As Mortgage Rates Crash Owning Vs. Renting is All About that Monthly Payment

Are landlords about to win the battle against homebuilders and homeowners?

The complexities of the housing market are shifting with the primary variable now becoming the difference between a mortgage payment and a month’s rent. So, the big question is whether a new low for the cycle in mortgage rates reverse the tide toward home ownership.

The Migration Component is also Becoming Structural

I’ve chronicled the post pandemic population shifts and the bullish effect they’ve had on the homebuilders and the residential REITs for years now. I’ve specially described my hobby of counting out of state license plates as I drive. For the record, I also count U-Haul and moving company trucks. And while these personal habits may seem like a waste of time to some, it’s been a worthwhile pastime which has kept me on the right side of the homebuilder and more recently, the residential REIT trade.

So, it was with interest that I read a recent article in which the Visual Capitalist chronicled the cities in the U.S. and Canada, which have gained and lost the largest portion of their population in 2023. As an aside, I spent a few days in Montreal, which came in third on the list of the fastest growers, in May this year, and I can vouch for the city’s vibrancy. If you haven’t been to Montreal, it may be worth your while, especially if you’re a fan of good food and awesome scenery. I especially recommend the French Fries and the Philly Cheese steak, anywhere. Even the stuff at the airport was good. And if you can take a tour to the surrounding country side, it’s a pleasant surprise.

Now, back to business. Here’s where it gets interesting. Although no one has said it, it looks as if the post pandemic, and still ongoing population shifts are now becoming structural. So, while, the pace of migration may be slowing, it’s still an ongoing phenomenon. And while it’s difficult to quantify where the Canadian migration’s source is (national, international, or both), Canadian cities are increasingly populous. In contrast, only two U.S. cities made the list of growers – San Antonio, and Forth Worth – both are in Texas, which should come as no surprise to anyone who reads my stuff regularly.

the cities who’ve lost the most population are all in the U.S. More interestingly, the list reads like a Hall of Fame compilation of where I see the most out of state license plates as I drive around; especially those that are not from New York, from where I see some, just not as many as the rest. But rest assured, the rest of the list is well represented in out of state license plates when I drive around. The reason for the exodus, according to the Visual Capitalist, quoting recent data from USA Today is the high cost of living.

Where Are All these People Living?

The simple answer is most likely wherever they can. Aside from those who are homeless or have adopted a nomad life style (RV based or otherwise), data from recent homebuilder and REIT earnings reports and the bullish stock performance in both sectors which reflects their bullish assessment, it’s all based on income and the shifts in supply and demand of the housing market.

For example, Toll Brothers (TOL) recently reported that it’s focusing its efforts on consumers with a minimum $200,000 annual salary. Other homebuilders are likely following suit. Yet, even though, they are selling and building fewer homes, because of their clientele, they are able to maintain excellent margins and profits.

In addition, as I’ve recently noted, the supply shortage in single family homes is now structural, which means it’s not going away anytime soon. There are certainly signs that the supply of existing homes is rising, which over time may help to alleviate some of the problem. On the other hand, given that the median, owner occupied, existing home is 43 years old, even a larger supply on the market may not alleviate the shortage meaningfully.

Interestingly, even though mortgage rates have fallen (see below for details), the pace of sales of existing homes remains tame. Moreover, homebuilders are in no hurry to build spec houses which will sit empty for long periods of time waiting for buyers. This translates to a prolongation of the structural shortage for new homes.

Meanwhile, multi-family home starts are steadily rising, especially in areas of the country (especially the Sun Belt) to which people continue to move. And quietly, there seems to be a quiet increase in sales for starter homes, which will also be worth watching.

All of which puts the onus of the situation on the Federal Reserve’s expected rate cut in September and what its effect may be on the market. Let’s see if a rate cut will spur an early fall increase in sales.

For more on winning homebuilder stocks and residential REIT picks, consider a FREE Two-Week Trial to Joe Duarte in the Money Options.com. And if you’re an active trader, a recent REIT trade I recommended delivered a $1089 profit in sixteen days. You can get the details here.

On the Ground – It’s All About the Monthly Payment and Who Built It

I keep an eye on a group of properties which are for sale or for rent. And what I’m seeing is that the rental market seems to have developed a slight edge on the sales market.

An existing home, which I’ve been watching for the past few months (built in 2023) failed to sell, even after significant price reductions). The owner changed strategies and put it on the rental market. It looks as if he’s got a tenant now – within three weeks of his change of heart. What’s interesting is that his asking rental price may be some $400 lower than what the potential mortgage payment would have been.

In other words, if the deal is attractive, someone will likely take it.

