Are We There Yet? Stocks Bounce Back after Massive Panic Attack. Growth Leads the Pack.

I can wait. I can be patient.

Thranduil, the king of the wood elves in the Lord of the Rings gave investors excellent advice when he uttered the iconic words in a hauntingly throaty voice: “I can wait. I can be patient.”

Thranduil image courtesy of fanpop.com.

The last few weeks have been frustrating for investors who’ve been waiting for the traditional end of the year rally. At one point the market seemed lethargic, so I suggested it needed some caffeine along with a barrel full of energy drinks. That didn’t last as stocks staged a mini crash after the 12/18/24 FOMC meeting when things went south rapidly.

Meanwhile, Bitcoin has been a money magnet. Yet, after the Fed’s 12/18/24 “hawkish” turn, even it too saw a downturn. Certainly, the selling everywhere was impressive, with damage to many stocks, crypto and bonds. Yet, as I’ve noted many times, including recently, in a market run by machines, technical developments are crucial to monitor.

Thus, I’ve noted that the RSI indicator for the New York Stock Exchange Advance Decline line (NYAD) is at the 30 level, which is an oversold reading from which multiple rallies have been born in the past few years. Moreover, the rapid selling of the last few days has taken NYAD outside its lower Bollinger Band (see below), a sign that a reversal to the means – an upside bounce, in this case – was in the cards.

Indeed, I wasn’t surprised to see the market turn around on 12/20/24 with the upside further juiced by a better than expected PCE inflation reading during a massive options expiration which was leaning toward the bearish side as indicated by a rapid increase in the Put/Call ratio, and a CNN Greed/Fear index which clocked in at 22 on 12/20/24 down from 43 a couple of days earlier.

Are We There Yet?

So, are we out of the woods? Maybe. But let’s not get ahead of ourselves. The stock market may be in the early part of a bottoming process, but it could take some time before things go back to “normal”.

Here is how things could develop from here:

• Stocks move decidedly higher for several weeks fueled by short covering and eventually fear of missing out (FOMO);

• Stocks enter a trading range; or

• The current bounce fails and stocks make a second and perhaps lower bottom or even a series of bottoms. In this scenario, the lowest bottom would likely be a frightening selloff fueled by true panic as the current rally fails. The telltale signs of a panic bottom are lower volume, more drama, and a higher reading in the RSI than the previous bottom readings. You can find similar signs in the NYAD and likely the major indexes.

As investors, we should be prepared for all possibilities by following these simple principles:

• Be like Thranduil. Stay patient.

• Stick with what’s working;

• Hold onto any position that is not stopped out. And most of all;

• Look for relative strength, build a shopping list and retool portfolios for the next up trend.

Where is the Money Going?

It’s always best to follow the money, especially after a huge selling rout as the groups which get the best start out of the gate tend to lead the next rally higher.

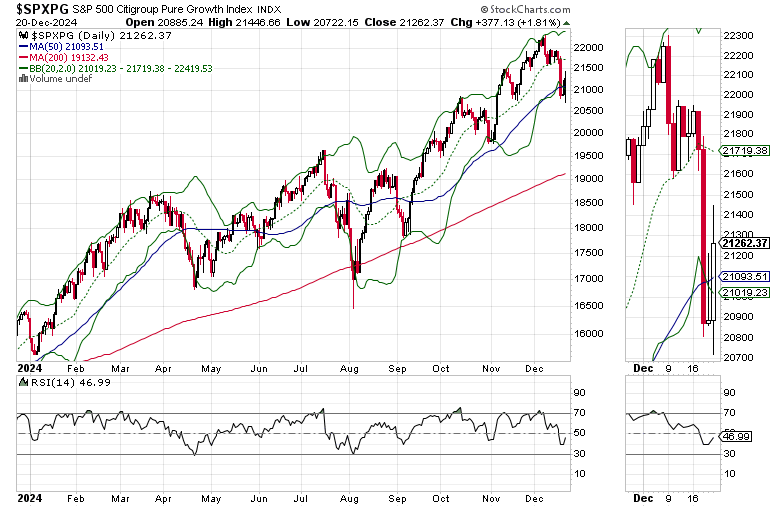

Interestingly, the best looking macro-sector on 12/20/24 was the S&P 500 Citigroup Pure Growth Index (SPXPG), which found support at its 50-day moving average and ended the day sporting a nifty engulfing candlestick pattern (the last candle expands above and below the previous candle and closed above the prior day). Engulfing patterns are often signs of important reversals. In this case, it’s an upside reversal.

Also note that the RSI was close to 30 prior to the reversal and that the 12/19/24 and 12/20/24 candles moved outside their lower Bollinger Band prior to the reversal.

