Will the Dip Buyers Come in on this Tariff News Induced Selloff?

Plus, a New Momentum BUY which is ignoring the volatility and looks set to take off.

Image courtesy of storyblocks.com

Another rocky Monday is unfolding on Wall Street as the now nearly customary tariff headlines and heating up of the geopolitical situation triggers algo strategies. Yet, beyond the headlines there remains a constructive vibe in areas of the market as the dip buyers continue to sneak in as I described in detail this weekend.

In other words, if the recent pattern of trading repeats, the dip buyers will come in over the next couple of days and stocks will remain range bound or eventually break out if there is a bout of good news which trips algo buy programs. So, the message remains the same. Stay focused on each individual position. Stick with what’s working and keep an eye on the dip buyers. They’re out there nibbling at things.

Market Update

The New York Stock Exchange Advance Decline line (NYAD) moved below its 20-day moving as the RSI flirts with the 50 level. A sustained move below 50 would likely accelerate the selling. Still, NYAD remains within striking distance of a new high.

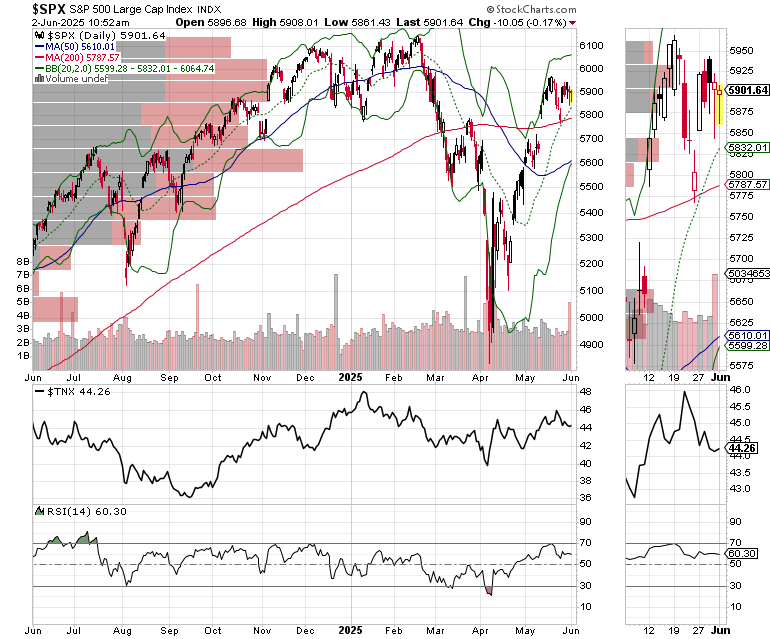

The S&P 500 (SPX) remains above its 20-day moving average and inside the 5850-6000 resistance band, which holds the key to the next trend. As long as SPX holds above the 20-day moving average, the uptrend remains intact. A move above 6000 will likely trigger mechanical trading (algo) buy stops and move stock prices higher. A break below the 200-day moving average would likely lead to more aggressive selling.

The U.S. Ten Year Note yield (TNX), is once again below 4.5%, as the PCE came in cooler than expected.

Bitcoin (BTC) is still treading water just below its 20-day moving average as the ADI, OBV, and RSI indicators suggest some indecision is creeping in. We may see a test of $100,000 while a move above $112,500 would likely create what could be a massive move up.

Bottom Line

We are still captive to headlines. Yet, there are plenty of stocks which are holding up while others are on the verge of breakouts. So, monitor the news, the market’s response to the news, and whether the dip buyers appear.

If you have a 401(k) plan that offers ETFs as investing vehicles, consider Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about tuning up your investment playbook, my new book “The Everything Guide to Investing in Your 20s & 30s” will get you started on the right foot – pre-order now. For those wishing to get started on day trading, consider “Day Trading 101.” For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better with extra energy, and vitality. Visit my Health Page.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.