This is not the time to walk away.

A Four Sigma Tag of the Lower Bollinger Band Occurred this Morning. Plus a Two Tiered Trading Plan.

A Four Sigma Tag of the Lower Bollinger Band on the S&P 500 Occurred this Morning. Plus a Two Tiered Trading Plan.

Image courtesy of pinterest.com

The natural reaction to daily market crashes is to walk away. Yet, history shows that eventually things will improve. So, as uncomfortable as it may get, it will pay off to prepare for things to get even stranger as the tariff situation morphs further. Only one thing is certain the intensity of daily events is likely to increase.

As I noted this weekend, there is a huge disconnect in reaction times between the digital world ( the AI fueled algo trading social media reality) and the analog (transistor radio speed of the global central banks). All of which leads to wild market swings as the Fed and other central bankers seem to stand by helplessly as the world cries for liquidity.

Take this morning’s fake out rally prompted by news that the White House was considering a 90-day pause on the tariffs. Within 30 minutes the White House denied the report calling it “fake news.” There went the rally. That’s where we are now, perhaps at the latter stages of the selloff where the situation for traders is so dire, and the pessimism so thick, that anything can move prices higher.

Who’s to say that the White House itself didn’t initiate the leak just to test the waters as to what might happen on good news? Certainly, the “pause” news was denied. Yet, it illustrates my point perfectly; the pessimism is so thick that any positive news will send stocks soaring.

In other words, this is not the time to walk away from trading screens. It’s a time to build that shopping list and prepare to deploy it.

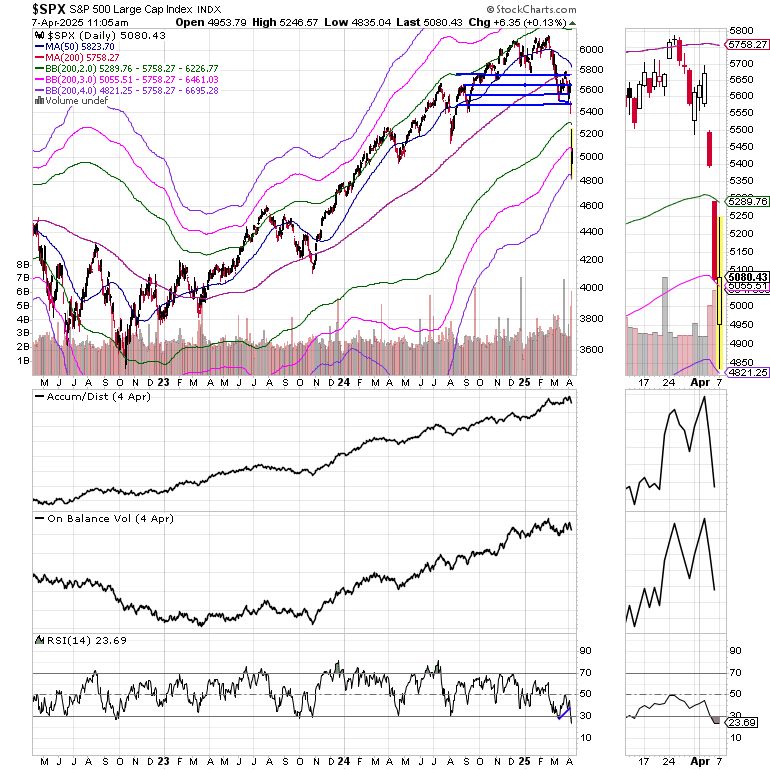

Market Update – A Four Sigma Tag of the Lower Bollinger Band Occurred this Morning

This morning, we witnessed something more extraordinary than last week’s 3-sigma event in stocks; a four sigma tag of the lower Bollinger Band in relationship to its 200-day moving average. That’s right, the S&P 500 (SPX) tagged the lower Bollinger Band which stands four standard deviations (4SD) below its 200-day moving average.

Note the purple line at the bottom of the chart. That’s the 4SD line. And the tag signifies that the market is now acting 4X outside what is considered normal behavior. Yes, I know the market doesn’t follow a normal statistical distribution. Yet, this is an event so far outside the “usual” that it bears noting, especially considering the fact that a tag or a breach of the 2SD line (green band) is usually good enough to spawn a turn in the markets. In other words, this market is now 400% oversold.

On the other hand, the New York Stock Exchange Advance Decline line (NYAD) is very oversold based on the traditional relationship between its 20 day moving average and its accompanying 2SD Bollinger Bands. This often sparks a reversal. However, and this is sobering, the NYAD just broke below its 200-day moving average and has plenty of room to fall before hitting its 200, 2SD line (pink line). I’ll leave the rest to the reader to sort.

Bitcoin seems to have lost its allure as “flight to safety,” at least for now as it tests key support, while hitting an oversold level (trading outside its lower 20day, 2SD Bollinger Band with its RSI nearing 30).

The U.S. Dollar, long given up for dead by many seems to have found its footing in the short term. The bears may prove to be right - not today. Support is at the $100 area for the U.S. Dollar Index.

The U.S. Ten Year Note yield (TNX) is, not unexpectedly, rising this morning. This is not surprising given its oversold level. Still, as I’ve been expecting, TNX is below its 200-day moving average.

This morning, I have a new trade with some conditions.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

SPECIAL PROMOTION! - In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. As a special bonus, you will receive a Free one month subscription to the Weekender portfolio with your first health purchase.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.