odds are above average for a September rate cut. Thus, Powell’s remarks, especially if they are perceived as a confirmation of a rate cut, will at least in the short term, affect the real estate market, and the corresponding sectors in the stock market - specifically, homebuilders and REITs which specialize in residential rentals (single and multifamily).

Where we Are

Ahead of Powell’s speech, the real estate market is subdued and segmented, but stable. Mortgage rates have come well off their early 2024 highs and those who can afford the higher prices of the current market are buying mostly new homes. Meanwhile commercial real estate (office related) remains mired in what could be a long term set of problems.

On the other hand, the big picture for housing remains straight forward. The housing shortage has become structural, meaning that it will take years before there are enough homes available for the number of people who wish to own one. And even if the current declines in prices continue, the eventual amount one pays for a house, is likely to remain elevated compared to before 2020.

Indeed, the pace of home purchases, both new and existing, has slowed, as has the rate of new single family homes being built. At the same time, investors have continued to buy new homes with the purpose of renting them, the so called Build to Rent segment of the industry (BTR). Meanwhile, the rate of apartment being built, continues to outpace single family homes.

Here’s the take home message:

· Large, well-financed homebuilders are in a good position. And despite having to cut prices and use incentives, they continue to sell enough homes to remain profitable, while doing so at very attractive profit margins;

· Real Estate Investment trusts (REITs), who own attractive properties in sought after locations continue to attract customers, often via incentivizing their lease options. Nevertheless, those who succeed continue to deliver healthy cash flows and profit margins; and

· On the commercial real estate side, storage and well positioned retail space and some mall operating companies are holding up, while the office leasers are nowhere near out of the woods.

Toll Brothers Joins the “We’ve Got this” Club

As we’ve seen recently with other homebuilders, D.R. Horton (DHI), Lennar (LEN), KB Home (KBH) and Green Brick Partners (GRBK), all long term holdings at Joe Duarte in the Money Options.com, along with the recently added Toll Brothers (TOL), homebuilders remain in the sweet spot, or “We’ve Got This” club.

In fact, TOL joins the club after its recent beat of expectations and upbeat forward guidance. In a familiar pattern, TOL is building enough houses to meet demand, while keeping prices at a level where the homes will sell and margins continue to grow. As with other builders they continue to concentrate on areas of the country where people are moving, Texas, North Carolina, and Florida.

The price chart for Toll Brothers is representative of the sector. Note the near breakout conditions with both the ADI and OBV lines rising as money moves in.

Here are some other interesting macro facts lifted from their earnings presentation:

· Publicly traded homebuilders now own 53% of the market – an increase from 26% in 2006;

· Households are increasing faster than housing supply;

· Existing housing supply is aging – the median owner occupied existing home is now 43 years old; and

· Home premiums have decreased from 17% (2022) to 5% making new homes more attractive than existing homes.

Putting it all together, as I’ve said before, the current status of the housing market is structural and will take years to adjust. I own shares in DHI, LEN, GRBK, KBH, and TOL.

