Brave New World Develops as the New Point of Emergence is Holding. What’s Next?

It's a whole new ball game.

I’m a bit puzzled at the surprise registered in the market about the stock rally following the Fed’s rate cut – even if it happened on the following day. By now, everyone should know that all the algos are programmed to rally on rate cuts while bond traders always fear inflation, which can arise from money printing. Thus, when the Fed pulled the trigger on its 50 basis point rate cut accompanied by the promise that more rate cuts are coming, the stock market rallied and the bond market pulled back, as expected.

As a result, the stock market retains an upward bias, while the bond market’s pullback, barring a major surprise on inflation, such as is plausible but not very likely in next week’s PCE data, is not likely to last. What’s most important is what the Fed does next and the market’s response.

Last week I wrote: “A point of emergence is an area of a complex system where all the agents in the system are vying to enter a small aperture simultaneously. Once a point of emergence is breached and the agents move through the hole, the system emerges to a new level of operation. We are there.”

It’s a New Ball Game

Here’s the new level of operation. The markets are now a greater influence on the economy than the economy is on the markets. I call it the M.E.L.A. system, and modeled it after the interaction between Complexity and Chaos. Complex markets are orderly, while Chaotic markets are disorderly.

Certainly, things may change. Yet the longer the current modus operandi remains in place, the lower the odds will be that the way the world once worked in the past will return. I want to be clear on this. If the stock market holds up, the odds of a recession are lower because investors will continue to use their stock gains to pay for living expenses. In other words, unless something changes, because more people are trading for a living than ever before -casually, part-time, or as profession. And their trading success, in an ongoing bull market fueled by Fiat money, where the spigot has just been reopened, is at least partially supporting the economy.

We’ve known this for a while. So, as I said last week, we trade one day at a time, while realizing that what we once thought was predictable is now predictably unpredictable.

For more on how to spot megatrends, check out my video on the subject.

What’s Working in the New World? Think Nuclear.

As I noted, we are in a brave new world where AI and its related dynamic, the need for increased power generation are the next megatrend, and the need for financing this energy hungry pursuit needs financing – the lower the financing rate the better. So, it was no surprise to see that the Three Mile Island nuclear plant is about to restart, with the power generated being sold to Microsoft (MSFT).

The news sent the nuclear stocks higher, led by Constellation Energy (CEG), which runs Three Mile Island. Further down the road, though, there was an interesting development with the smell of inside baseball. I’m referring to Brookfield Renewable Partners (BEP), which operates as a limited partnership, and which means that your CPA won’t like it if you buy it. Mine certainly won’t, so I won’t, although I’m not happy about it.

Here’s why. BEP and Canadian uranium miner Cameco (CCJ), which I just recommended at the Smart Money Passport, and in which I bought shares, own what’s left of Westinghouse Electric, which makes – wait for it – nuclear reactors. Cameco is a leader in producing electricity generating grade uranium, while Brookfield, via its multiple private equity vehicles owns a large network of nuclear and clean energy generation assets throughout the world.

The price chart for BBE suggests that money has been coming into the shares in fits and starts over the last few months, suggesting that smart money has been steadily building positions in the partnership ahead of the announcement.

Grid Stocks Like the Fed and the Nuclear Bump

All of which brings me back to the central theme of what the future may hold, as the electrical grid continues grab the center of the money flow game.

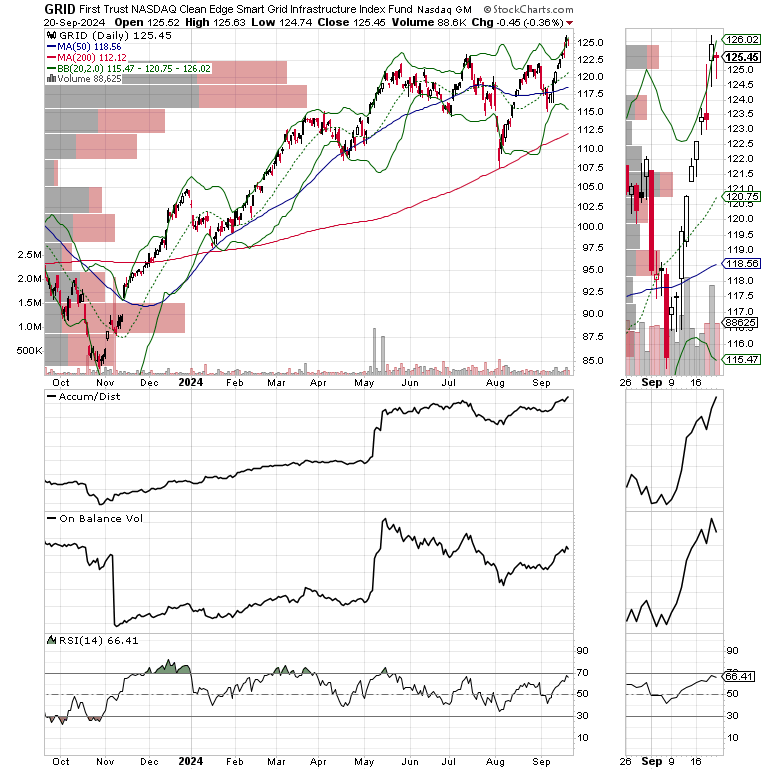

The FT Nasdaq Clean Edge ETF (GRID) delivered a breakout after the Fed lowered rates, although it remains overbought. Expect a base on base consolidation here, which for patient investors may be an opportunity to gather a few shares.

