Panic bottoms mark the end of corrections.

The bond market got spooked by this morning’s softer than expected GDP report. At first glance it seemed as if the 1.6% year over year growth print would be bullish for bonds, as it suggested the economy was slowing and that the Federal Reserve would finally have some room to ease rates.

Unfortunately, the inflation data inside of GDP came in hotter than expected. Thus, the selloff in stocks and bonds. Of course, the stock market was already in a funk prior to the data as Meta’s (META) future guidance, after it met last quarter’s earnings expectations fueled an overnight selloff in the futures.

Earlier this week, I noted that the PMI data was suggesting that something was up in the economy. Specifically, I noted:

“Inside the (PMI) report, there are several points worth noting:

· Survey respondents reported “below trend business activity in April;”

· Inflows of new business fell for the first time in six months;

· Companies are cutting payrolls at a pace not seen since the pandemic; and

· The deterioration of conditions eased price pressures for the service sector.

The bottom line is that, based on this data, the economy is slowing and that it’s starting to show up in inflation figures. That’s important because we have two inflation related reports due out later this week, the first look at Q1 GDP, and the Fed’s favorite inflation gauge, the PCE report.

Here’s the problem. The official data has been in conflict with the PMI data for the past 9-12 months. This, of course, means that the government’s data may differ, perhaps in a major way, from the PMI data.

But, how long can this divergence last? As I noted in my recent Smart Money Weekend report, I had three experiences last week, where everyday people are starting to struggle. Thus, what I’m seeing, albeit with no statistical significance, is more akin to what the PMI data is suggesting.”

Based on this morning’s GDP report, it seems as if the government’s data is starting to confirm the private market’s data. In addition, based on personal observations, as I noted this past weekend, individuals are struggling more in this inflationary environment.

Incidentally, you still have an hour to vote on your inflationary expectations. Go here.

Bonds Focus on Inflation, while Ignoring the Slowing Economy.

The new buzzword is now stagflation where the economy slows and prices continue to rise. This is what the bond market is focusing on, which in turn is pushing stocks lower. That’s because the GDP price deflator clocked in at a 3.1% year over year growth rate, above the 3% estimate, and doubling the Q4 figure.

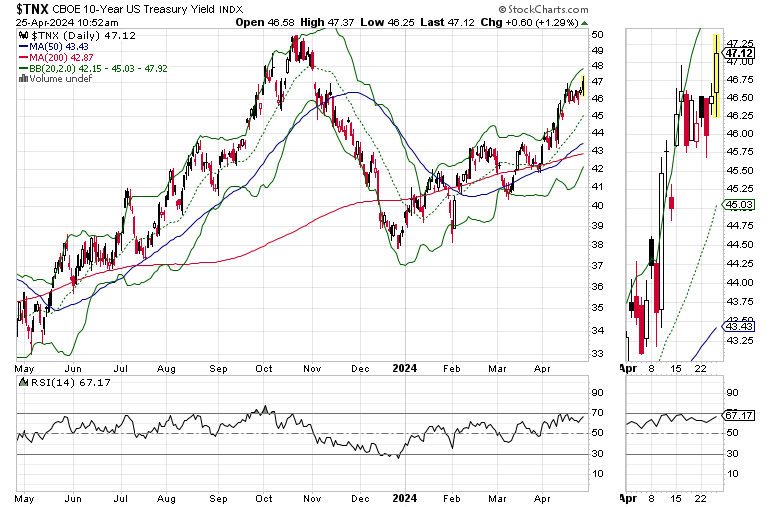

The U.S. Ten Year Note yield (TNX) is now testing the crucial 4.7% yield area. A move above this yield could easily take TNX back toward 5%, which is nearly certain to take stocks below any support levels which have not been taken out in the current correction.

Are We Approaching the Panic Bottom?

From a trading standpoint, the infinite dollar amount question is whether further selling in stocks will lead to a panic bottom. The answer is all about how the selling develops and what happens to the market’s oversold status.

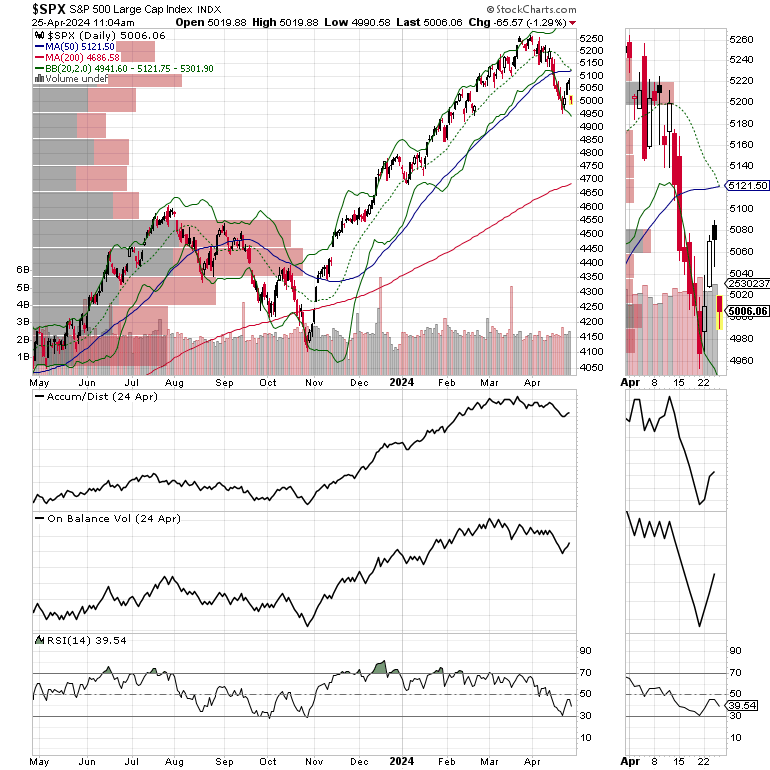

Specifically, if the S&P 500 index (SPX) breaks below its recent support near 4960, making a new low, but the RSI’s subsequent low holds above the previous low in the current downtrend, then we may be seeing a panic bottom.

That would mean that the recent bottom, on 4/21/24 would have been the momentum bottom. So, if RSI doesn’t make a new low, and SPX makes a new low on lower volume than it did on its previous low for this decline, we may have a panic bottom. This is important because panic bottoms often mark, the low point for corrections and bear markets.

Bottom Line

Tomorrow’s PCE deflator will be a huge number for the markets. If the PCE comes in as all other inflation numbers have of late (PMI, and now GDP Deflator), expect bond yields to move toward a test of the 5% area on TNX.

If stocks move lower but a new low on SPX is not confirmed by a new low on RSI, we may have a panic bottom. Panic bottoms often mark the ends of corrections and bear markets.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

I also appreciate single coffees, which you can buy me here.

For intermediate and long term trading recommendations take a FREE Two Week Trial to Joe Duarte in the Money Options.com.

You’re the music. I’m just the band.