October Surprise: A Stronger than Expected NFP Number Could Upset the Housing Apple Cart.

Those who recently locked in their mortgage rate may be the smart money.

Investors should prepare for a bond market shock and some repercussions. That’s because the housing market may be vulnerable to an unpleasant surprise if the NFP number comes in above expectations.

A Sense of Urgency is Palpable

Some in the market aren’t waiting any longer as the number of potential buyers who have locked in a mortgage rate rose by 68% since the Fed’s rate cut. Those that did might look back and pat themselves on the back, as they may have bought the bottom of the cycle.

Indeed, those who have locked in rates may be the smart money as recent employment market data and stronger than expected jobs market data suggests that this week’s NFP number could come in stronger than the expected 148,000 new jobs created.

That means that a lot could change in the bond and mortgage markets if this week’s employment report comes in stronger than expected and bond yields shoot up. More on that below. And if you want to voice your opinion on whether NFP number will be above or below expectations, you can cast your vote here.

Of course, it’s hard to tell whether this is the absolute bottom in mortgages or not. But it seems beyond plausible. According to Redfin, even though the increase in mortgage locks is encouraging, this rise in locks may at least partially due to buyers who had already begun the home buying process and had been waiting for the rate cut locking in their rates.

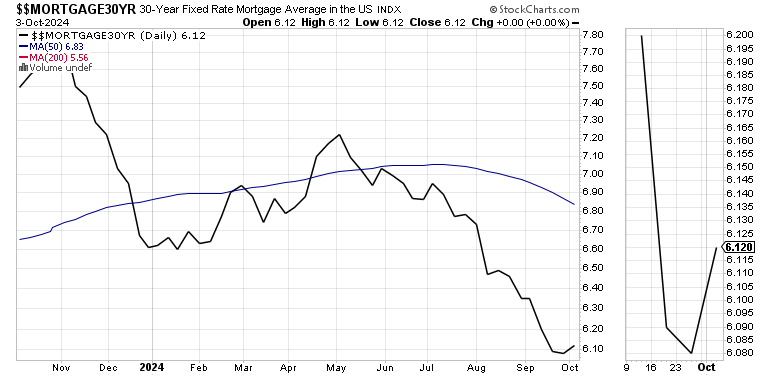

When it Comes to Mortgages Look at Bond Yields, Not the Fed

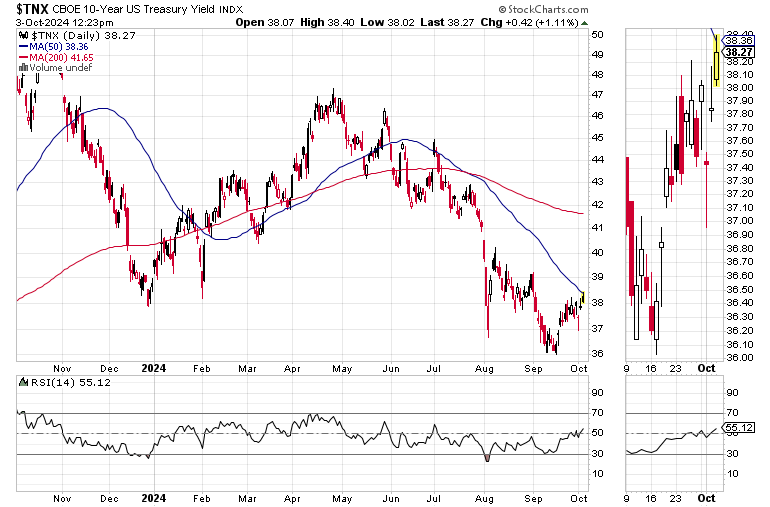

It’s also important to note that the mortgage market takes its direction from the bond market, which means that no matter what the Fed does, mortgage rates are more dependent on what the U.S. Ten Year Note yield (TNX) does in response to the Fed’s actions.

And the current chart depicting the average 30 Year Mortgage does have that look of a potential bottom being in place as rates just turned up.

Moreover, unless something happens that makes bond yields break to new lows, we may have seen the bottom in mortgages for the next few weeks to months. Thus, what happens next in housing highly dependent on what potential home buyers will do in response to a potential rise in bond yields and the subsequent increase in mortgage rates.