It’s All About Interest Rates

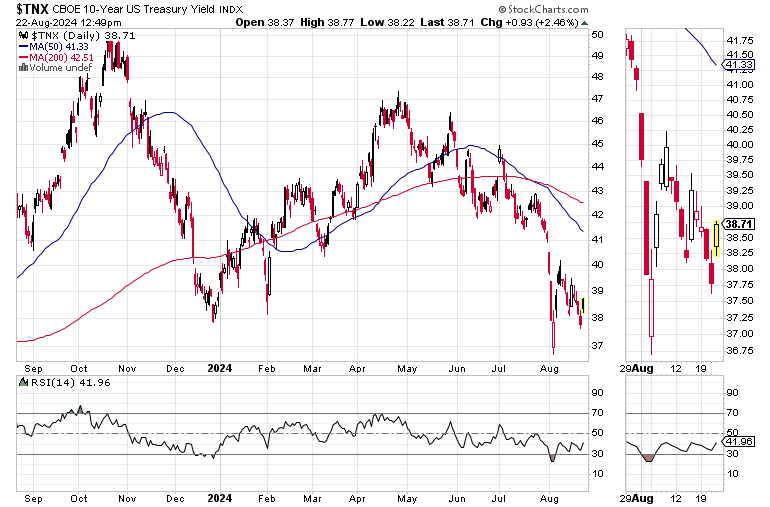

All of which brings us back to Mr. Powell. The financial markets are hoping, and pricing in, some sort of decline in the Fed Funds rate in September. And they may get it. While, some Federal Reserve officials have suggested they are leaning toward such a move, while others are not. Still, according to the most recent FOMC minutes, most agreed that a rate cut in September was doable.

On the inflation front, prices are now fluctuating. My recent grocery bill had a few items that cost less than they did a week or two ago, while other prices are stable and some are still inching higher. And although gasoline prices are stalling, insurance rates aren’t falling. I dread renewing my car insurance later this year. Meanwhile, existing jobless claims are still climbing, while the Labor Department just revised its jobs numbers down by 818,000, meaning that the previously released new jobs created numbers are down by almost a million – that means fewer people are actually working than what the official statistics say.

Certainly, the bond market is in a good mood. The U.S. Ten Year Note yield (TNX) remains below 4%, which is a good thing for mortgage rates, but has not done a thing for credit card interest charges or brought down rental rates below what incentives are doing. Maybe a Fed rate cut would spur something along those lines.

Mortgage rates remain below 6.5%, where they’ve been for the past three weeks.

What Happened to the Summer Rush?

I just returned from a trip to Wisconsin, where I mercifully escaped the 100-plus degree heat in Texas for a few days. I drove around the Green Bay area and saw two “For Sale” signs, both on empty lots, with no activity on them as far as I could tell. When I returned to the heat, all the activity I noted here a few weeks ago seemed to have cooled down.

The townhome which Opendoor is selling in my neighborhood is still for sale. On the other hand, the fella who couldn’t sell his house and kept dropping the price may have a renter soon as some folks seem to be interested.

What the Charts are Saying

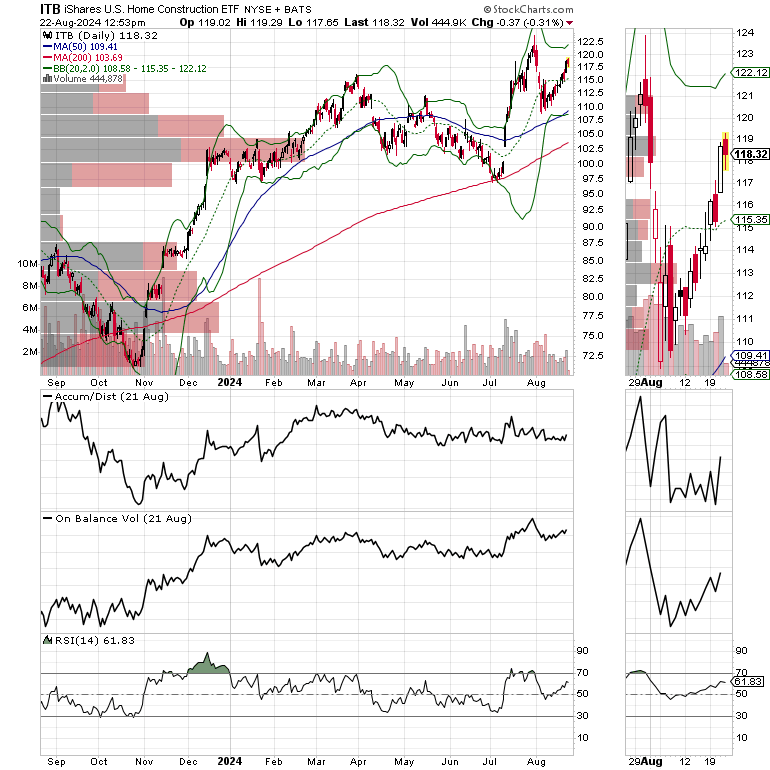

The iShares U.S. Home Construction ETF (ITB) remains in a stable consolidation pattern with an upward bias. Both the ADI and OBV lines are stable, suggesting investors remain patient.