Meanwhile, after Fed Chairman Powell’s Jackson Hole speech, taken as bullish by the stock market, the action in an existing home I’ve been following (this one is only four years old and in good shape) picked up for a while, but has slowed down. Even though people visit, the house is still sitting on the market. It’s selling for $10,000 more than its Zillow estimate and the estimated mortgage payment is roughly $400 more than what the above landlord is asking for rent – without the added home owner’s association cost ($220/month).

In addition, the brand new townhomes I’ve been watching, where the builder is looking a bit concerned, are still for sale. All the while, there is some increased activity (municipal water infrastructure) in other areas I’ve been monitoring. The difference is the lots which are now being fit with gutters and city infrastructure are lots owned by large publicly traded builders while the townhomes with little action are owned by small local builders, who can’t compete with the deep pockets of the publicly traded builders.

Mortgage Rates Hit the Low for the Cycle

Fed Chairman Powell, in his recent speech at Jackson Hole, Wyoming said the Fed’s interest rate policy was about to change. The market took it as a sign that there will be a rate cut in September. This expectation has kept the U.S. Ten Year Note yield (TNX), the benchmark for most 30-year mortgages below 4%.

In turn, the average 30-year mortgage has remained below 6.5%, while making a new low for the cycle at 6.35%.

Thus, lower rates should spur more activity in home sales. But what we’re seeing is an increase in refinancings, as buyers who bought homes with mortgages above current levels (some above 7%) are refinancing in order to reduce their monthly payments. What’s not evident is an increase in mortgages for home sales.

Where the Money is Flowing

Investors are keeping their cool. The iShares U.S. Home Construction ETF (ITB) is in consolidation mode, even as bond yields trickle slightly higher.

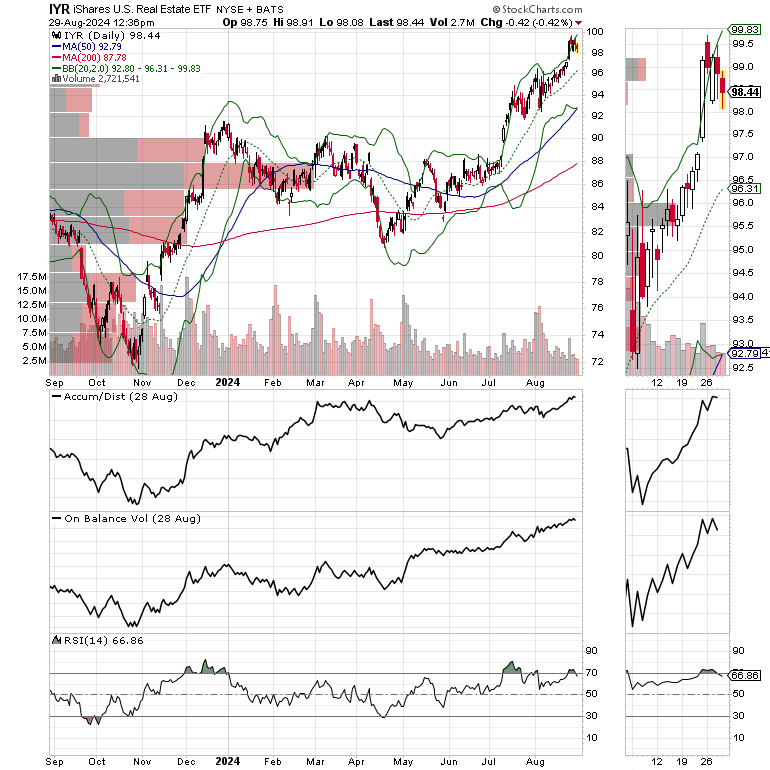

Similar action is visible in the iShares U.S. Real Estate ETF (IYR), which has come a long way lately and is due for a rest.

Bottom Line

The post pandemic population shifts are becoming structural with large U.S. cities continuing to shrink.

Canadian cities, with the exception of U.S. cities San Antonio and Forth Worth, both in Texas, are the fastest growing population centers in North America.

Supply and demand remain in favor of homebuilders.

Mortgage rates just hit a low for the cycle, yet potential homebuyers are increasingly opting for renting with the difference between a potential mortgage payment and the monthly rental charge dictating their course of action.

Everyone is waiting for the Fed’s move in September. The big question is whether it will spur more homebuyers to come off the sidelines or whether the renting dynamic, because of more attractive pricing, will win out.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

Thanks for the suggestion. But, as it stands, this setup works well for my system. I will have a look, though and see if in the future it keeps me on the right side of trades as my current setup does.

Has anyone ever told you that you can adjust the number of bars present in the Volume By Price indicator on StockCharts? Just type a number into the parameters portion of it. The default is 12 and I find for longer term charts something between 40 and 75 works pretty good. Makes the chart look much better.