Stock traders are trying to get ahead of an expected 25 basis point cut in the Fed Funds rate which will likely be announced this afternoon at 1 PM Central Time. Yet, although the rate cut has a high chance of coming through, the most important thing for the markets is what the Fed says in its statement as well as the remarks and answers to questions from Chairman Powell during the post announcement press conference.

Image courtesy of gettyimages.com

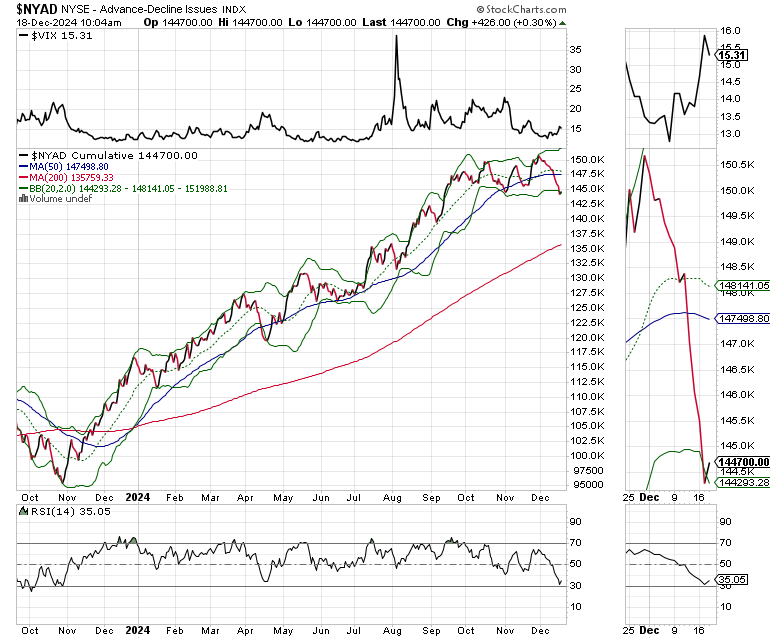

Ahead of a likely volatile afternoon, the New York Stock Exchange Advance Decline line (NYAD) is trying to bottom out after yesterday’s breakdown, which took it outside of its lower Bollinger Band. Usually, a move below the band is a prelude to a reversal. Thus, it’s not unrealistic to consider the possibility that stocks are closing in on some sort of bounce. Moreover, the NYAD’s RSI is hovering just above 30, which means it’s oversold. When these two technical events happen together, the odds of a reversal increase.

Equally important is what happens in the bond market. The U.S. Ten Year Note (TNX) is struggling to get back above the 4.5% area. Thus, its response to the Fed’s announcement and Powell’s press conference remarks will be a large influence on stocks.

Meanwhile, Bitcoin (BTC/USD) is due for a consolidation. As the price chart shows, BTC has been trading outside its upper Bollinger Band for the past three days. That’s a clear sign that a pullback is overdue. I’m not expecting a crash, but a move back to $100,000 is well within the cards. If history is any sign, we are likely to see another dip buying frenzy.

I’m also watching to see what happens after the Fed’s announcement. A decline in bond yields (TNX) could accelerate the pullback in BTC as money moves back into treasuries. The RSI for BTC has been hovering near the 70 area for quite a while. But its current posture shows a decline in upward momentum. Thus a move back to an RSI of 50 is not out of the question. If BTC breaks below $100,000 we could see a test of its 50-day moving average.

Thinking Ahead

This morning, I am adding a new pick to the Rainy Day Portfolio, a subsection of the Weekender Portfolio. The Rainy Day Portfolio is designed for very long term trend trades. Today’s trade features a tech stock which has been forming a bottom for the past few months and which is starting to show signs of recovery. As with other holdings in the portfolio, investors should be willing to remain patient. Here are some trade results which illustrate the time frames and the potential results of this approach.

• SOLD - Pulte Group (PHM) Bought 9/28/23: $73.80. SOLD 4/16/24: $108. Return for this trade: $3420 per 100 shares (46.3%).

• SOLD AAON Inc. (AAON) Above $80. Bought 6/20/24: $80.05. SOLD 11/8/24: $138.24. Return for this trade: $5849/100 shares (42.43%).

• SOLD – Equity Residential (EQR). Bought 5/1/23: $63.50. SOLD 11/1/24 closing price: $69. Return for this trade: $550 + $401.25 in dividends: Total Return: $901.25 (4.19%).

• SOLD - Mid-America Apartment Communities (MAA). Bought 5/6/24: $134.75. SOLD 10/4/24: $153. Return for this trade: $1825/100 shares (13.54%).

• SOLD - Taylor Morrison Home (TMHC). Bought 2/23/24: $56.35. SOLD 8/6/24: $62. Return for this trade: $565/100 shares (10.02%).

• SOLD - Global X Uranium ETF (URA). Bought 8/25/22: $22.25. SOLD 7/25/24 closing price: $27. Return for this trade: $475/100 shares plus dividends: $476.73 (21.42%).

Thanks to everyone for your support.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

If you’re looking for a slower pace to sizeable profits check out Joe’s Weekender Portfolio.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101 will get you started along the right path.

And if you like this post, hit the Like Button and Share it. It helps to spread the word.

You’re the music. I’m just the band.