A Point of Emergence Approaches as the Brave New World Needs Money and the Fed’s About to Hand Some Over.

It just feels as if something big is about to happen.

“Don’t fight the Fed. Don’t fight the market’s momentum.” – Marty Zweig (RIP).

A point of emergence is an area of a complex system where all the agents in the system are vying to enter a small aperture simultaneously. Once a point of emergence is breached and the agents move through the hole, the system emerges to a new level of operation.

We are there.

Once again, the short sellers got caught unaware of what happens when bearish sentiment reaches a climactic point and deep pocketed long only players and their algos decide to take revenge. When this happens, as it did last week, you get a major short squeeze, and stocks rise. Moreover, the upside momentum in stocks still has some legs and although there are no guarantees, it could take prices decidedly higher in the short to intermediate term as the Fed’s rate cut cycle unfolds. The real issue, though, is what happens when the central bank finally pulls the trigger on September 18.

That’s the short term stuff. Longer term, we’re likely dealing with the evolution of structural changes in the way money moves and works; meaning that the current changes in society are not going to reverse anytime soon and in fact are reaching a point of emergence to a new level of operation. That does not preclude that markets won’t sell off or that at some point, we won’t have a bear market.

It just means that the rules are changing and that, as I’ve said before, the markets are now a greater influence on the economy than the economy is on the markets. It’s called the M.E.L.A. system, and it’s based on the theory of Complexity and its interaction with Chaos. You can get a full description of the M.E.L.A. system here.

Yet, as I note below, we seem to be at one of those moments when much is about to change and we’re not going back to the way things were before. From a trading standpoint, it doesn’t mean this time is different. In fact, it’s just a different version of what we always do; follow the money.

So, for now, we stick to business – trade one day at a time, while realizing that what we once thought was predictable is now predictably unpredictable.

The Brave New World Needs Money. And the Fed’s About to Hand Some Over

“Electricity, Biology. Seems to me it’s Chemistry.” Neil Peart (RIP)

Last week, I noted that the overarching theme for investors is the convergence of “several megatrends (trends that will last for years).” Specifically, I cited the housing shortage, the energy transition, and the expansion of artificial intelligence (AI) throughout global systems, while adding that they all converge into a derivative megatrend, the rise in demand for electricity. In addition, I noted, “because megatrends require financing, they are all further bound by interest rates,” while adding “Cue the Fed.”

Indeed, we’re living in times where the changes that have been slowly taking place for decades are all adding up and a huge point of emergence from the familiar to a new level of operation is upon us.

That’s what complex systems do. Individual agents interact with one another in an endless game of bumping and grinding until something gives and a door opens. Moreover, when one agent finds the door, the rest of the crowd follows.

So here we are. Industry is pushing for AI. Governments are pushing for clean energy. Global hot spots continue to multiply. People are relocating from city to city, to the countryside, to different states, and to diverse countries. In the U.S. there is a housing shortage. And demand for electricity is rising.

Yet, to get to that shiny clean future of self-driving cars, green homes, and whatever follows, the electric grid must be expanded, more servers must come on line, and better technology needs to be developed. To fund all these things money needs to be available, at the lowest possible cost. And where does money come from? Well, cue the Fed.

In other words, the money helicopter is just warming up.

