Clash of the Titans. It’s the Fed’s Liquidity Vs. the Bond Market.

It's not the event. It's the money flow.

The month of October is likely to remain volatile. On the one hand, the Fed, and the rest of the major global central banks, especially China’s PBOC, are once again flooding the world with easy money. On the other hand, the bond market is freaking out about the potential for a resurgence of inflation after a blowout September payrolls report. This sets up a potential “Clash of the Titans,” with the stock market caught in the middle. It all boils down to whether the stock market holds up as bond yields rise and which sectors attract money.

It’s Not the Event – It’s the Money Flow.

September’s employment report delivered an upward surprise with 254,000 new jobs created versus expectations of 140-150,000. The stock market rallied and the bond market tanked. Things could change. As has been the norm this year, there is probably more to the jobs data than meets the eye, and it could take several days to sort out the details.

It’s easy to get rattled by these events. Yet when it comes to trading it’s all about the market’s response and how each individual portfolio position responds to it. Thus, rather than panicking, success in this market will be built around deciphering the interaction between the bond market and how money flows.

Right now, based on the information that’s available, here’s why the bond market is worried:

· Inflation’s rate of rise, until now, had been flattening out. That’s not a sign that the inflation already in the system is receding but that it’s not rising as rapidly as it was a few months ago;

· Global Central Banks, worried about their economies (PBOC is worried about the Chinese economy in general and the Fed is worried about the status of the U.S. employment market) are pumping liquidity (newly printed money) into the financial system;

· The huge QE which followed the pandemic has not been fully drained from the system. That means the Fed is may overfill the gas tank;

· The combination of multiple central banks refilling an economy’s gas tank which is not empty, and where the recent payrolls data suggests that the job market is recovering increases the odds of inflationary pressures reigniting the rate of rise in inflation;

Bond markets hate inflation, thus the U.S. Ten Year Note yield (TNX) blew out above its recent, and very tight trading range, and is now pushing on the 4% yield area.

Before you day trade, get the facts with my new book - Day Trading 101.

Mortgages May Have Bottomed Out

I spend a lot of time analyzing the housing market. It’s not as sexy as the technology sector. But it does account for 16% of U.S. GDP, while tech accounts for some 10%. In other words, housing is a bigger tail that wags the real economy’s dog than technology, which is a major contributor to the trend in the major stock indexes.

I recently wrote a piece titled: “October Surprise: A Stronger than Expected NFP Number Could Upset the Housing Apple Cart,” whose assertions proved to be correct, and in which I detailed the misconception that the Fed is the major influence on mortgage rates. As the charts below illustrate, the U.S. Ten Year Note Yield (TNX) bottomed out ahead of the Fed’s surprise 0.5% rate cut, and mortgage rates followed.

As I further discussed in the article, many potential home buyers locked in their rates ahead of the Fed’s rate cut. Now, they look like the smart money, as mortgage rates, which seem to have already bottomed are almost certain to jump over the next couple of weeks.

Nevertheless, expect volatility in TNX as the yield has risen too rapidly to be sustainable, which means that a move back toward 3.8%, the 50-day moving average is likely. What happens there will decide what comes next.

There are two viable scenarios for housing which could develop. One is that buyers panic and a buying frenzy starts as they fear that rates will only rise further and they will be shut out at what could be rates near the lows for the foreseeable future. The other is that they just walk away and decide to rent or stay put. Stay tuned.

If you’re not getting my FREE weekly real estate and interest rate updates, you can sign up here.

Buy the Dip in Housing?

Does this mean that the housing market is about to collapse as it did in 2007? Certainly, anything is possible, especially if interest rates hit levels which spook homebuilders and potential buyers. But here’s what’s different between this market and the subprime mortgage crisis; compared to 2007-2008, when the market was oversupplied, currently demand is outpacing supply while builders are only building enough houses to meet the demand of customers who can pay.

The iShares U.S. Homebuilding ETF (ITB) saw some selling last week as bond yields rose, but held above its 50-day moving average. That means the intermediate term uptrend is intact. The 50-day moving average has been an excellent place to buy dips in ITB since it turned around in July.

