Why Lennar’s Earnings are Proof of the Housing Market’s Expanding Structural Issues.

And why, their caution could be the sign of an important and bullish shift in thinking for homebuilders.

Image courtesy of metropolitantitle.com

Earnings reports are full of useful information. And Lennar’s Q1 2025 is spot on in highlighting the current status of the housing market.

Buying a home has a new structural dimension, while investing in the housing market is becoming an exercise in patience and perseverance. That’s because multiple external factors revolving around personal finance have stymied potential buyers creating a disconnect between the Bid, what people are willing to pay and the asking price, the Ask. On the other hand, potential buyers are beginning to show signs of adjusting to the new reality of the market, which is a hopeful sign for the future. The biggest potential winners of this dynamic environment may be the homebuilders, although it could take some time before the market recognizes this fact.

Let’s Catch Up

The housing market is trying to pick itself up with the bright spot being an increase in traffic to many properties on the market during the spring season. Certainly, the rise in February’s existing home sales was a pleasant surprise, which validates my observation of increasing traffic. Still, there may be some seasonal distortions due to weather and natural disasters in California and the Southern U.S. having slowed activity in January with some catchup in February. But good news is hard to come by these days, so we’ll put this one in the win column.

The downside is the persistence of unaffordable prices in many desirable properties with the structural stalemate – high demand, tight supplies, high unaffordability – keeping a lid on the potential return of another bull market.

From an investment standpoint, barring another wave of selling in the homebuilder stocks, the odds favor the bottom for the sector having been put in place. Moreover, confirming the long term investment thesis that is materializing, many homebuilders are expanding their footprints via increasing their lot purchases and drafting plans for new potential developments while others are using the bear market to expand via buying out smaller rivals who’ve run into financial difficulties.

The New Structural Dimension

The term, structural, refers to a variable in any market which is part of the foundation – an immovable object. It helps to think of structural in terms of something which has been in place for so long that it’s something you drive by and almost fail to notice until you need it; something like a gas station, a structural component of any geographical landscape.

With the Federal Reserve not likely to lower interest rates at its 3/19 meeting, the heavy lifting for mortgage rates is left to the bond market where the focus has been on inflation, keeping rates higher than in the early part of the decade. Of course, the 2020-2022 time period was abnormal since the precipitous decline in interest rates was due to the pandemic and the related moves by the Fed – QE and pushing interest rates to near zero.

But it’s not all about interest rates anymore. There’s something deeper afoot.

Lennar Admits Challenges and Hunkers Down

Perhaps the most telltale sign of where things are was Lennar’s (LEN) Q1 2025 earnings, which reflect most of the above points and can be summed up as flat and flat at best in the future. That doesn’t mean the company isn’t profitable or poised to flourish in the future. They still have plenty of cash on hand and are clearly prepared to weather the story. Yet, as with most homebuilders of late, LEN beat lowered expectations for the quarter. Yet, inside the report there were what are now familiar findings for the industry – flat margins, lots of incentives required for closing sales, and weak guidance showered by happy talk about hanging in there and the future being brighter once interest rates fall, etc.

Yet, perhaps the signature move is that the company is basically hunkering down, having jettisoned its lot developing arm, and focusing on working off its inventory and only building new homes when someone orders them.

The stock just made a new low, but is trading well outside its lower Bollinger Band, while the RSI remains nearly oversold, which suggests that we may be witnessing a panic bottom.

A Steep Hill to Climb for Homebuyers with Signs of Hope on the Horizon

According to Builder Online, citing data from NerdWallet, there are seven reasons why buyers are currently stuck in the mud. Indeed, according to the report 69% of potential home buyers say the market has never been worse for homebuyers while simultaneously remaining hopeful, looking for this year to be a better year. Consider the following findings of the survey:

• Only 28% of potential buyers were successful in 2024;

• Home prices were the number one reason for the disappointment with a staggering disconnect between buyer’s budgets ($259,088 on average) and the median sales price of $420,000.

• 35% responded that the cost of living is too high and prevents them from buying a home;

• 33% cite not having enough money for a down payment as the reason for not buying;

• 15% are looking to buy this year – up from the previous high of 9% in 20219; and

• 54% are searching for potential buys with online apps, while 35% are developing a down payment fund and 44% are working on improving their credit scores.