Already, we’re seeing some signs of what could very well happen. If the most recent mortgage data is any clue, those who wish to refinance may have already done so. That’s certainly what the flattening out of refinancing demand did over the last week in response to the flattening out evident in TNX, in turn mirrored by the most recent mortgage.

On the other hand, weekly demand for mortgages for home purchases rose by 1%, while delivering a nice surprise by rising over 9% year over year.

The Big Picture for the Housing Market.

Over the last few weeks, I’ve chronicled the recent developments in the housing market, which, as a group you can find here. If you’ve missed these posts, I recommend reviewing the last five, prior to this one, which began on August 29, 2024.

Here are the new terms of engagement in the housing market:

· The current housing shortage is structural. It is likely to remain in place for years;

· Supply and demand remain in favor of homebuilders and attractively located rental properties with lots of perks;

· Mortgage rates may be near the lows for the cycle;

· Consumers trying to decide whether to buy or rent are mostly influenced by the monthly payment they will have to deliver either as a mortgage or rental payment;

· New homes seem to be more attractive for buyers than existing homes; and

· Homebuilders should remain profitable but their margins are starting to shrink.

In addition, due to the rapid rise in housing prices over the last twelve months, as I recently wrote, sellers are panicking and prices are starting to come down. According to Redfin, potential buyers are starting to come back, at least as measured by the number of tours for listed homes on its service. Moreover, rents are starting to fall, with average rent falling

On the Ground

Last week, in this space, I wrote that the lack of activity in the housing market was of concern and that home sellers were starting to panic. Thus, as always happens, it seems as if it’s always darkest before the dawn. This week, I’m seeing some new activity on the ground, which is encouraging, although it may be short lived if the NFP number spooks the bond market.

Specifically, one of the undeveloped subdivisions owned by a small builder I’ve been keeping an eye on is now sporting a “new construction” sign from a realtor, which means that they are starting to take new orders. Let’s see how quickly the place fills up – or not.

Also encouraging, although it could well be temporary, I’m seeing a bit more traffic in new homes which have been completed and unsold for some time. This contrasts with existing homes, which are getting traffic but no buyers. I’m also seeing an increase in activity in single family homes which have been For Rent for some time.

In addition, there are lots of apartment complexes which are on the verge of completion in my area. We’ll see what happens there when they finally hit the market.

Bonds Yields Continue Their Slow Upward Creep – NFP Could Set Housing Back

The U.S. Ten Year Note yield (TNX) remains below 4%, but a stronger than expected employment report could move bond yields decidedly higher. Other inflationary pressures are starting to surface as well. This morning’s ISM Non-Manufacturing (services) data came in stronger than expected with the prices component delivering a robust 59.4 reading, well above the forecast of 56.3 and the previous month’s reading of 57.3.

TNX is testing its 50-day moving average, which is an important resistance level.

