Where AI, Market Volatility, Your 401 (k) Plans, and the Housing Market Meet

Think in terms of server farms.

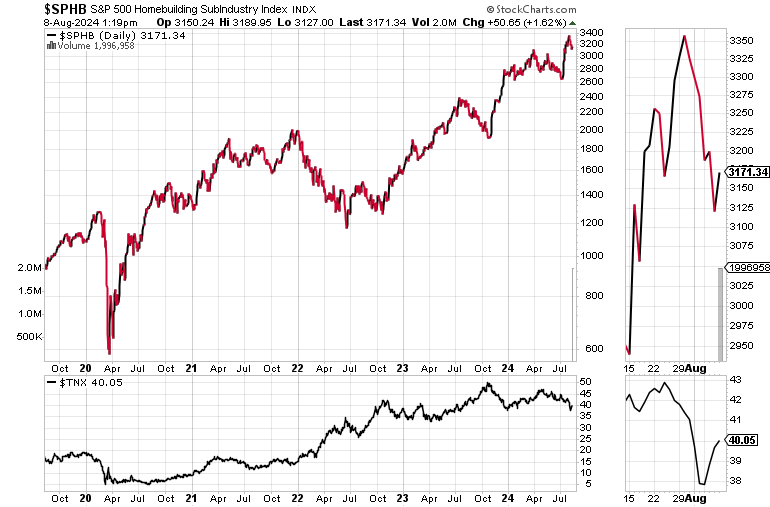

The homebuilder stocks remain in a long term bull market. Yet, because of the stock market’s effects on the economy, via the M.E.L.A. System, homebuilder stocks are increasingly sensitive to short term gyrations in interest rates.

And as I discuss below, no matter what they say about the so called AI bubble, AI has been in place for a long time and it is the central cog in the M.E.L.A. system. Spoiler alert: All the data which influences the lifeblood of the global economy: loans, and liquidity, is stored in server farms. And the answer to loan requests comes from the same farms where the algorithms decide whether you can buy that new house or new car.

Reviewing M.E.L.A.

Familiar readers may recall the M.E.L.A. system, which I developed several years ago and which I detail here; where M is for markets, E is for economy, L is for life changing decisions, and A is for algorithms. Together, these four components act in concert to influence the way money moves around the world.

Here’s a quick summary. Whereas in the past, the economy (E) influenced the financial markets, in the present, the financial markets (M) have become the drivers of the economy. That’s because the global economy is now based on debt. Thus, most large purchases are based on credit scores and for those who are employed, the current value of their 401 (k) plan, which is a major source of wealth.

A great credit score and a fat 401 (k) will usually clinch that coveted loan. Thus, it follows that since most 401 (k) plans are invested in stock mutual funds (heavily weighted toward the S&P 500) when the stock market is rising, it’s easier to obtain credit for major purchases (houses and cars) because 401 (k) plans are in good shape and happily growing as the major indexes rumble higher.

Loan payments are a major source of liquidity and cash flow for corporations. Therefore, during bear markets, the economy tends to slow as bankers are less willing to lend money to those whose 401 (k) plans are slumping. Fewer loans means fewer people are paying bills, reducing liquidity in the financial system, which translates into fewer car and houses purchased. Thus, bear markets make it harder to make those life changing financial decisions (L).

The final component is the algorithms (A), whose presence in our world is ubiquitous. Although the A component of M.E.L.A. is listed as the last component, it is central to the operation of the system because it is the place where all the data which fosters the lending climate is storied.

Consider that most loans decisions are now made via an algo whose job is to compute the odds of the bank getting paid based on the innards of credit scores and 401 (k) plans. Next, consider that Wall Street has access to this type of data in real time and that the numbers are then crunched by algos whose job is to contribute to the Buy/Sell decisions of the trading algos utilized by hedge funds, big banks, mutual funds, and commodity trading advisors (CTAs). Moreover, the decisions made by algo fueled investors are factored into the order flows which tell the market maker algos whether money is flowing into or out of stocks, which in turns develops into the market trend at any moment, as they, in turn, adjust their risk management.

