The Wall of Worry is Gone. Without Expanding Liquidity Stocks May Stall.

The Fed is living in the past.

Image courtesy of wallpapercave.com

The wall of worry has disappeared. This market needs liquidity to push prices higher. Unfortunately, the Fed is living in the past, clutching to the stale tenets that say the economy drives the stock market. The tide has shifted. It’s now the wealth effect, via 401 (k) plans, IRAS, and trading accounts that drive the economy.

It’s called the MELA System. Markets (M) create the wealth effect. Economies (E), thrive when markets are rising as the wealth effect drives Life Decisions (L), such as buying houses and cars. Moreover, as Mr. Powell and the gang at the Eccles Building don’t seem to grasp, news travels fast these days as the algos (A) in the markets and social media respond instantly to events and new trends are created.

So, when you’re making decisions on last month’s stale data, instead of focusing on the present you’re always behind the 8-ball.

The Wall of Worry is Gone

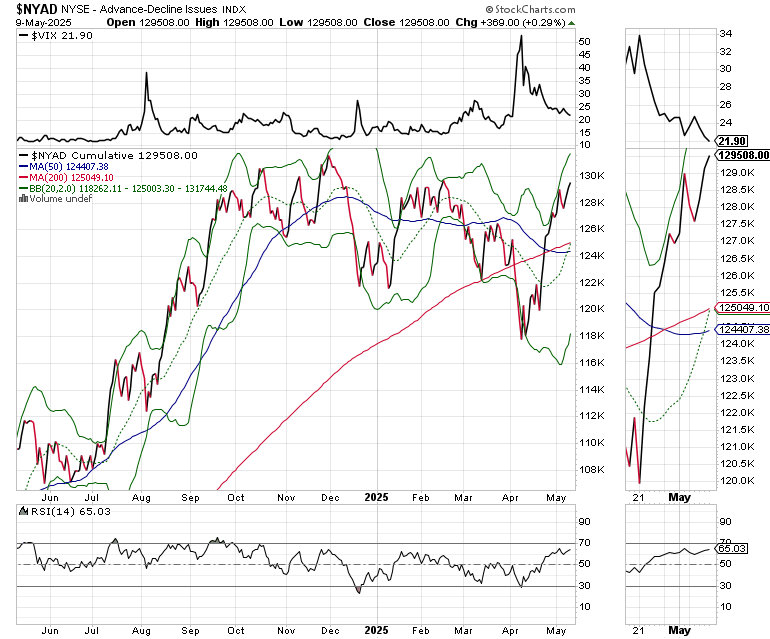

This rally is starting to get tired. Sentiment is suddenly too bullish. Earnings are not that impressive. Institutions are unbelievers. And the highly improved market’s breadth can’t seem to get over the hump and deliver the necessary new highs to deliver an “all clear” signal.

Some of it is likely due to the evolving tariff and Ukraine situations which remain murky. Some of it has to do with the feud between the White House and the Fed. Most of it, though, is the result of liquidity having tapered off since bottoming out in February, as I detail below. And while liquidity may be once again improving, without the Fed stepping on the gas pedal, soon, the market won’t be able to mount a barn burner rally which lasts.

So, while I’m not turning bearish. I am becoming a bit more cautious as the money spigots seem to have tightened up some. What would make me become more constructive? A nice jump in liquidity followed by a series of news high on the New York Stock Exchange Advance Decline line would go a long way.

On the other hand, with trade talks over the weekend, and a bit of luck, maybe the bulls can get a little continuation bump from positive headlines. It would be nice if any trade deal or the groundwork for one emerges. Hopefully, that’s good enough to get the Fed off the Fence. Still, with a big rise in bullish sentiment, negative news may be the trigger for some selling.

It’s Going to Take Something Very Bullish for a Full Positive Reversal of this market

Over the last few weeks, I’ve noted that many of the most beaten up groups in the stock market have rebounded. And while the recovery has been welcome, despite recent improvements many sectors are still in correction mode. The good news is that many are not too far from full reversals into long term uptrends.

One of them is the semiconductor sector (SMH), which has rebounded back above its 20 and 50-day moving averages. SMH has broken above a down trend line going back to the January 2025 top, a development confirmed by positive crossovers above the 20 and 50-day moving averages. Much of the rebound can be attributed to oversold conditions reached in early April (RSI below 30) and a steady, albeit not complete reversal of the tariffs imposed by the White House on the sector. Both the ADI and OBV lines have turned up, which signal money moving back into the sector.

