Momentum Monday. Stocks Trade Lower. Bottoming Process Unfolding.

Plus, a new low risk, high profit potential option trade.

Image courtesy of vecteezy.com

The stock market continues to sell off in thin pre-Christmas trading. But money is quietly flowing into one group which is the subject of today’s low risk, high potential option trade.

Market Update – Everything is Selling Off. But it’s Getting Very Oversold.

The pre-Christmas session is nowhere near the usual “Santa Claus rally” environment as few are willing to buy stocks during what is the traditional year end period in 2024 as the Fed has taken away the punch bowl. As I noted this weekend, there were three possible scenarios which were developing:

• Stocks may move decidedly higher for several weeks fueled by short covering and eventually fear of missing out (FOMO);

• Stocks may enter a trading range; or

• The current bounce, which we saw on Friday, fails and stocks make a second and perhaps lower bottom or even a series of bottoms. In this scenario, the lowest bottom would likely be a frightening selloff fueled by true panic as the current rally fails. The telltale signs of a panic bottom are lower volume, more drama, and a higher reading in the RSI than the previous bottom readings. You can find similar signs in the NYAD and likely the major indexes.

As things stand this morning, it looks as if the last bullet, a failure of Friday’s bounce is developing. On the other hand, things could change in a hurry, although the Fed’s talk of slowing or pausing interest rate cuts in 2025 seems to be taking hold.

So, as I noted above, if the market makes a new low but the RSI indicator does not, the odds would favor that we’ve put in some sort of tradeable panic bottom. That doesn’t mean we should rush into stocks, but it’s a positive sign, which should raise our alert level toward going long the market.

This morning, the New York Stock Exchange Advance Decline line (NYAD) is testing its recent lows. Moreover, the RSI for NYAD is just above 30 after hitting a low well below 30 last week during the heavy post FOMC selling spree. Thus, until proven otherwise, the market is, believe it or not, trying to put in a bottom.

Meanwhile, the CNN Greed/Fear index is at 26 this morning. That’s a new low for this cycle and it’s a sign that traders are nearing that panic stage where they want to be out of everything. These types of readings on the Greed/Fear index are bullish from a contrarian standpoint, but are imprecise when it comes to timing, so they don’t necessarily pinpoint precise entry points into the market.

The U.S. Ten Year Note yield (TNX) is still flirting with the 4.5% yield as traders continue to fret about inflation. The RSI is near 70, which means that we may see a consolidation or a retracement in bonds.

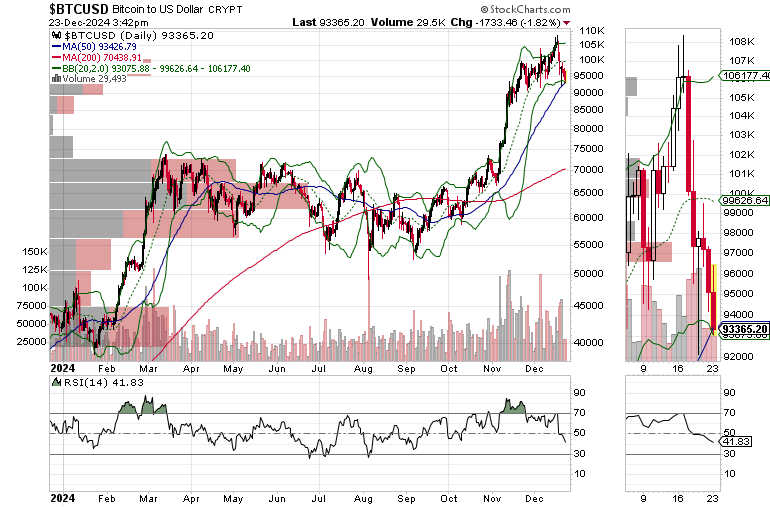

Bitcoin (BTCUSD) is testing the support of its 50-day moving average. As with the NYAD and TNX, however, the RSI indicator is nearing an extreme level, which means a reversal is plausible. We are currently hedged in BTC with a long position which is nicely profitable in our ESP portfolio (update tomorrow) and a short option position which is holding its own nicely in this portfolio.

Momentum Portfolio Update

Our Momentum Portfolio is nearly 100% cash currently as I’ve been reducing the number of positions in the mix over the last couple of weeks and we’ve been stopped out of most positions which were active.

I am, however, putting together a shopping list. And this morning, I am adding a very low risk, high potential option trade to the portfolio.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.