Finally, it’s worth noting that housing is a physical asset and that physical assets are traditionally seen as inflation hedges.

Is this a time to buy the dip on homebuilders and REITs? For the answers, check out a FREE Two Week Trial to Joe Duarte in the Money Options.com. For short term trades often featuring these bullish trading vehicles click here.

What About the Grid?

Hurricane Helen crushed the southeast U.S., literally wiping out the electric grid in North Carolina while seriously harming parts of Florida, Georgia, Tennessee, and some areas of Kentucky.

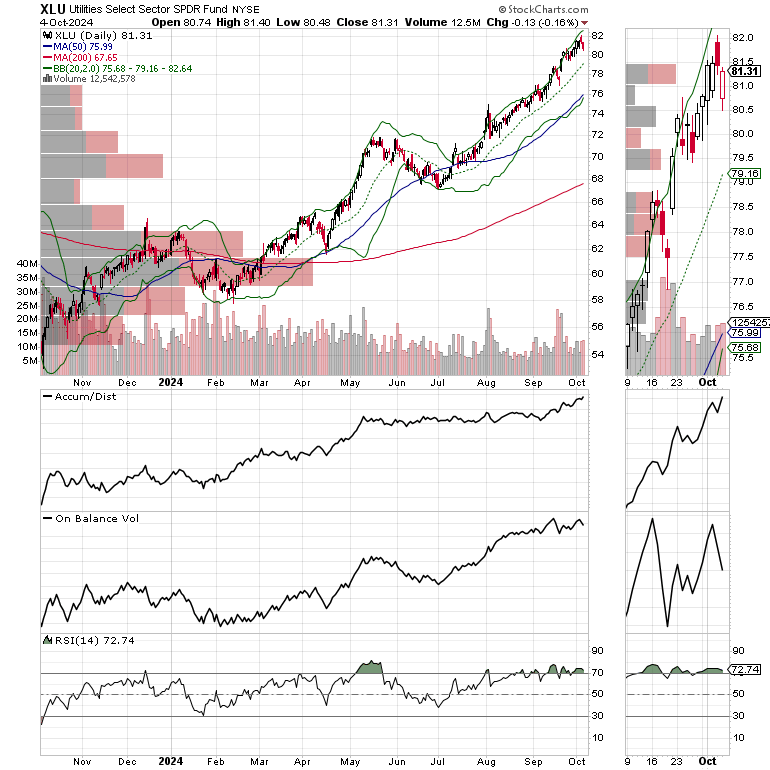

The effects have not totally disrupted the uptrend in the electric utility sector. The Utilities Select Sector SPDR Fund (XLU) sold off slightly, but remains above its 20-day moving average which has been a great place to add to positions on most dips since February.

The Invesco Dynamic Building and Construction ETF (PKB) is testing its recent highs as investors wonder if the likelihood of an increase in business for these building materials, engineering, and construction companies will be overshadowed by rising bond yields. Moreover, inflationary pressures, if they resume after central banks flood the economy with liquidity, could hamper the ability of these companies to complete projects in a timely manner.

Finally, the United States Oil Fund (USO) is starting to flex is muscles as tensions in the Middle East are still on the rise. If you’re an ETF trader, consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. I just recommended a USO option trade at Joe Duarte in the Money Options.com.

AD Line Powers On. Events Could Affect Short Term Trend.

The New York Stock Exchange Advance Decline line (NYAD) remains in an uptrend/consolidation pattern. A move back to the 20-day moving average is still possible while the RSI is no longer overbought.

The Nasdaq 100 Index (NDX) is still trading between 19,500-20,000 with 20,750 being an important resistance level.

The S&P 500 (SPX) is also within striking distance of making a new high. 5650 is now short term support

VIX Rises Suggesting Further Turbulence Ahead.

The CBOE Volatility Index (VIX), has moved back to 20, suggesting investors are becoming uneasy and that more turbulence lies ahead.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

#1 Best Seller in Options Trading –

Options Trading for Dummies (4th Edition) Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)