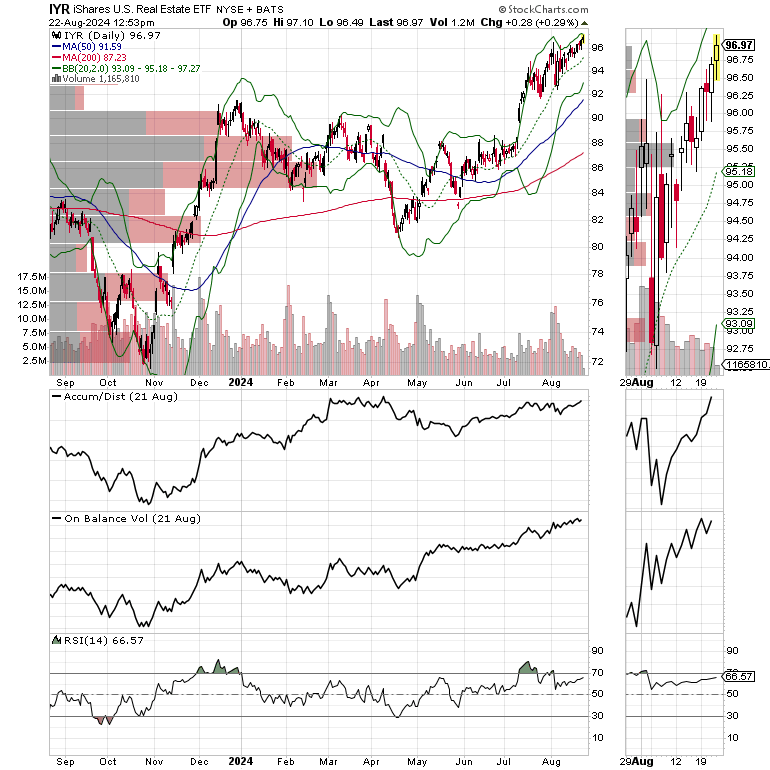

For its part, the iShares U.S. Real Estate ETF (IYR) is moving steadily higher with both ADI and OBV rising as money is moving in. I’ve just posted two new REIT trades at the Smart Money Passport that are showing positive momentum. For long term homebuilder and REIT plays, check out a Two-Week Free Trial at Joe Duarte in the Money Options.com.

Bottom Line

Mr. Powell’s remarks are likely to move the markets. If the bond market likes what he says we may see a test of the 3.75% yield on the U.S. Ten Year Note. That would translate to a new low on the average 30-year mortgage, perhaps a decisive break below 6.5%.

Although expectations are high for bullish comments at Jackson Hole, I wouldn’t be surprised if Powell leaves things alone while stringing the markets along. We’ll know soon enough.

If indeed rates fall after his remarks, it’s hard to know if that’s going to be enough to get anyone off the house buying fence, or if it’s instead going to push them onto renting until prices come down further.

I’ll be watching what the homebuilders and REITs do in response to his speech. And I’ll be keeping a very close eye on how long the effect of his words on these two areas of the stock market last.

That’s because, as I’ve said before, and I will say again, the changes in the housing market are now structural. Thus, the supply and demand side of the housing market favors homebuilders and residential REITs.

In other words, it’s always prudent to consider buying into these groups on dips.

Thanks to everyone for your ongoing support, especially new members. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.

I've noticed a lot of individuals who were excited to buy multi-family homes and rent them out a few years back have lost that excitement these days. Amazing what a few percentage points higher in interest rates can do.

Big fan of REITs — O has been very good to me over the years. Excellent post, as always.