The Housing Shortage is Becoming Structural. Why this Changes Everything.

The dismal June data may mark the bottom.

Despite June’s dismal data, the bullish tone in the homebuilder sectors and the housing REITs remains in place, as the equilibrium between supply and demand remains in their favor. Certainly, this is not news for regular readers, as I’ve been bullish on the homebuilders for quite a while. What makes things different now, is that even as many investors stay negative on the sector, the on the ground reality is quietly contradicting the data as a secular change in the market is taking hold.

Was June the Bottom?

The June data, may mark the bottom in the housing market. According to, Substack’s Daily Chartbook:

· The median price of an existing home is now above the median price for a new home;

· Two thirds of the homes that were on the market in June had been listed for at least 30 days – a nearly 60% year over year increase;

· Nearly 20% of the houses sold in June had undergone a price cut.

On the other hand, more recent data offers a slightly different picture as PulteGroup (PHM) CEO Ryan Marshall said the quiet part aloud during the company’s recent earnings call: “While subsequent Wall Street channel checks confirmed a change in short-term demand, the fact remains that we are operating in a housing market that has been underbuilt relative to population, immigration, and household formation for more than a decade. The resulting housing deficit of several million homes is likely a structural reality for years to come, given the zoning challenges we face in most municipalities.”

This statement changes everything for potential homeowners, investors, renters, and the Federal Reserve. Here’s why:

· Homebuilders have figured out how to make money in a difficult market;

· Potential home buyers are facing difficult choices as time and circumstances are tight; and

· Some will make the leap to buying a home, while others will opt to rent.

Putting it all together, because of the combination of high interest rates, low supplies, and the persistently high prices in existing homes, the homebuilders have most of the clout, while the home rental REITs, especially those with newer properties in attractive areas are also in a favorable position. That means that when the Fed finally drops rates, the pent up demand will likely ignite a bullish wave of business for homebuilders.

A Romp through the Data and Earnings

Echoing, the data cited above, June existing home sales came in well below expectations (-5.4%, month over month). The usual suspects were cited; high mortgage rates and rising home prices. New home sales also came in below expectations. But, as I said above, homebuilders have adjusted to the new environment, and the subsequent slower pace of sales while Wall Street is lowering estimates, almost guaranteeing earnings beats.

For example, PulteGroup (PHM) handily beat lowered expectations in earnings and revenues. Yet, the stock, after initially selling off came back to flat after the company’s earnings call. The reason for the initial selloff was a slight decrease in overall sales, which of course, should have come as no surprise to anyone since the earnings cover the quarter where mortgage rates were above 7%.

PHM reported a 2% increase in average sales price, an 8% increase in closings, and a 30 basis point gain in gross margin, which in aggregate, helped drive a 19% increase in earnings to a second quarter record of $3.83 per share.

But here’s the kicker. PHM spent $104,000 to develop a lot and delivered an average sales price of $549,000 – nice work if you can get it. Jim Zeumer, Vice President of Investor relations noted that in Texas and Florida, usually strong areas for the company, consumers are turning cautious and this has led the company to do some price discounting and incentivizing, while citing July traffic, so far, as “solid.” This is consistent with what I’m seeing on the ground where traffic is increasing, and suggests that when July’s data is released, there may be some pleasant surprises.

The bottom line for Pulte, as with the rest of the sector seems to be that supply and demand are on their side and because of higher selling prices their profits are likely to remain sustainable, although growth is likely to slow or remain flat. On the other hand, if the Fed eases, the company expects the pent up demand to transform into more buyers. I agree.

In addition, Taylor Morrison (TMHC) also beat expectations but reported flat sales. As with PHM, above, the take home message is: steady as she goes.

Real Estate Giant Beats Earnings

Interestingly, real estate management giant CBRE Group (CBRE)’s shares rallied as the company beat expectation, while citing, in its press release that its Americas commercial leasing business is now leading the way along with improvement in commercial and multifamily properties. In addition, its mortgage business is showing growth.

The stock broke out to a new high on 7/25/24.

