Take $819 Profit on UFPI. Plus Double Barrel Tech Monday - Two New Picks

Money is moving to tech.

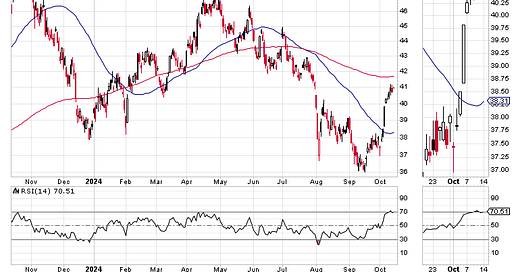

Last week, I recommended purchasing shares in building materials company UFP Industries (UFPI). This morning, it’s time to take this one home with an $869 profit. The stock could certainly move higher over time, but given the potential volatility of the moment, this is a good time to take the money and run.

SELL UFP Industries (UFPI). Bought 10/8/24: $129.50. 10/14/24 intraday price: $138.19. Return for this trade: $869/100 shares (6.71%). That bring our profit total to $2917 since September 23, 2024.

Market Update

As I noted in this weekend’s Smart Money Trading Strategy Weekly, the crosswinds of two major hurricanes, the back and forth between China and the markets regarding stimulus measures, the potential ambivalence of the Fed regarding its next interest rate decision while other global central banks are promising more rate cuts is creating the potential for volatile markets ahead of the U.S. Presidential election.

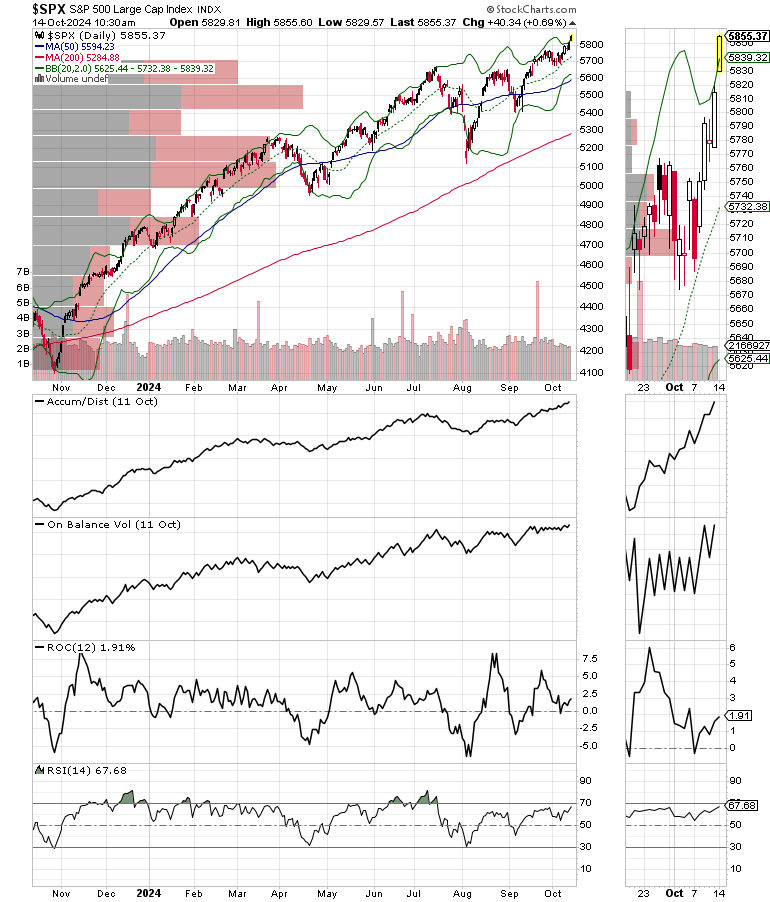

Investors are clearly undecided about what’s next. And you can see it in the price charts. The U.S. Ten Year Note yield (TNX) is stubbornly trading above 4%, while the New York Stock Exchange Advance Decline line (NYAD) is increasingly hesitant.

Note that NYAD did not confirm last week’s or this morning’s new highs on the S&P 500 (SPX), while showing signs of being a bit tired this morning. This may be a short term development, but it is worth watching as major divergences between NYAD and the major indexes are often preludes to significant declines.

Meanwhile, money is moving into technology stocks with the Nasdaq 100 Index (NDX) is closing in on a new high, while the S&P 500 (SPX) is also moving decidedly higher.

This morning, I have two new Momentum picks and updates on the rest of the active trades in the portfolio, including adjustments to sell stops. Tomorrow, I will have a full update on the Extended Stay Portfolio.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.