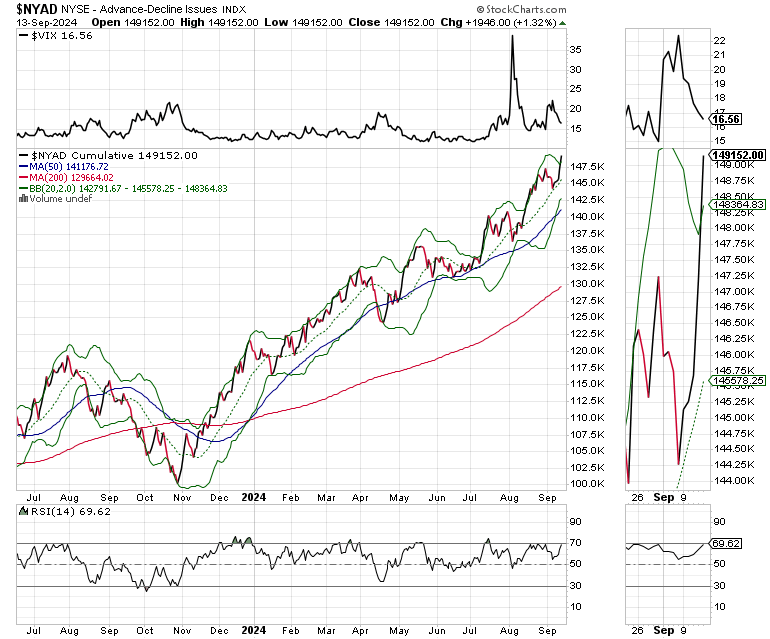

What will the market do? It’s anyone’s guess. What we do know is that the New York Stock Exchange Advance Decline line made another new high and that the recent drawdown in the S&P 500 (SPX) found support as expected, near 5400 before taking off and approaching new highs on its own. See below for more details.

For more on how to spot megatrends, check out my video on the subject.

NVDA Finds a Bottom

Last week, I noted NVDA was not dead and that perhaps “a successful test of the 90 area may be a nice starting point for a recovery,” while suggesting that we “keep an eye on NVDA, along with the rest of the semiconductor sector, as in the VanEck Vectors Semiconductor ETF (SMH).” I also noted that the stock was “acting as it did in early August, testing its lower Bollinger Band while the RSI is nearing 30, while adding “– spoiler alert - it may bounce from here.”

And so, it did. The issue here is whether it can continue to climb or whether it will stall out at its 20-day moving average. The ADI and OBV lines are slightly divergent, suggesting a pause is likely.

Grid Stocks Move Big

The FT Nasdaq Clean Edge ETF (GRID) rose to the top if its recent trading range. A breakout would be a big deal as it would suggest that investors are all in on the notion that even if NVDA rolls over, the grid upgrade rolls on.

The Utilities Select Sector SPDR ETF fund (XLU), a fund which I own, and a core holding of the Sector Selector ETF service made yet another new high, giving some credence to the notion that the grid upgrade is still a huge deal.

Homebuilders and REITs Dig into Rate Cut Fever

Sectors related to the housing shortage megatrend, homebuilders and REITs continued to attract money. That’s because the housing shortage is structural and the market is betting that mortgage rates will go even lower after the Fed starts its rate cutting cycle.

The iShares U.S. Home Construction ETF (ITB), powered higher and is nearing a potential breakout, as the short squeeze I expected materialized.

The iShares U.S. Real Estate ETF (IYR) made a new high, and remains in a major momentum driven climb. For strong REIT and homebuilder picks, check out a FREE Two- Week Trial to Joe Duarte in the Money Options.com.

Bond Yields and Mortgage Creep Lower

Ahead of the Fed’s rate decision, the U.S. Ten Year note yield (TNX) remains below 4%. But, as complexity would have it, TNX and is threatening to remain below 3.7%, which now becomes an important short term resistance level.

Mortgage rates, remained below 7% for the fourteenth straight week and made another new low for the cycle.

If you’re an ETF trader, consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here.

AD Line Remains in Uptrend as it Tests Key Support

The New York Stock Exchange Advance Decline line (NYAD) made several new highs last week. Bear markets don’t unfold when NYAD is making new highs.

The Nasdaq 100 Index (NDX) is back above its 50-day moving average. 19,500-20,000 is fairly stout resistance.

The S&P 500 (SPX) is on the verge of a breakout. 5650 is critical resistance. A move above this point would confirm the bullish action in NYAD.

VIX is Back Below 20

The CBOE Volatility Index (VIX), reversed its bearish tone, moving nicely below 20.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

Great Post Joe

I agree that we are reaching an emergence and that electricity will play a huge role.

My interest is in longer trends and the consequences so I wonder what you think about the fact that for the last decade those in charge have been arguing about the stupidity of the electrical revolution rather than getting ready to support it. Asia has used to time to prepare and develop new ways.

How do you think things will shift going forward and can we have hope to catch up using all the protectionist measured that have been enacted the last few year and keep being put in place today?

Wow! Thanks for the kind words. The short answer is: I wish I knew. All I can say is that there seems to be a quiet but palpable sense of urgency, and that whatever is coming is getting closer while interest rates are too high to finance what needs to be done. Beyond that, I just trade one day at a time.