Very Special ESP Tuesday: Stocks Move Steadily Higher as Hedge Funds Throw in the Towel

It’s a Day to Celebrate with a Special Offer. Plus, Updates on two recent ESP breakouts and a new contrarian pick.

Image courtesy of storyblocks.com

Hedge funds are throwing in the towel on their short positions, and the market has been moving higher on their short covering spree. For now, there is more upside potential, given the liquidity boost from the Fed and the U.S. Treasury’s backdoor maneuvers (buying T-bonds and selling T-bills, respectively). This liquidity has put a floor under the market and is bringing money in from the sidelines. In this issue, I’m updating two of our current holdings which are moving steadily higher and adding a very contrarian new pick to the ESP portfolio while celebrating a special day.

Special Announcement:

Today is a special day as my new book “The Everything Guide to Investing in Your 20s and 30s” is released. If you want to know more about the book, now in its 3rd edition, you can listen to my recent in depth interview on the Prudent Money Radio Show for details.

But here’s why this is exciting. To celebrate the release of the book, I am offering a 20% discount special offer to the Smart Money Passport, which you can access here. But you better hurry, the offer expires on 6/17/25.

Market Update

The New York Stock Exchange Advance Decline line (NYAD) made a new closing high yesterday and is extending its strength this morning.

The S&P 500 (SPX) is well above 6000 now and moving steadily higher. The next test is the 6000-6100 resistance band. A move above 6000-6100 will likely trigger more mechanical trading (algo) buy stops and rekindle the uptrend.

The U.S. Ten Year Note yield (TNX), remains stuck in a narrow trading range as traders await the CPI number, due out on 6/11/25. A move below the 200-day moving average for TNX would be very bullish and could happen if CPI comes in better than expected.

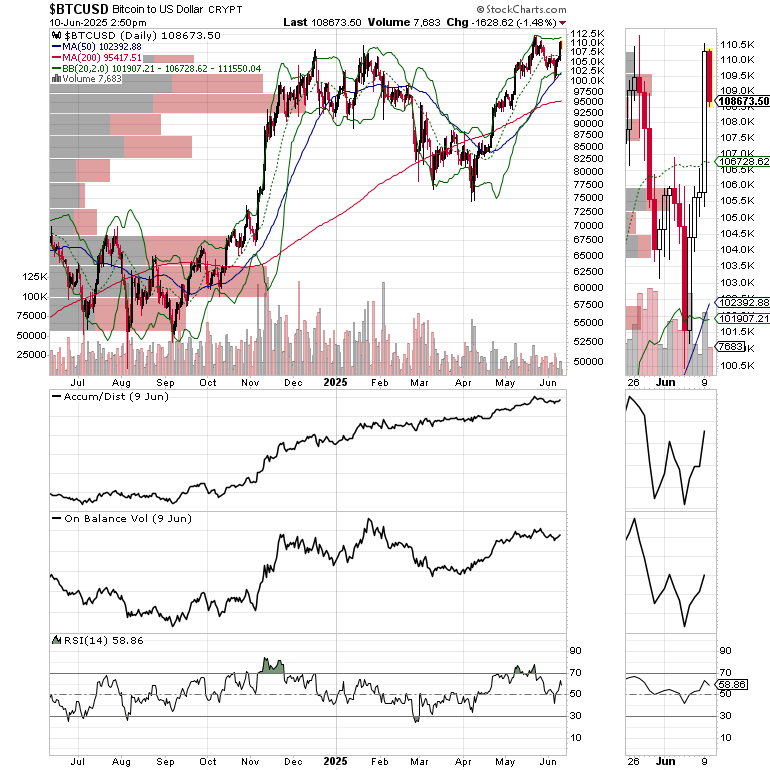

Bitcoin (BTC) continues to attempt a potential breakout above the $110-$112,500. Let’s see what happens next. Much depends on how the stock market responds to CPI.

Bottom Line

Stocks, bonds, and Bitcoin are poised to move higher. But much depends on the CPI number in the short term. A better than expected report could lead to a test of the all time highs in SPX, a move above $112,500 for BTC and perhaps a fall below 4.3% for TNX.

Trade what you see.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.