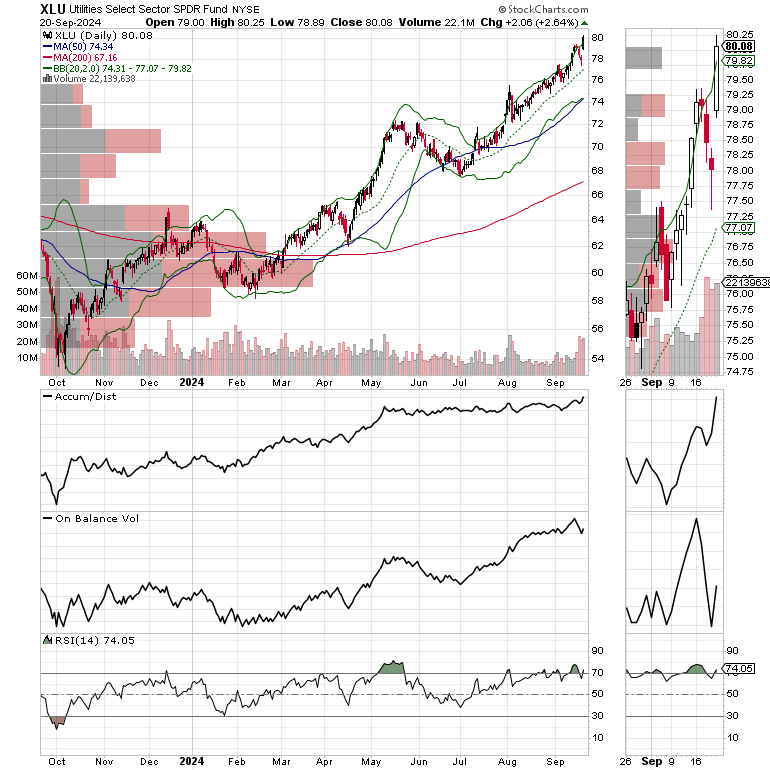

On the other hand, the Utilities Select Sector SPDR ETF fund (XLU), a fund which I own, and a core holding of the Sector Selector ETF service continues to power higher. This new high was fueled by the nuclear related utilities in its holdings.

Homebuilders and REITs Hold Up Despite Profit Taking and a Slight Miss by Lennar

The housing shortage megatrend is structural, meaning that it’s not going away anytime soon. That’s why even though bond yields (see below) rose slightly after the Fed’s rate cut, homebuilders and REITs held their own.

Shares of homebuilder Lennar Inc. (LEN), which I own, took a tumble after its recent earnings report as it missed its revenue forecasts ($9.4 vs. $9.6 billion expected), while beating its earnings estimates with some asterisks. What the algos didn’t like what that margins were smaller than expected (despite being pretty good) and that forward guidance was flat for the next quarter – still pretty good. If shares don’t fall further, this is likely another dip buying opportunity.

We recently took a $1000 plus profit on homebuilder PulteGroup (PHM). Get the details here.

Bond Yields Remain Below Key Reversal Point. Mortgages Deliver New Lows for Cycle

The U.S. Ten Year note yield (TNX) retraced some of its recent decline after the Fed’s rate cut, but it remains below 4%. At the end of the week, TNX was straddling 3.7%, which is a critical short term resistance area.

Mortgage rates, remained below 7% for the fifteenth straight week and again made another new low for the cycle.

If you’re an ETF trader, consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here.

AD Line Takes a Well Deserved Break

The New York Stock Exchange Advance Decline line (NYAD) again made several new highs last week, but got ahead of itself as it breached the upper Bollinger Band. A move back to the 20-day moving average is likely. If it holds, expect another attempt at a new high to follow.

The Nasdaq 100 Index (NDX) remains above its 50-day moving average but has not been able to breach the 19,500-20,000 resistance area. Look for more bumps for the short term.

The S&P 500 (SPX) broke above 5650 and has very short term support at 5650-5700. As with NYAD, a consolidation would be welcome.

VIX is Back Below 20

The CBOE Volatility Index (VIX), is hovering near 16. This is reassuring.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

#1 Best Seller in Options Trading –

Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition) Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)