Surprise! PMI Report Paints Dramatic Slowing Inflation Panorama. Plus a New Paycheck Trade

Is Inflation Finally Going to Give in to the Fed?

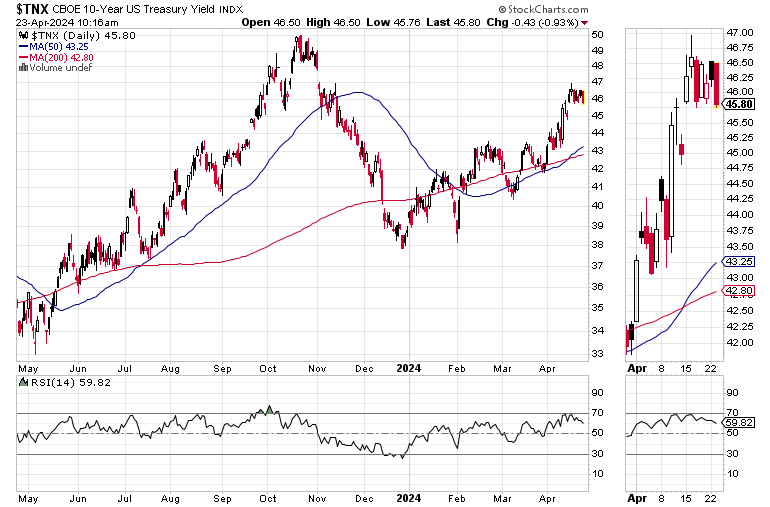

Anyone watching their trading screens this morning, right around 9:45 Eastern Time saw the U.S. Ten Year Note yield (TNX) plummet in response, to of all things, an S&P Global PMI report which came in well below expectations (49.9 versus expectations of 52.2).

And here’s why. Inside the report, there are several points are worth noting:

· Survey respondents reported “below trend business activity in April;”

· Inflows of new business fell for the first time in six months;

· Companies are cutting payrolls at a pace not seen since the pandemic; and

· The deterioration of conditions eased price pressures for the service sector.

The bottom line is that, based on this data, the economy is slowing and that it’s starting to show up in inflation figures. Specially worth noting is that employers are cutting workers. This suggests that all the WARN notices over the last few months could finally be catching up to the present. It will be interesting to see what happens to jobless claims over the next couple of weeks ahead of the Non-Farm payrolls.

More important, we have two inflation related reports due out later this week, the first look at Q1 GDP, and the Fed’s favorite inflation gauge, the PCE report.

Here’s the problem. The official data has been in conflict with the PMI data for the past 9-12 months. This, of course, means that the government’s data may differ, perhaps in a major way, from the PMI data.

But, how long can this divergence last? As I noted in my recent Smart Money Weekend report, I had three experiences last week, where everyday people are starting to struggle financially. Thus, what I’m seeing, albeit with no statistical significance and purely anecdotal, is more akin to what the PMI data is suggesting.

The bottom line is that if the PMI data and the government’s data start to agree, then we could have a totally different ballgame on our hands with regard to what the Fed may or may not do with rates for the rest of the year.

Let me know what you think about the upcoming PCE by voting in my latest poll here.

Bond Yields Move Decidedly Lower

The U.S. Ten Year Note yield (TNX), was down almost 0.5 points in reaction to the report in the early going. The next real test is whether TNX can move below the 4.5% area.

Homebuilder stocks took the news well. The S&P Homebuilding Subindustry Index (SPHB) looks set to challenge its 50-day moving average. A move above that could well take the index back to its recent highs and perhaps higher, if the interest rate environment becomes more favorable.

All of which brings me to my upcoming homebuilder pick.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.