Momentum Monday - Stocks are on Pins and Needles. Bitcoin Pauses. Plus, Two New Trades for a Tentative Market.

When the election is past, we will still have to worry about liquidity.

With the Fed’s next meeting a couple of days away, and the elephant in the room (the election) looming, contrarian investors should position themselves for all potential outcomes. And while what will happen will occur and the effects will reverberate, the most important intermediate term factor for the stock market is liquidity.

As I’ve recently noted, over the past couple of weeks the rise in bond yields has squeezed the financial system’s liquidity and the Fed is essentially obligated to ease rates. More important is whether the central bank will reignite its QE initiative and flood the system with newly minted money. Until that is clear, we can expect a bumpy ride.

Image courtesy of nationalinterest.org

Market Update

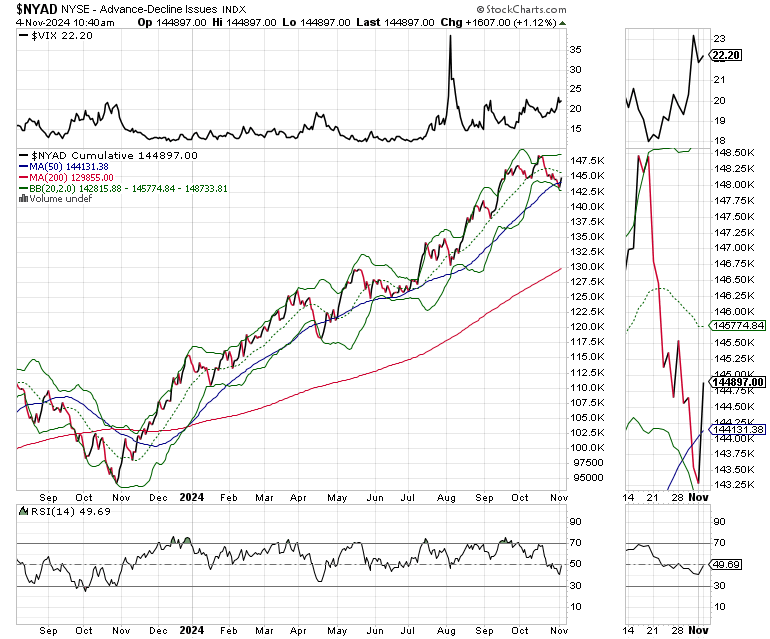

This morning, the New York Stock Exchange Advance Decline line (NYAD) is back above its 50-day moving average. This is a short term positive. Things would be smoother if NYAD resumed a steady climb with the 50-day line as reliable support.

For their part, bond traders seem to be buying the recent high yields in the U.S. Ten Year Note (TNX). This is a short term positive for sure. As I’ve noted multiple times, the 4.3% yield on TNX looks a bit top heavy. As a result, I’ve recently added an option play to capitalize on a potential bond reversal, which I will update in tomorrow’s Extended Stay Portfolio (ESP) post.

The reversal in bond yields is having a slightly negative effect on Bitcoin (BTCUSD), this morning. But the cryptocurrency is still trading above its 20-day moving average with $72500, the recent high still within reach. As I’ve recently noted, recent events have turned Bitcoin into a money magnet, prompting me to add two trades on the cryptocurrency.

In today’s Momentum Monday update, I have two new trades. One is a technology ETF while the other is a special situation option play.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101 – will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.