What to Expect from Friday’s NFP Number and a New Potential Short Squeeze Trade

Friday's Employment Report Could Set the Stage for the Next Market Trend

Tomorrow’s Non-Farm Payroll data will likely, as usual be a market mover. Both stocks and bonds will respond. It is possible to consider the fact that if the number is seen as bullish stocks will rise and perhaps a new up leg will blossom. On the other hand, if the number is seen as being bearish we can expect to see an uptick in bond yields and a significant move down in stocks.

Of course, the market’s response will be related to what traders will expect the Federal Reserve to do in response to the numbers. Ahead of the data, the Fed gave the market a bit of a gift by announcing that it will increase the pace of its QT process by selling $25 billion worth of U.S. per month, a reduction from the previous $60 billion per month.

That’s not a bad thing at all. Fewer bond sales by the Fed will ease the squeeze on yields; unless, of course inflation continues to rise.

The data ahead of the NFP numbers has shown two distinct trends. The manufacturing sector is slowing, at least based on PMI and ISM data as well as anecdotal evidence and bearish comments from the Dallas Fed Services survey. On the other hand, wage pressures are consistently rising on both PMI and ISM numbers as well as the Employment Cost Index (ECI) report.

If there is a sidebar, it’s that the PMI, ISM, and other private market data sources, along with anecdotal data, and now government data (JOLTS and GDP) suggests that perhaps the economy is slowing, while the monthly NFP numbers suggest the economy is in great shape.

As a result, it will be interesting to see what happens if the NFP numbers come in as usual of late, and the markets respond in an unexpected fashion; such as rallying in the face of a strong number.

The Cries of Stagflation are rising.

Even during Fed Chairman Powell’s post FOMC presser, a reporter asked if the Fed was worried about stagflation. Powell brushed the query aside. But the perception that we are in a period of low growth and persistent inflation is gathering steam.

Moreover, the most recent GDP data echoed that sentiment with a rise in the GDP deflator and a GDP headline number of only 1.6% growth. In addition, the JOLTS number showed a decline in job openings, a drop in the number of workers quitting, even as wage pressures are still present.

All of which brings me to tomorrow’s NFP number. First, I will note that I’m not a forecaster, as that’s IMHO a foolish endeavor. But, if the numbers trend along the same lines of the last few months, we can expect to see a beat of the market’s expectations; a larger number of new jobs created than expected.

Certainly, voters in my latest poll, are expecting a stronger than expected number, by a wide margin. You can see the results here. If you haven’t voted, you can still do so.

Ahead of the Report

Ahead of the NFP number, the Fed has made it clear that it doesn’t want to raise rates, but that if it must it will likely do so. That’s why a huge NFP beat would be bad for the markets. Even if the number isn’t a huge beat, however, traders will be focusing on wages. If wage pressures are above expectations, I would expect trouble in bond land, and a selling in stocks.

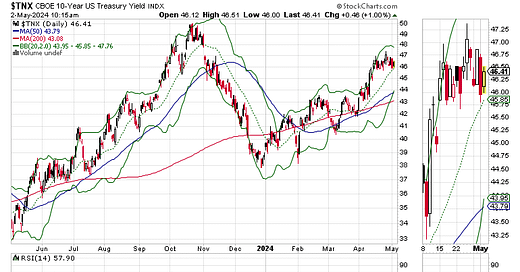

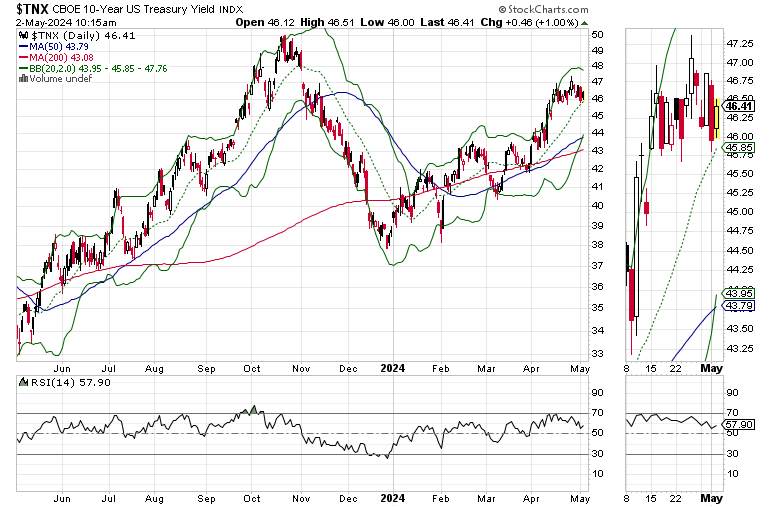

The U.S. Ten Year Note yield, TNX is still hovering just below 4.7%. A bearish NFP number may push TNX above 4.7% and could well spur a move toward 5%. Needless to say, that would be a bad thing.

On the stock side, the S&P 500 (SPX) is still trading above 5000. On the upside, a bullish number will likely set SPX on a path to test the 5150 area and its 50-day moving average.

Meanwhile, this set of circumstances gives us an opportunity to trade based on certain conditions. Thus, I have a new conditional trade just below. I’ll give you a hint. The stock is tracing a chart pattern which is suggestive of a short squeeze, such as I described in this recent video, which I highly recommend viewing.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.