Something’s Not Adding Up in the Stock Market as Bitcoin Teases $100,000. Staying Patient.

It's all about Bitcoin, bonds, and Stocks. Which way will it break?

Something’s not adding up in the stock market as neither lower interest rates or the traditionally bullish month of December are pushing stock prices higher. As I’ve noted lately, there is a Bitcoin Effect which is likely connected to this unusual behavior in the markets.

In other words, the insertion of Bitcoin into the calculus for money managers and traders now offers an alternative to stocks and bonds. And it’s the tug of war between these three asset classes, in a volatile world, where Chaos Theory is evident, that’s making the markets difficult to trade. As I wrote way back in October: “There are two major tenets which anchor Chaos Theory. One is that, based on the dot plot of the original equations by its creator, Dr. Edward Lorenz, resemble a hurricane. The second is the principle of the Butterfly Effect, where the flapping of a butterfly’s wings in a distant region of the world can cause hurricanes elsewhere – directly or metaphorically.”

Just look around.

As a result of this predictable unpredictability, the endpoint of Chaos Theory, the market has a look of indecision with a bit of rotational bent to it. The problem is that there is no dominant rotational trend emerging as money can’t seem to stick to any decision for any length of time.

Image courtesy of craiyon.com

The bottom line is that money flows are turning skittish and that this is not time to be cavalier.

Certainly, tomorrow’s CPI is unsettling traders. And the possibility of an interest rate hike in Japan is not helping. Yet, it’s uncanny that with both the Fed and the central bank of China both lowering rates simultaneously, there isn’t much of a bid in stocks.

But that’s where we are. And when there is no trend, there is no point in taking untoward risk.

Market Update

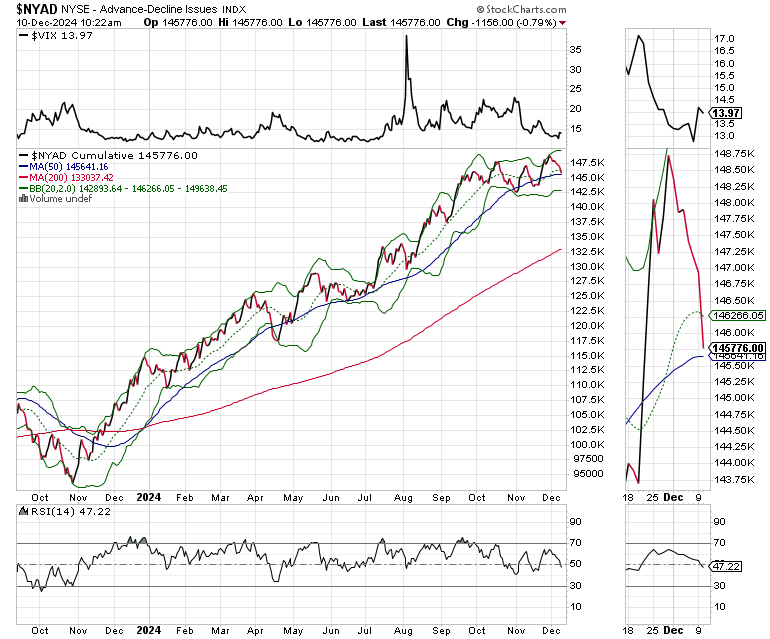

The major indexes remain in choppy trading patterns which indicate rising uncertainty in the trading community. The New York Stock Exchange Advance Decline line (NYAD) is once again below its 20 day moving average and threatening a test of the 50-day. This is not a good look for sure.

The U.S. Ten Year Note yield (TNX) remain below the 4.3% yield area and is now testing its 200-day moving average. We may see a test of the 20-day moving average before the market decides what to do next. Then a retest of the 50-day if the 20-day turns back the sellers.

Bitcoin (BTC/USD) is still consolidating, but may be gearing up for a decisive move as the Bollinger Bands are starting to close in on prices, a sign that volatility is decreasing and that it’s coiling up for what could be a decisive move. Our Bitcoin trade continues to hold up nicely as we were fortunate to enter it before the recent breakout.

Both the ADI and OBV lines are rolling over as short sellers (ADI) build positions and buyers (OBV) are pulling back. The RSI is now below 70, which means that upside momentum is also waning. If the 20-day moving average fails, we could see a move back toward the 50-day MA near $85,000. If that happens we will likely see an oversold RSI reading of 30, which would offer an opportunity for a rebound.

The core of the ESP portfolio is holding up quite nicely in this market. I also have several pending trades which have yet to be triggered.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

If you’re a weekend investor, I’ve got just the thing for you. Check out my steady pace long term focused Weekender Portfolio. One of the portfolio’s core holdings is up 15% this morning after beating earnings expectations.

If you’re thinking about day trading, my new book – Day Trading 101 – will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.