In other words, affordability is only a symptom and reality is setting in. And although many are hopeful and are still looking, while others are attempting to improve their standing, owning a home is now beyond the financial means of a significant number of people because inflation has reduced the buying power of their cash. Moreover, the wide chasm between what people are hoping to spend and what they may have to spend is nearly $160,000.

Nevertheless, the fact that over 50% of potential buyers recognize their situation and are improving their situation is a hopeful sign.

From an investment standpoint, this confluence of factors puts homebuilders and those who wish to sell an existing home in a difficult situation, especially if they purchased a home withing the last few years and are looking to at least break even. Of the two constituencies the large publicly traded homebuilders have the upper hand because of their deep pockets, which affords them the opportunity to build enough houses to meet demand, keeping supplies tight, and remaining profitable.

On the Ground

The data above is supported by what I’m seeing in my frequent “kick the tires” tour. Traffic at most of the “for sale: homes I monitor has visibly increased over the last few weeks. This is partly a Spring related seasonal development along with the recent drop in mortgage rates to the 6.5% area. The downside, however, is that even though traffic is increasing, and the sellers have dropped prices, these particular properties are still asking anywhere from $430,000 to $499,000 clearly above both the median price and the budgeted sum.

Interest Rates

The Federal Reserve left interest rates unchanged at their 3/19/25 FOMC meeting, as expected. What’s most important is how the bond market reacted.

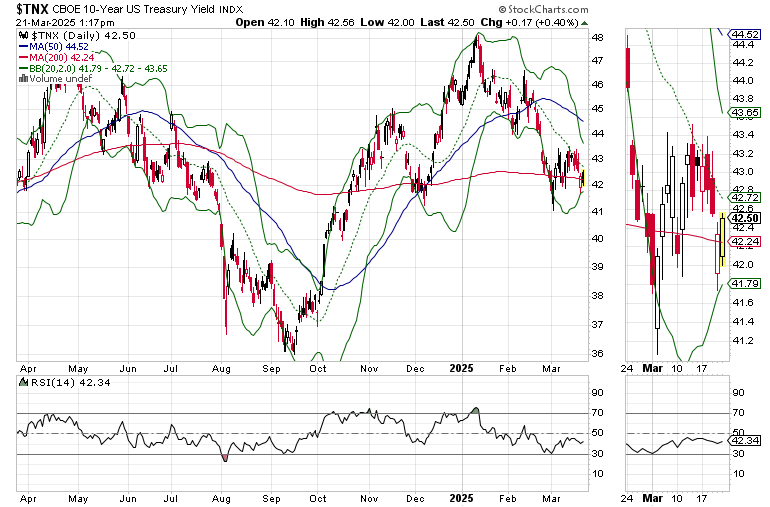

The U.S. Ten Year Note yield (TNX) seems ready to make a big move. Not only is it holding at its 20-day moving average but the Bollinger Bands (BB) are starting to squeeze. This usually marks the prelude to a big move. Let’s see which way things break.

Meanwhile, the average 30 year mortgage is, as usual, following the action in TNX. A move lower by TNX would lead to a fall in mortgage rates which could move buyers into the market.

The homebuilder stocks continued their recent grind near their recent bottom. No new lows in the overall sector, aside from Lennar, suggests that investors with a long term time frame are becoming patient and dipping into the sector. I recently added a large group of homebuilder stocks to my Rainy Day portfolio which is tailored toward very long term focused, value oriented investors.

Bottom Line

The housing market is between a rock and a hard place and Lennar’s recent flat outlook and caution is the first sign that homebuilders are starting to see the reality of the situation. n retrospect this may be a bullish sign as it will sharpen the company's focus and future readiness.

From a macro standpoint, on one side there is a wide chasm between home buyers and potential sellers in a market with tight supplies. On the other side, there is an ongoing realization from home buyers and home sellers that movement is required. The former are showing signs of restructuring their finances in order to afford a home, while the latter is slowly decreasing prices and preparing for a long haul.

The action in the Spring selling season is positive but not brilliant as traffic has increased but sales are not as robust as they have been during periods where homes have been generally more affordable.

In the broad sense of things, the homebuilders, due to their deep pockets, their ability to provide incentives, and their crafty management of demand adjusted supply remain in a favorable position. Barring extraordinary external events, investors with a long term time frame will likely prosper by investing in this sector over the next few weeks to months.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

SPECIAL PROMOTION! - In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. As a special bonus, you will receive a Free one month subscription to the Weekender portfolio with your first health purchase.