Momentum Monday. The I Must Break You Moment Nears. Panic Bottom vs. Further Pain Straight Ahead.

It's either a crash or the prelude to another "buy the dip" opportunity

Image courtesy of i.pinimg.com

Market Nears Major Decision Point

Stocks are getting pounded this morning in a post-Christmas low volume environment, which I will detail below. Suffice it to say that Mr. Market is trying to break the will of the remaining bulls. This is why I’ve been writing about staying patient and being prepared for the past few weeks.

That said, it’s important to understand what’s unsettling traders and triggering the automated trading systems (algos) which rule the market.

I’m not one for forecasting, so this isn’t a prediction of what the future holds. But, I’m all about being prepared for whatever the market (algos) decides to throw at us. So here are a few likely influential things to consider for 2025. Their unifying trait is their potential to sow uncertainty. Uncertainty breeds indecision. Indecision leads to trading avoidance from some and panic selling from others. That’s what’s happening in the market today - low volume and panic selling. And here are some of the reasons:

• Washington D.C.: You fill in the blanks;

• Geopolitics: Lots of global hot spots at different stages of Chaos or future Chaos;

• Megatrends: AI, shifting sands in energy and natural resources

• The ongoing reshuffling of the financial order and international trade relationships;

• Bitcoin’s evolution;

• The structural situation for migration (domestic and international) and the housing market; and perhaps the trickiest variable of them all;

• Inflation and the Federal Reserve.

Putting it altogether, it’s not difficult to conclude that 2025 may be quite the year as these divergent variables all vie for attention and exert their influence on the way money flows through the financial system. So here are the three plausible scenarios as to what happens next:

• Stocks may recover and move decidedly higher for several weeks fueled by short covering and eventually fear of missing out (FOMO);

• Stocks may enter a trading range; or

• The current bounce fails (it is doing so as we speak) and stocks make a second and perhaps lower bottom or even a series of bottoms. In this scenario, the lowest bottom would likely be a frightening selloff fueled by true panic as the current rally fails. The telltale signs of a panic bottom are lower volume, more drama, and a higher reading in the RSI than the previous bottom readings, especially in the NYAD (see below).

As investors, we should be prepared for all possibilities by following these simple principles:

• Stay patient and aware of what’s happening in the markets;

• Stick with what’s working;

• Hold onto any position that is not stopped out. And most of all;

• Look for relative strength, build a shopping list and retool portfolios for the next up trend.

How do we get through all of the uncertainty? We trade one day at a time and stick with what’s working by following the money – wherever it leads.

Market Update – Is a Panic Bottom Around the Corner?

We are either making a significant panic bottom or getting ready to break to lower lows. This morning, the New York Stock Exchange Advance Decline line (NYAD) has broken to a new low. But the RSI for is not making a new low, remaining above 30.

Note also the similar pattern which unfolded in November 2023 before the market took off for the next twelve months. As a result, if history repeats, we may be in the early stages of a panic bottom, which sets the stage for a new rally. Things could certainly get worse, and this scenario is not guaranteed. But it is quite plausible. Let’s see how things go.

Fear is definitely on the rise as the CNN Greed/Fear index is at 26 this morning, dropping 10 points from last Friday’s close. Rising fear goes along with the panic bottom scenario. VIX is rising, but has not crossed above 20.

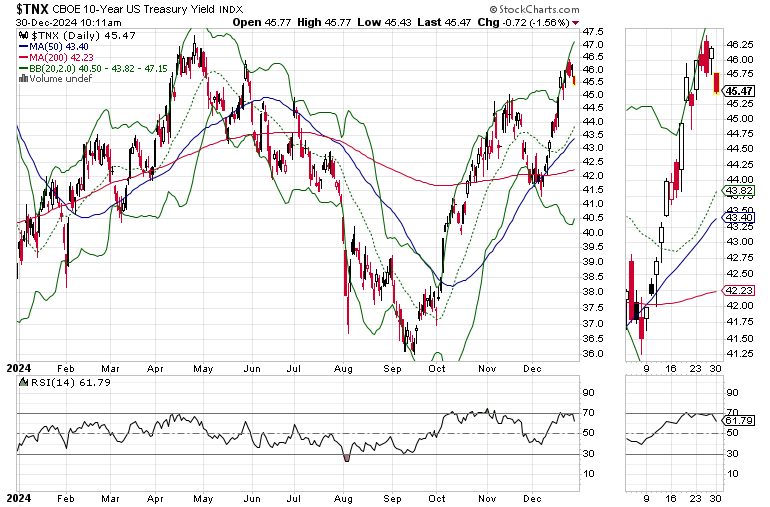

The U.S. Ten Year Note yield (TNX) recently hit the top of its trading range and now looks to cut below the 4.5% yield. But the bond market remains skittish as traders continue to fret about inflation. Still, the RSI for TNX is near 70, which means that we may see a consolidation or a retracement in bonds.

Bitcoin (BTCUSD) is under increasing selling pressure with a test of $90,000 approaching. Our BTC short position is delivering the goods. Yet, BTC is approaching the 30 area on RSI, so some sort of bounce may be in the works.

Momentum Portfolio Update

Our Momentum Portfolio is nearly 100% cash as I’ve been reducing the number of positions in the mix over the last couple of weeks and we’ve been stopped out of most positions which were active. I am, of course, putting together a shopping list.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.