Bonds, Bonds, Bonds…And Mortgages

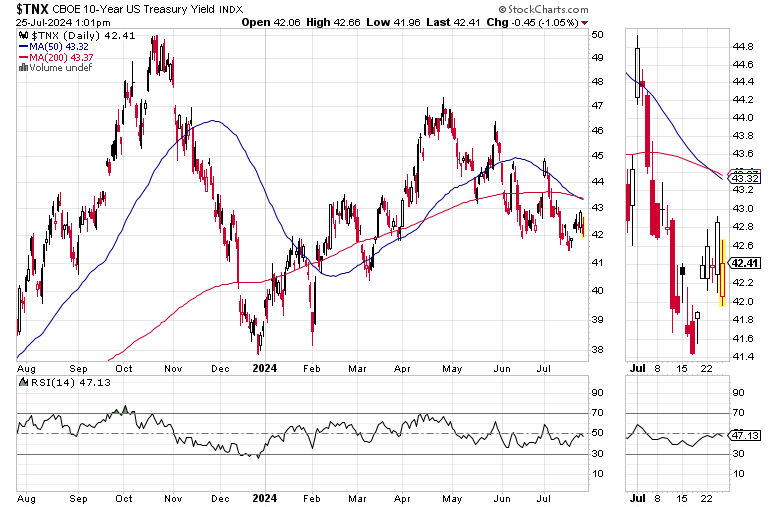

The U.S. Ten Year Note yield (TNX), the benchmark for the average 30-year mortgage remains nicely subdued, trading near the low end of its recent trading range.

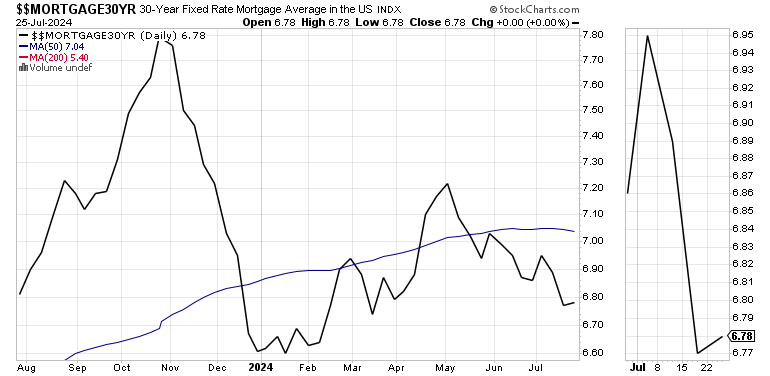

For their part, mortgage rates are following right along, with the average 30-year mortgage remaining below 7% since May 17, 2024.

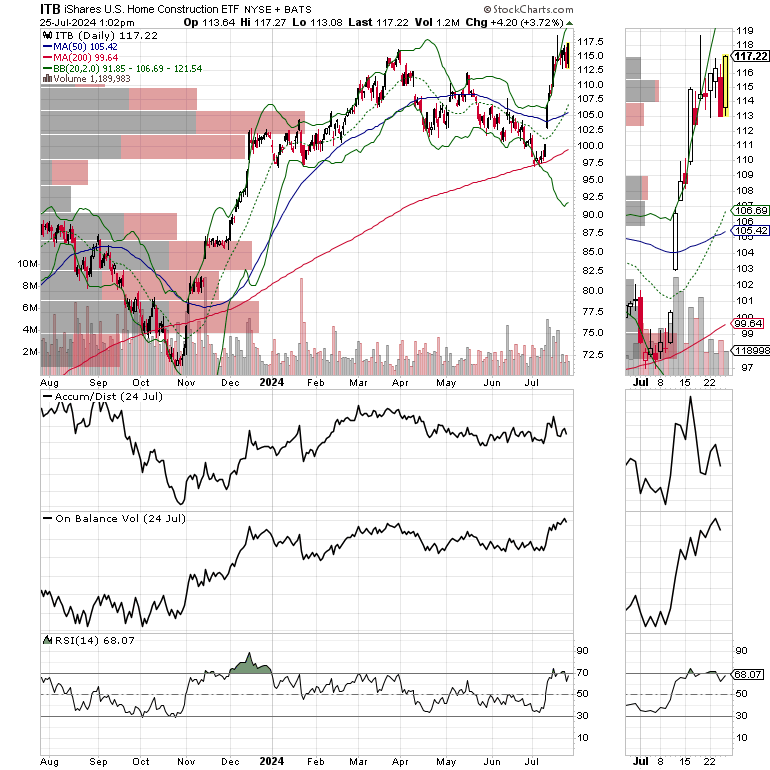

Meanwhile, the iShares U.S. construction ETF (ITB) is consolidating after its explosive rally in response to the rising possibility of a Fed rate cut, perhaps before the election, although I wouldn’t hold my breath, although the PCE deflator data due out on 7/26/2024 could change everything.