It's One Big Algo System

But wait. There’s more. Let’s now add in the algos which run X, Facebook, YouTube, and all the other social media which is viewed by millions of people, and is also monitored by other algos. When news hits, the algos disseminate it. Other algos read it and enact their programs which are designed to respond to the news. Eventually people read the same news, often after the algos have already acted, and what used to take weeks to develop, now often develops in seconds or minutes, which each response further augmented by more algos and more people responding.

Figure - The Central Cog in the M.E.L.A. System: the server farm.

And where it all comes together is in the current trend of interest rates. And since lower rates eventually move stocks higher, when interest rates fall – 401 (k) plans tend to prosper. You get the picture. The current world is more influenced by what happens on Wall Street than what happens in the real world.

After the pandemic, the MELA system became more evident in the housing market. Initially, the pandemic caused a crash in the housing market, which in turn led to a massive decline in the S&P 500 Homebuilding Subindustry Index (SPHB). However, once the Federal Reserve hit the gas pedal on money printing (QE), the homebuilders rallied both on the major decline in interest rates as well as the sudden explosion in demand for new homes in the suburbs, rural areas, and the Sun Belt states.

Over the past five years, you can see that the homebuilders have been in a secular (long term) bull market. You can also see that periods of rising bond yields have slowed the upward grind of the sector. Most recently, when bond yields crashed in response to the mini-crash in stock, homebuilders broke out of their consolidation. You can also see that once TNX moved back toward 4%, SPHB rolled over.

Specifically, on 8/7/24, we saw TNX rise sharply as the most recent Ten Year Note auction by the U.S. Treasury was not well received by the market and yields rose in response. This can happen anytime the treasury auctions bonds, and most of the time, the results are temporary.

The take home message here is twofold:

· Homebuilders remain in a long term secular bull market as supply and demand remain in their favor; and

· Homebuilder stocks are now, more than in the past, acutely sensitive to short term changes in interest rates, especially during periods of market volatility due to external events which can range from extraordinary events such as currency crises and geopolitical happenings to mundane things such as U.S. Treasury bond auctions.

Ten Year Note Tests 4%

Traders fretted during the T-Note auction on 8/7/24, but the key is what happens around 4%. As the price chart below shows, TNX failed to rise above 4% on its attempt this morning. This is encouraging. If TNX remains below this key point, it will likely keep mortgage rates below 7%.

For now, mortgage rates remain below 7%. The next big worry is what happens to the employment situation. If job losses begin to mount, it will be negative for 401 (k) plans as contributions will be reduced. If stock prices fall, that will add to the 401 (k) plan misery.

The action in the iShares U.S. Home Construction ETF (ITB) is highly correlated to that of the Homebuilder index, described above. You can see that ITB is holding above its 50-day moving average even though it’s under a bit of pressure as interest rates fluctuate in the short term. OBV looks a bit sluggish, so the 50-day needs to hold.

For its part, the U.S. Real Estate ETF (IYR) is holding up very nicely even as interest rates fluctuate. This is very encouraging.

Bottom Line

The stock market is a major contributor to the status of the economy as loan approvals largely depend on the status of 401 (k) plans.

Algorithms are the central players in loan approvals.

Supply and demand continue to favor the homebuilders and the rental and storage REITs.

Homebuilder stocks remain in secular bull market. REITs are showing excellent relative strength.

Market volatility increases daily homebuilder stock price volatility, but supply and demand still favor the sector.

To invest successfully in the homebuilder and REIT sectors, focus on the long term trend for both interest rates and the stocks in the sector.

Thanks to everyone for your ongoing support, especially to new Buy Me a Coffee members and subscribers to all my services. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.

M.E.L.A. Is incredible! Well done Joe.