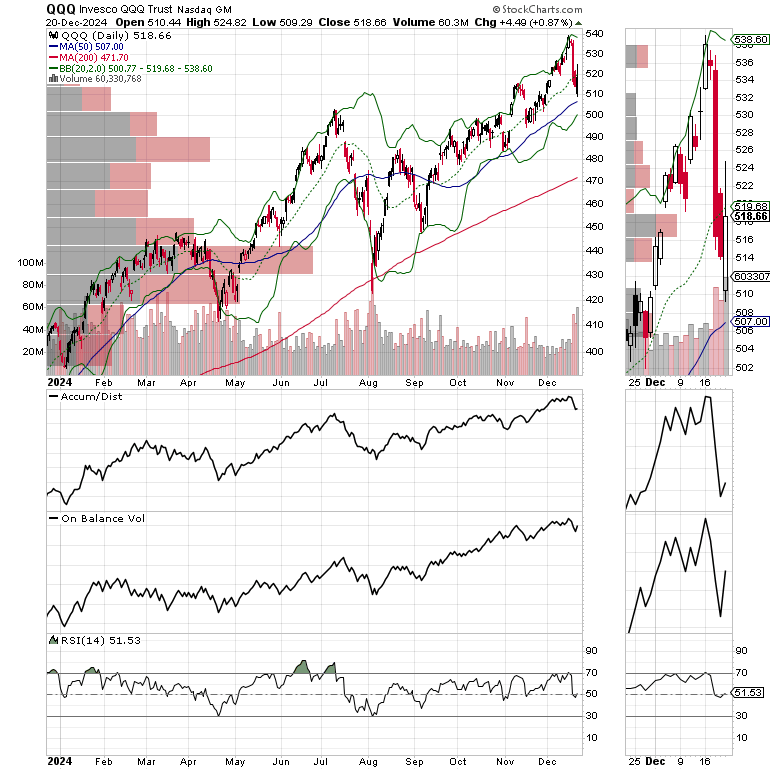

Thus, if these early signs remain in place, a great place to look for interesting stocks might be inside the Invesco QQQ Trust (QQQ), which is heavily tilted to large cap technology stocks (one of them is my pick of the week at the long term high profit potential Weekender Portfolio), while others are likely to appear at the Smart Money Passport, with the latter featuring a shorter time frame for cashing out.

In addition, it’s important to watch for signs of the rally broadening out, as it will open up more opportunities.

Finally, it’s important to keep in mind that volatility isn’t likely to go away altogether and that geopolitical and Washington developments may affect the day to day trading activity. Yet, until proven otherwise, it’s quite possible that a bottoming process has started.

Ten Year Yield Hits 4.5%.

Last week I suggested the PCE report (out on 12/20/24) could calm the bond market, and it did as it came in slightly softer than expected. Still, the recently bullish tone in the bond market has evaporated on the hotter than expected inflation reports prior to the PCE (PCI and PPI) and the Fed’s changing tune about inflation. As a result, the U.S. Ten Year Note yield (TNX), the benchmark for the average 30 year is above the key 4.5% yield. A sustained rise above 4.5% would likely spur more selling in stocks.

Liquidity Continues to Rise.

Meanwhile, there seems to be enough money sloshing around in the financial system looking for something to do. The National Financial Conditions Index (NFCI) made another new low this week, falling further below -0.65. This remains bullish because the lower the number goes, the higher the liquidity level in the financial system. We’ll see if this keeps stocks from falling further.

Bitcoin is Suddenly Out of Gas. Stay Patient.

Bitcoin (BTCUSD) got a dose of reality as it fell to its 50-day moving average, just as the New York Stock Exchange Advance Decline line (NYAD) is trying to right itself. This inverse relationship continues to support the notion that stocks and Bitcoin are directly competing for investor’s cash these days.

Our position in Bitcoin continues to hold its own as we wait for things to settle down. Get the details here. If you’re an ETF trader, consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about starting a day trading career, my new book “Day Trading 101” will get you started on the right foot. For steady gainers, check out the Smart Money Weekender Portfolio.

Market Breadth Improves. Let’s See if it Holds.

The New York Stock Exchange Advance Decline line (NYAD) is well oversold and could be on the road to recovery, but it’s still very early in the process. We need to see NYAD hold above its recent low, although last week’s reversal is certainly encouraging after NYAD hit its recent low. Let’s see what happens at the November lows for NYAD, the first important resistance level.

The Nasdaq 100 Index (NDX) successfully found support at 21,000-21,250. As I stated above, this is due to large cap tech stocks rebounding.

Both the ADI and OBV lines remained in consolidation patterns with the OBV line moving higher on 12/20. This suggests that buyers are moving in on the dip. This is bullish if it persists.

The S&P 500 (SPX) broke below 6000 level, but found support at its 50-day moving average. Let’s see what happens as the index tries to move above the key round number during this initial bounce.

Note the bullish engulfing candlestick on 12/20. This is a sign that buyers bought the dip. Let’s see if the bullish climate persists.

VIX Reversed Ending the Week Below 20

The CBOE Volatility Index (VIX), reversed its recent rise and closed below 20 as bearish sentiment cooled off. This too is constructive for the markets.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

#1 Best Seller in Options Trading –

Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition) Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)

Loved this one! Great work!