Take $1030 Profit on JCI. Take 116% Profit on Bitcoin Futures ETF Call Option. The Market is Taking a Break Ahead of CPI.

Let's see what happens with CPI

This morning, we are taking a $1030 profit (13.59%) on shares of Johnson Control (JCI) and a 116% profit on a Bitcoin Futures ETF (BITO) call option.

• SELL - Johnson Controls (JCI) above its 20-day moving average. Bought 10/8/24: $75.80. 11/5/24 intraday price: $86.10. Return for this trade: $1030/100 shares (13.59%).

The JCI trade is a prototype trade for this portfolio with nearly 30-day holding period delivering a very credible result.

This option trade was a very low price, very low risk trade which has delivered just as it was designed to do.

• Sell to Close the ProShares Bitcoin Strategy ETF (BITO) December 31, 2024 $23 Call Option. Bought 10/29/24: $0.90. Closed 11/12/24: $1.95. Return for this trade: $105/contract (117%).

Taking a Break - Image courtesy of loveswah.com

I don’t have a new pick this morning as I’m focused on managing the current positions in the portfolio. I am also waiting for the release of the CPI tomorrow before unlocking some of the potential trades in my shopping list.

Market Update

The major indexes are rolling over this morning, which is a good thing as we don’t want the market to overheat. The backdrop for stocks remains positive with both the seasonal tendencies and the Fed’s rate cuts providing a bullish background. The market is a bit overbought and there is some worry about the CPI number due out tomorrow.

The New York Stock Exchange Advance Decline line (NYAD) is within striking distance of a new high and trading above its 50-day moving average while VIX is well below 20.

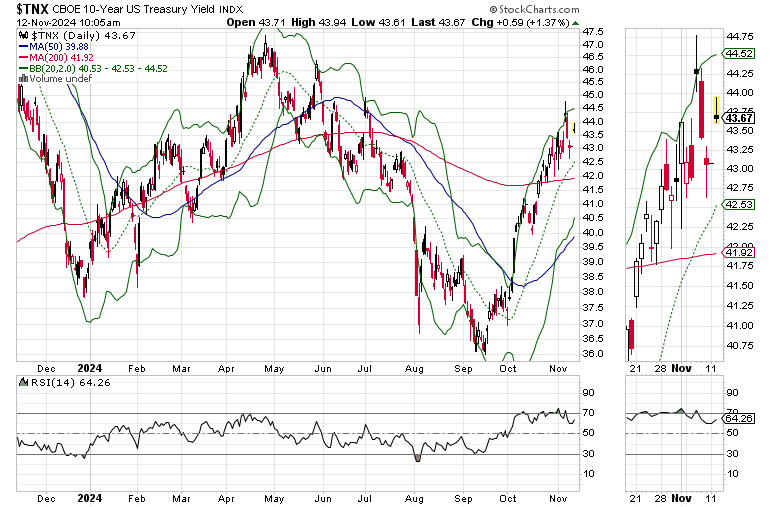

The bond market is backing up a bit as well as fears of a hotter than expected CPI work their way through trading desks. The U.S. Ten Year Note (TNX) is likely to fall below the 4.3% level on a better than expected number, which would be supportive of stocks. A hot number could move TNX above 4.5%.

Bitcoin is also overextended in the short term, trading outside its upper Bollinger Band. Any pullback to the 20-day moving average is likely to provide an excellent buy on the dip opportunity.

As I’ve recently noted, recent events have turned Bitcoin into a money magnet, prompting me to add two trades on the cryptocurrency. I am recommending taking profits on one of the trades while we close out the option trade as I indicated above.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport Momentum Portfolio.

My new book – “Day Trading 101” is now available, offering easy ways to get started in the trade.

I also appreciate single coffees, which you can buy me at the link above.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.