Tentative Bottoming Process is Proceeding. Why it Pays to Trade with Precise Entry and Exit Points.

The Market is not totally Out of the Woods Yet.

Over the last couple of weeks, I’ve suggested the market has been trying to put in a bottom. I’ve based this on two factors:

· Market sentiment has plummeted. The CNN Greed/Fear Index recently registered a bullish reading of 31; and

· The market’s breadth as measured by the New York Stock Exchange Advance Decline line is bottoming out.

Together, these two indicators are highly suggestive that a market bottom is unfolding and that we are seeing a rotation away from the AI driven technology sector into other areas of the market. That said, we need further confirmation before giving the all clear to fully return to the long side.

First, we need to see a continuation of the positive action in NYAD. This morning’s action is certainly encouraging.

That’s because NYAD has moved back inside its lower Bollinger Band. Now we need to see NYAD move above its 50-day moving average.

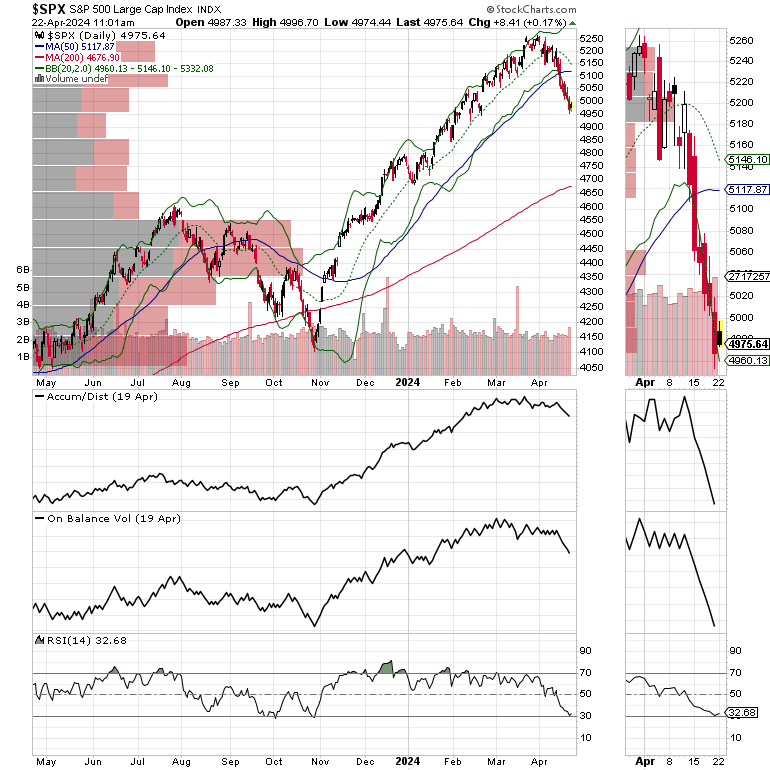

For its part, the S&P 500 (SPX) needs to move back above 5000 and then continue to move higher with 5100 and the 50-day moving average being the next key areas of resistance to conquer. On the other hand, both the RSI for both SPX and NYAD recently tagged the 30 area, registering oversold readings.

Finally, a meaningful rally is unlikely until we see a reversal of the recent trading pattern where stocks rise in the early going only to fade by the close. The bullish side to this is that the longer it goes on, without a further market breakdown, the more oversold stocks will become; thus creating the conditions for a major short squeeze and market bottom.

Meanwhile, it’s paid off to trade with precise entry and exit points. One such trade I recently recommended, was entering shares of Taiwan Semiconductor above $146. The trade was built on expectations that the company would beat earnings expectations and that the stock would move above $146 on its way to $150.

As the price chart shows, the stock never triggered the entry point. Thus, we avoided a whole lot of potential pain. On the other hand, I currently have an open trade which has a seasonal theme, which is holding up well.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.