Waiting for the Bus: Employment Data Could Make or Break this Market

One very out of favor group is suddenly bucking the trend. Is Buffet bottom fishing?

Image courtesy of https://community.snapwire.co/

Is Warren Buffet putting his money to work in the most out of favor sector in the stock market? There are some signs which suggest that perhaps he is.

In an earlier post today, I noted that “a lot can happen over the next few days, starting with Friday’s employment report.” That’s because the relationship between stocks and bonds is strained. Until recently, falling bond yields were a boon for stocks. But that’s not the case anymore as the recent decline in bond yields has not produced any time of sizeable bounce in stocks.

Instead, we’re seeing a breakdown in the market’s breadth, which until recently had been the volatile trend’s saving grace. Yet, I’m noticing one sector of the stock market which is attracting money in the stealthy manner that is often a sign that big money is bargain hunting. More on that just below.

What’s my point? This week’s employment data (ADP private payrolls and Challenger-Christmas’ layoff tally) have delivered weaker numbers than expected. Moreover, given Musk’s, albeit court altered activity, has created, at least on paper, a potentially large decline in the number of federal employees. Combined with ADP and Challenger’s data, it is plausible that the 148,000 new jobs expected by the market may actually be a much lower number. On the other hand, given the heavy emphasis and reliance of the BLS on statistical maneuvers, we may get yet another big beat on the up side. It’s a tough call on which way things are going to go, other than anything that misses up or down, especially in a big way, will move the markets.

Market Update

As I noted last weekend, and as we are seeing on a regular basis, traders have hit the Sell Everything button. Yet, history shows these types of selling sprees usually set up nice buying opportunities. The big question is always when.

Perhaps the biggest change in the markets is the sudden weakness in the New York Stock Exchange Advance Decline line (NYAD), which filters out the noise in the indexes caused by heavily overweight stocks such as NVDIA (NVDA). This morning, NYAD fell below its 50-day moving average, which is a negative development. This has continued throughout the day, and is concerning. If there is a silver lining is that the RSI for NYAD is getting close to oversold. A reading of 30 would signal that the worst part of the decline may be close to ending.

Meanwhile, the U.S. Ten Year Note (TNX) yield is moving back above its 200-day moving average. That’s what I’ve been expecting in the short term as the RSI for TNX hit 30 last week. Thus, Friday’s employment report will likely settle the score. A weak report could push TNX below 4%. A stronger than expected report, could send TNX back above 4.5%.

The effect on stocks of a stronger than expected employment report could be very negative as a rise in bond yields would suggest that the Fed isn’t likely to lower interest rates anytime soon.

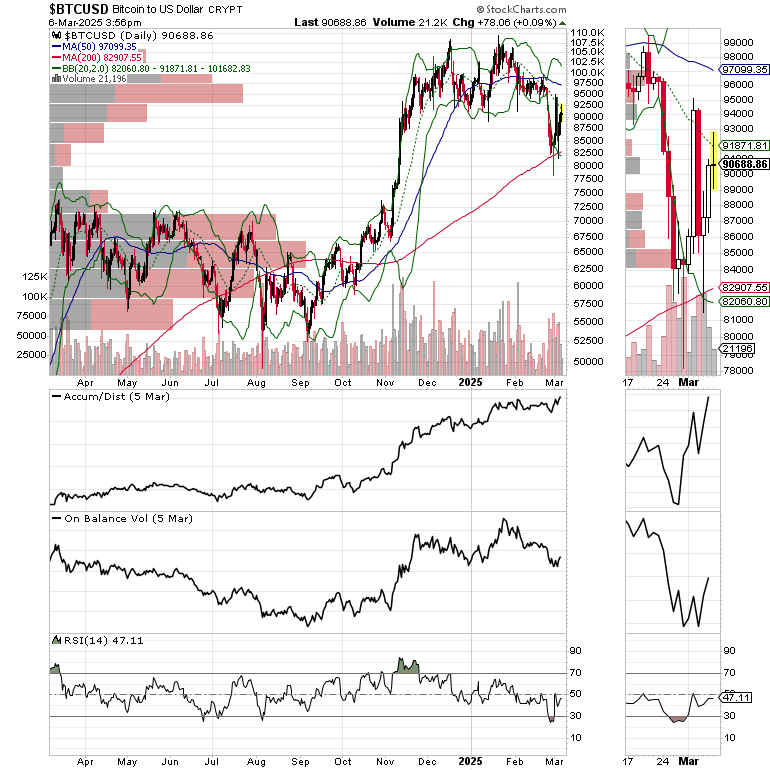

For its part, Bitcoin has found some support as talk of a government funded Bitcoin reserve is rising and a potential announcement of terms may come as early as Friday – adding potential fuel to the fire after the employment report.

So where does that leave us? As a contrarian investor, I’m always looking for outliers beyond the current trend. As a result, I’ve found five stocks with excellent long term potential selling at bargain prices which are sporting the signs of a big investor (maybe Warren Buffett) building positions.

These stocks are by no means going to be slam dunks; yet. Certainly, given their recent prices and the extremely negative sentiment against the sector in which they reside, the long term prospects are brightening. So while it could take some time to reap the eventual profits which are likely in the future, the wait may be worthwhile.

Indeed, the trades are designed for those investors with a long term time trend, of perhaps 9-12 months or longer. That’s why I’ve added these five stocks to the Rainy Day Portfolio is my Weekender service. You can find them here with a subscription to the Weekender.

Here’s even better news. If these five bellwether stocks continue to show relative strength, it will trip the alert button on similar stocks in the sector, which I will likely add to my shorter term focused trading portfolio here at the Smart Money Passport. I have my eye on a select group of them which are likely to blossom if the current dynamic gathers steam.

So, if you’re a long term investor, here is a chance to get in on some potential bargains at the Weekender. If you’re more short term oriented, stay tuned for more here, at the Smart Money Passport.

The sector I am referring to is housing, where as the S&P 500 Homebuilder Index chart (SPHB, below) shows the last six months have seen a nearly 35% decline in prices. This decline has mostly been due to high mortgage rates. Yet, despite the decline in the homebuilder stocks, homebuilders continue to sell houses, albeit at a slower pace. They’ve also continued to make money despite shrinking margins. In addition, because there is a housing shortage, demand remains high while supplies remain tight.

The result is that the homebuilder sector is now trading at less than 10X earnings in a market where any sustained decline in mortgage rates will likely revive the shares.

Thus, despite all the potential macro possibilities and the ongoing market volatility, I’ve found five stocks with excellent long term potential selling at bargain prices which are sporting the signs of a big investor (maybe Warren Buffett) building positions.

Let’s see how this turns out. But from a contrarian standpoint, it’s interesting to see that as the rest of the market is wobbly, suddenly somebody with big bucks is nibbling at the homebuilders.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership. Two new trades were posted yesterday.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

If this market is dragging you down maybe you need a shot of clean energy and vitality. You can find a wide variety of top notch products to get your edge back on health page.