On the other hand, SMH still has plenty of upside room before it crosses above its 200-day moving average, which would confirm that the long term uptrend is back in control. That puts a lot of pressure on the 235-255 price range where the 200-day and two large VBP bars converge. If SMH can get above that trading band, the odds would favor it moving back toward its old highs as the breakout would signify that the bears have been vanquished.

The building and construction sector (PKB) has also seen a significant rebound. Indeed, PKB is back above its 200-day moving average, now testing a potential long term reversal. Much of this has to do with the expectations that international companies will be building U.S. factories and that these engineering and infrastructure companies will benefit. It surely looks good on paper. But there are still lots of t’s to cross and I’s to dot, which means that anything is possible.

And while it’s still a worthwhile sector, there is still lots of uncertainty and an unfriendly Federal Reserve to contend with. Yet, it’s been a profitable area over the short term. We recently took a $1900/100 share profit on an infrastructure company in our Momentum Monday portfolio,.

Bottom line – stocks have come a long way in a short period of time. Price charts are suggesting that investors are taking some profits. Liquidity is adequate but not overwhelmingly bullish. And China and the U.S. are playing a high stakes game with the start of trade talks, as the Fed sits this crucial moment out. In other words, trade small and have your eye on the door.

Liquidity Watch – Slight Improvement. But more is needed.

Liquidity is stabilizing. But the market needs a larger and steadier stream of money cycling into it in order rally for several weeks. The latest reading, May 2, 2025, of the Fed’s National Financial Conditions Index (NFCI) came in at -0.45 which is slightly better than the prior reading but is still displaying much tighter conditions we saw in February. Negative numbers signify ample liquidity. Yet, the nearly 10-plus basis point rise over four weeks is cautionary and at least partially explains the general weakness in stocks.

Sentiment Summary – Greed Needs Liquidity to Power Stocks Higher.

The CNN Greed/Fear Index (GFI) closed last week at 62. This is a big reversal from the reading of 3 delivered a few weeks ago. Thus, we’re back to Greed. And greed needs liquidity to fuel further gains.

The Composite Put/Call Ratio closed at a moderately bullish 0.74. The index P/C ratio closed at 1.04. Both are neutral.

The CBOE Volatility Index (VIX) closed at 21.90 well off its recent high above 50, confirming the wall of worry is gone.

The S&P 500 (SPX) is struggling to get above 5750. A sustained move above this level will be a big positive. Here is some useful background to help you sort out this important price level.

The bond market is increasingly skittish but is range bound.

Bond Yields Hold Steady

The bond market is increasingly volatile, albeit in a tight range. That’s unsettling. System liquidity and uncertainty about trade, tariffs, and wars is spooking traders.

The U.S. Ten Year Note yield (TNX) is still hovering near 4.3% with the 200-day moving average proving to be stubborn support.

If you’re an ETF trader, consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about starting a day trading career, my new book “Day Trading 101” will get you started on the right foot. For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better with extra energy, and vitality. Visit my Health Page.

NYAD – Oh! So Close!

The New York Stock Exchange Advance Decline line (NYAD) delivered an intraday new high on 5/2/25 but has since faded. It’s still within reach of the important milestone but has not delivered in a convincing fashion.

The Nasdaq 100 Index (NDX) is testing its 200-day moving average. A sustained crossover by NDX would go a long way to reassure the bulls.

The S&P 500 (SPX) continues to butt heads with the 5750 resistance level. As with NDX, and NYAD, the bulls would love to see a move above key resistance.

VIX Heads for Test of 20

The CBOE Volatility Index (VIX) topped out above 50. Now, it’s testing the 20 level. VIX below 20 would also be a bullish development for stocks.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now! #1 Best Seller in Options Trading

Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition) Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)

Great point you make about the growing digital divide among older people. There are those who understand how the speed of digital messaging impacts the markets and economies and those that don't - like the Fed Chair.

I'm not sure it has to do with age in this case. It seems more of an institutional issue. The "Fed way" is the "Fed way." There doesn't seem to be anyone at the Fed that does what Peter Lynch championed - getting out and kicking the tires. I'm not implying it's political. The world works on fiberoptics and real time data. Walmart, Costco, and Target know where you're standing in their store and build a profile on you by tracking your cell phone in real time. The Fed should have access to real time data and update their models. Otherwise, they will always be "behind the curve" and the markets and the economy will always take the hit because of the way they run their business.