Trading Week Starts with Nifty Move in Advance Decline Line and Our First Trade

As I noted in my recent Smart Money Summary, I am concerned about the situation in the stock market, although not to the point where I’m recommending going to 100% cash. Instead, I am focused on sticking with what’s working.

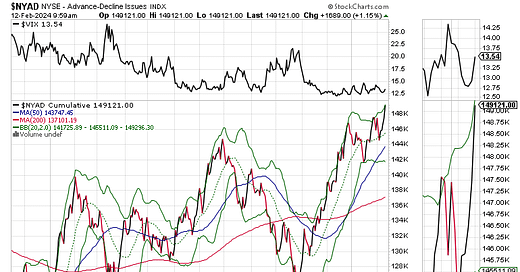

One of my main concerns has been the lack of confirmation of the recent highs in the indexes, such as the S&P 500 (SPX) from the market’s breadth, as envisioned via the action in the New York Stock Exchange Advance Decline line (NYAD).

This morning, we got a glimmer of hope as the NYAD finally made a new high. This suggests that, at least in the next few days, the market’s trend remains to the upside.

Of course, there are no guarantees, especially when tomorrow’s CPI number could be worse than expected. If that’s the case, we can expect some volatility.

NYAD’s chart speaks for itself, as it has broken out to a new high. Moreover, the RSI reading (lower panel) is still below 70, which means that barring something nasty developing, the rally still has room to rise.

As a result, I am posting the following trades.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.