Trade What You See. Getting Beyond the Tariff Peekaboo Dynamic by Focusing on Money Flows.

Headlines are important. But so is following the money. Plus two New Momentum Monday Stealth Money Picks and our Memorial Day Discount Offer has been extended.

Thank you all for the robust response to our recent discount offer. As a result, the Memorial Day Special Discount package has been extended to May 30. So, if you missed it, you can still grab the full Smart Money Passport service for our discounted price. You can get the details here, or go straight to the subscription page here.

Image courtesy of storyblocks.com

This is a good time to stay patient as the daily grind and the uncomfortable Peekaboo games perpetrated by the news easily distract us from following the underlying flow of money in the markets. That’s because despite the scary news there are significant structural changes in the global economy which are affecting how the smart money moves. Thus, even though daily trading action can be harrowing, price charts continue to document money flows into areas of the market which are being ignored by the headlines but not by the smart money.

That’s where we want to be.

Trade What You See.

The stock market is back in rally mode as yet again, the threat of monster tariffs has been scaled back. Of course, it’s foolish to ignore the potential damage to portfolios caused by any huge tariffs that actually stick. And yes, it is possible that everything could go wrong and a bear market may resume.

Thus, while it is reasonable to keep our eyes wide open for that possibility, it’s also important to keep an eye on what’s working and where the current volatility in geopolitics, tariffs, and the usual Washington dance of fiscal and monetary policy are heading.

The big picture is all about the restructuring of trade and the movement of supply chains away from China to other countries. The usual ones we hear about are India, Vietnam, and to some degree Thailand.

Yet, here’s what the headlines are ignoring. According to a recent survey by insurer Allianz, 90% of companies are planning to return production to the U.S. That’s a lot of retooling and construction work that will have to be done. Of course, there is no guarantee that any of this will actually take place or that the scope of the transition will be earthshaking.

But from a market standpoint, all we have to see is enough activity in this dynamic to move the needle and move money into the areas of the market which will benefit. So what’s my bet? The infrastructure and engineering, basic materials, and related areas of industry.

And that’s where today’s two Momentum Monday picks come in; two companies which are poised to profit handily from this still mostly ignored structural dynamic.

Market Update

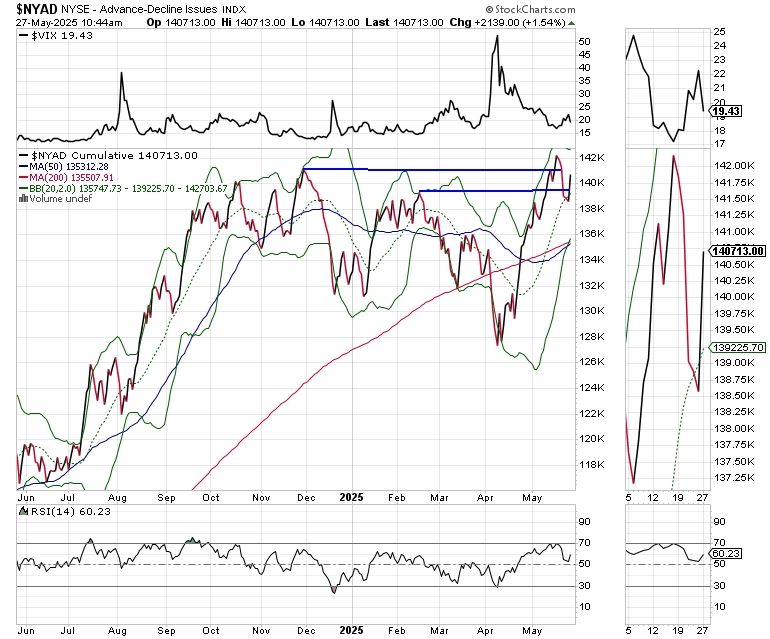

The New York Stock Exchange Advance Decline line (NYAD) is once again within reach of a new high. That’s because money is flowing into areas of the market beyond the headlines.

The S&P 500 (SPX) has also recovered and is once again within reach of the 5900-6000 resistance band which holds the key to the next trend. A move above 6000 will likely trigger mechanical trading (algo) buy stops and rekindle the uptrend.

The U.S. Ten Year Note yield (TNX), despite all the talk of a debt Armageddon remains range bound and is within reach of a move below 4.5%. Once again, the recent tag of the RSI level of 70 on TNX has proven to be an excellent predictor of a turnaround in rates.

Meanwhile Bitcoin (BTC), in which we have a nicely up trending trade in our Momentum Monday portfolio, is setting up for what could be a significant breakout above the $110,000 value. Note the ADI and OBV lines are rising while the Bollinger Bands are squeezing in suggesting that money is moving in (ADI and OBV) while a big move is setting up (Bollinger Bands).

Bottom Line

There is plenty to worry about. But there is also lots of stealth money moving into areas of the market when no one is looking. If we spend all our time worrying about the headlines and ignoring the money flows, we’re missing half the story. And it’s that half of the story which will make us money.

Trade what you see.

Incidentally, the Memorial Day Special Discount Offer went so well over the weekend, that I am extending it to May 30. So if you missed it, you can still grab the full Smart Money Passport service for our discounted price. You can get the details here, or go straight to the subscription page here.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.