Homebuilders and REITs

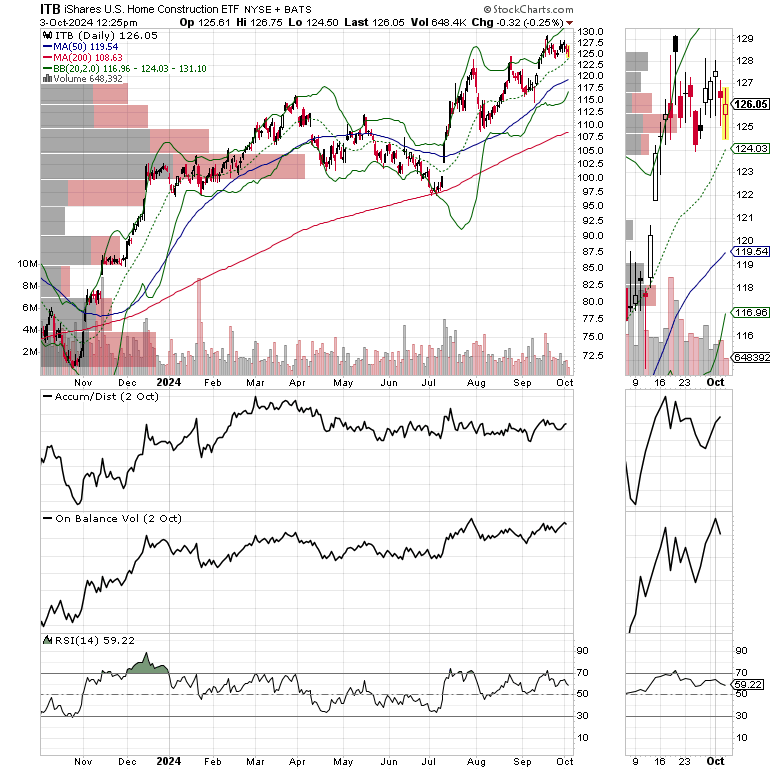

The iShares U.S. Home Construction ETF (ITB) remains in an uptrend, and has broken out to a new high. It is due for a pause, but so far money keeps moving in. Lennar’s earnings will likely be a big influence on this ETF in the short term.

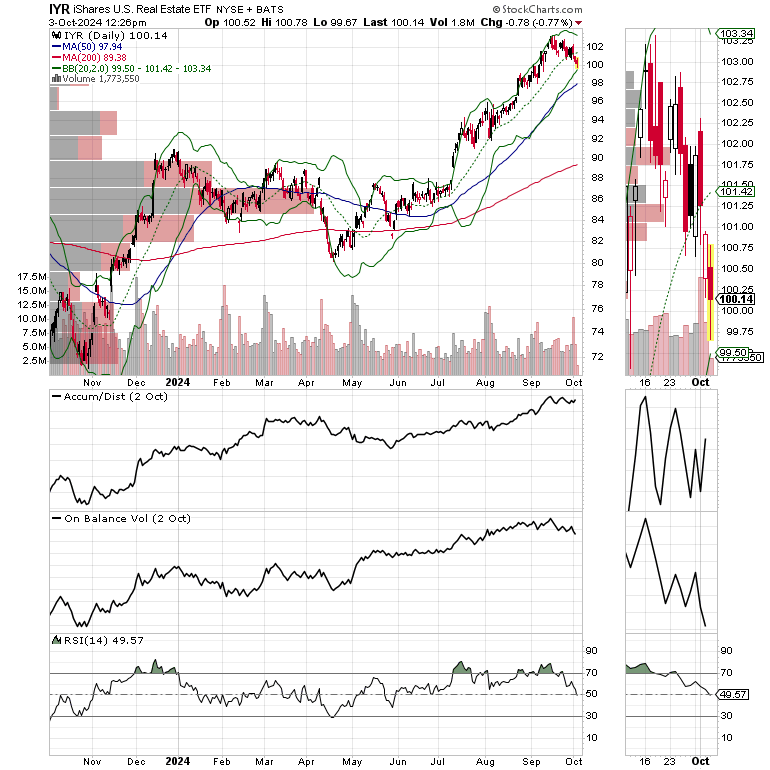

The iShares U.S. Real Estate ETF (IYR) is proving to be more interest rate sensitive than ITB as the pop in bond yields is taking some wind out of its sails. The consolidation I’ve been expecting in this one is likely to lead to a test of the 20-day moving average in the short term.

Bottom Line

Homebuilders remain in the supply/demand sweet spot, but outside influences such as consumer concerns about the economy and the jobs market are starting to seep into their growth rates. The big question is whether lower mortgage rates will counter their fears.

It all adds up to increasing competition in the housing market with residential REITs and homebuilders having the upper edge in a rapidly shifting market.

A stronger than expected NFP number could upset the mortgage apple cart.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Joe, it is so important to keep educating people about the relationship of bond rates (especially 10 year bonds) and mortgage rates.

I find it borderline criminal that the mainstream media keep shouting about the FED rate and almost always connects it (falsely) to mortgage rates

Sho nuff. The Fed just cut rates by half a point and bond yields and mortgages are both rising as bond traders fear inflation. As I said in the article, it is at least plausible that we may have seen a short to intermediate term bottom in mortgages and those who are waiting for lower rates may be out of luck for a while.