We Have a Situation. Homebuilder Bull Market May be Ending.

Inflation and higher interest rates are taking their toll.

Shhhh! Don’t tell anyone. But I’m secretly hoping that some big algo HFT farm reads this article and uses it as a contrarian signal that the bottom for the homebuilders is in. But things sure do look a bit glum as the latest inflation data and the persistent affordability crisis are reaching critical mass.

We have a Situation

There is a developing situation in the homebuilder sector as the most recent decline in mortgage rates, which may have already run its course, has failed to deliver any meaningful boost to sales for either new or existing homes and homebuilders are signaling that while current sales and profits are stable, the future is murky. On the other hand, other areas of real estate, including some sections of the commercial side are holding up better. Yet, this relative strength may not last.

According to a recent report by Goldman Sachs (GS), unless inflation eases, mortgage rates are likely to remain above 6% for 2025. Given that, according to recent Census Data Bureau data, the average household in some states now spends over 60% of its monthly income on housing, it looks as if the bull market in the homebuilder sector is likely over unless we see a reversal in inflation and mortgage rates follow. So, as I’ve said before, it’s all about the monthly payment now. And it seems to be getting worse.

This isn’t just an investment quandary, as the housing market accounts for 16% of GDP, which brings up the question of whether the overall economy is closer to a meaningful slowdown than the Federal Reserve or the statistics suggest.

Image courtesy of https://cdn-res.keymedia.com

Inflation Sucks the Life out of Future Earnings for Toll Brothers

Over the last few weeks, I’ve been bullish on the homebuilders based on the notion that lower rates would push market timers into making their move into new homes and creating a boost in sales. This viewpoint was also based on the steady sales reported by most homebuilders albeit with several asterisks such as their increasing use of incentives and more aggressive lot management. In addition, there are two other major factors which are bullish for homebuilders; the structural nature of the housing shortage (it’s not going away any time soon) and the fact that large builders are quietly buying up local builders with significant market share. At some point, the consolidation wave could extend to an increase in M&A for the publicly traded homebuilders.

But here’s the thing. If there aren’t enough houses on the market, and everyone remains bullish about their prospects but the homebuilder stocks are breaking down, you have to go with what the price charts are saying.

You know things aren’t going well when a company delivers record results, especially during challenging times, and the stock tanks. That’s what happened to Toll Brothers (TOL). Here’s what’s puzzling. TOL caters to the top of the food chain consumer, the group that is holding up best, according to the consensus view.

Yet, TOL’s CEO, despite offering lower guidance gave the usual boiler plate answers to analysts questions. Basically, he said he’s not worried because his target clients are doing well and the company will be fine. At the same time, he hinted at being conservative on his estimates but hoping that, just as the company did this year, they will be able to deliver positive surprises. Moreover, there was a lot of talk about balance and ongoing incentives to potential buyers, while again “hoping” to increase the sales price.

In other words, TOL is going to make money. Just not more money that they made this year, unless they get lucky and things go perfectly with the economy and the Universe.

The bottom line is that Wall Street isn’t buying the steady as she goes, “we’ve got this” narrative any more.

As the price chart shows, the stock got clobbered with both ADI (rising activity from short sellers) and OBV (more buyers than sellers). At some point the bleeding will stop. But for now, it looks as if investors have lost their patience with TOL and the rest of the group.

Something is Way Off

TOL, and other homebuilders, are making money. But the market doesn’t seem to care. That means that the sector has developed a confidence crisis among investors. You can blame inflation and its effect on the bond market. Indeed, the response from the bond market to the much hotter than expected Producer Price Index (PPI) which followed a warmer than expected Consumer Price Index (CPI) tells the story.

Because bond yields are the basis for mortgage rates, higher yields are the bane of the housing market. That means that a reversal of the recent decline in yields, will keep money moving out the homebuilders until the sentiment is so gloomy that there is no downside left. When that day will arrive, is hard to predict. But there will be signs of a bottom at some point and we’ll be there if it makes sense.

Is this hopeless? Of course not. Day to day trading by algos responds to the latest news and money flows. That means that the tone for the homebuilders could change at any time.

What we know is that there is a structural housing crisis and that supply and demand favor the homebuilders. Yet, the market doesn’t seem to care even as companies continue to deliver above expectations because of the uncertainty about the future. And that means, that as always, the price charts get the final decision.

The S&P 500 Homebuilding Subindustry Index (SPHB) has broken down with its recent move below its 200-day moving average. It is oversold (RSI near 30), yet it has the look of a sector which has seen better days. Note also that when yields fall the rallies have been smaller of late while rising yields push SPHB lower more aggressively. That's a sure sign that money is moving out.

The recent decline in the U.S. Ten Year Note yield (TNX) again stalled near the 4.2% area, roughly corresponding to the 200-day moving average. Thus, a move bac to 4.5% is possible. Such a move will likely exacerbate the selling in the homebuilders.

REITS Are Holding Up Better than Homebuilders - For Now.

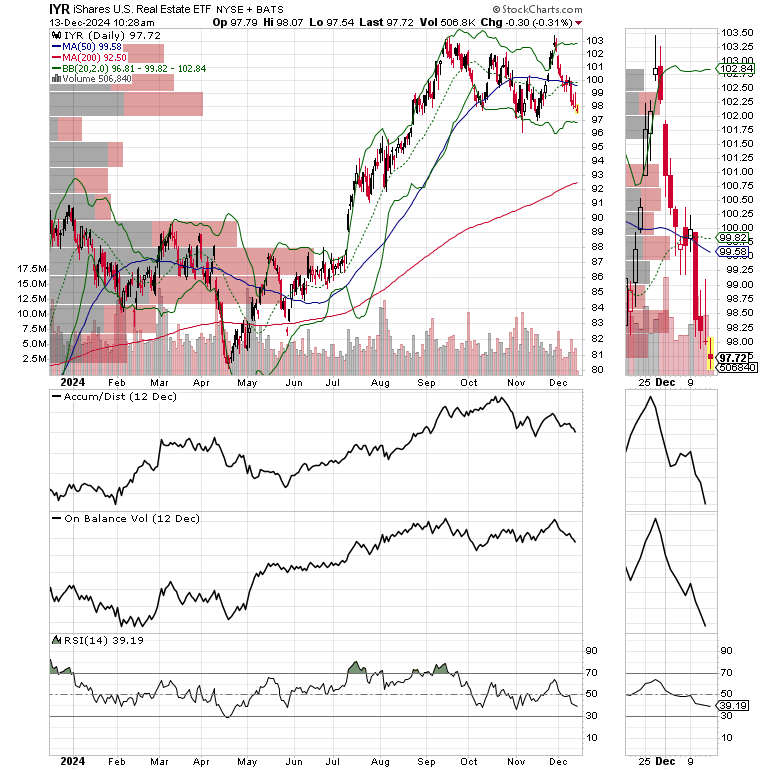

The iShares U.S. Real Estate ETF (IYR), home to many housing and commercial real estate REITs is also showing some weakness, but remains in a consolidation pattern. The $97 area is critical support. A break below $97, would lead to more aggressive selling.

Bottom Line

The homebuilders are reeling as money is leaving the sector in droves. Whether this is a pause that refreshes remains to be seen. The next domino to fall could be the REITs.

At the end of the day, there is no point in fighting the primary direction of money flows. And at this point, when it comes to residential housing, money is heading out the door.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For longer time frame trades have a look at The Smart Money Weekender Portfolio.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101 (https://shorturl.at/Ad0K7)

– will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.