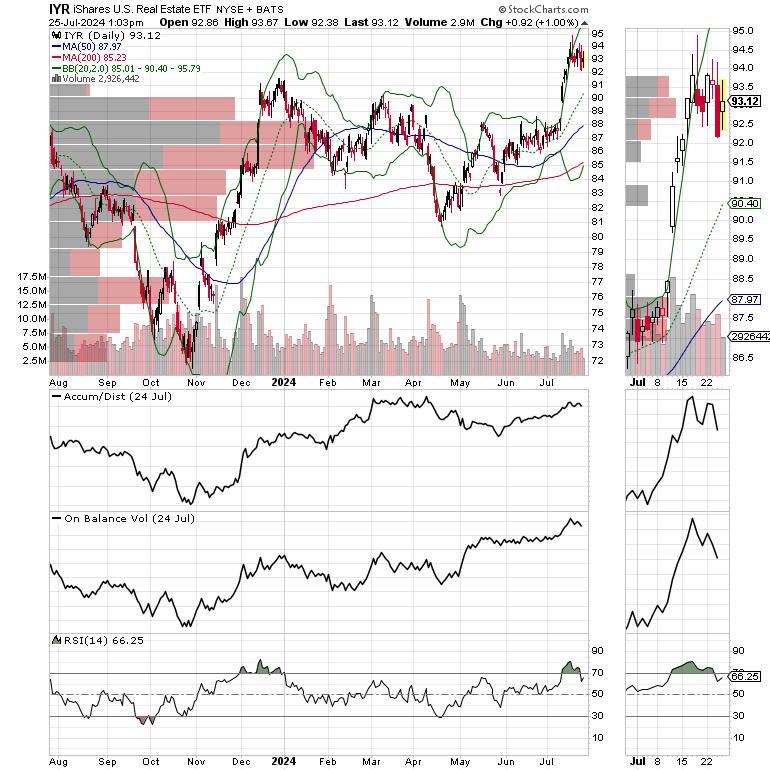

In addition, the iShares U.S. Real Estate ETF (IYR) is now marching in lockstep with ITB, confirming my analysis that housing REITs are also benefiting from the “structural” changes in the housing market.

For individual REIT and homebuilder stocks consider a FREE Two Week trial to Joe Duarte in the Money Options.com.

If you’re an ETF trader, interested in these and other sector trades consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here.

On the Ground

One final thing; in my regular rounds through my neighborhood in the northern reaches of the DFW metroplex, I’m seeing a continuation of the pickup in action I’ve been describing of late. This past weekend, I saw something I haven’t seen in quite a while: SOLD and Contract Pending signs.

I saw them in front of both lower end and upper middle and lower upper end houses. Moreover, those town homes, I’ve been writing about are starting to draw some traffic.

I’m interested in how things are going in your neck of the woods. Drop me a line at jdimo5700@gmail.com.

Bottom Line

June’s dismal data may mark the bottom for the housing market.

The supply shortage in the housing sector is now structural. That means it’s here to stay, perhaps for a period of years.

There now are more houses coming onto the market. Texas and Florida’s hot markets seem to be slowing.

Homebuilders and home rental REITS are in excellent position to deliver steady profits.

Conditions are now ripe for a rate cut by the Federal Reserve will likely ignite a major housing boom.

The bullish thesis isn’t guaranteed as the key is, more than ever, interest rates.

Thanks to everyone for your ongoing support. You Rock! I really appreciate it.

If you like this post, PLEASE, hit the Like button, and Share it as it helps to spread the word.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

You're the music. I'm just the band.

Enjoy this post?