Stocks Recover as Moody’s Downgrade Initially Spooks Traders. Dip Buyers Sneak In.

Plus, two new trades powered by macro tailwinds – Improved liquidity and focus on mergers and acquisitions.

Image courtesy of gigglesandhugs.com

Stocks started the day under the weight of the Moody’s U.S. debt downgrade, but prices recovered and the trading tone improved as improving liquidity put a floor under the market and the dip buyers moved in. A consolidation pattern, and even a moderate pullback is not out of the question, but the constructive environment remains intact. Moreover, there is the bullish simmering vibe of a potential merger and acquisitions wave overhanging the market, as the recent bear market has created opportunities for bargain hunters.

Take this morning’s announcement that Regeneron Pharmaceuticals (REGN) got the bankruptcy court nod to purchase the bankrupt 23andMe DNA database for $256 million. While this is not a takeover, it’s a variation on the theme as REGN will now have access to the DNA information of 15 million 23andMe users which it can put toward research and development of new products. The bankruptcy resulted from liquidity and operational problems at 23andMe as financial conditions tightened during the recent bear market - highlighting the potential for other companies to be in similar positions and becoming takeover targets.

Certainly, this market has come a long way fast and it’s due for a consolidation. That said, this morning’s recovery suggests that those who missed the rally from the recent bottom are eager to buy dips. Thus, as long as stocks hold above key support over the next few days, perhaps longer, the bulls get a bit of a nod.

This morning, I’m adding two new picks to the Momentum Monday portfolio. Both are driven by the macro environment. One is a direct beneficiary of the trend toward healthy foods and the other is a defense stock which should benefit from the evolving geopolitical environment.

Market Update

The New York Stock Exchange Advance Decline line (NYAD) delivered a new high last week, finally giving us an “all clear” signal. That said, we’ll be monitoring what happens in the short term as we want to see NYAD hover near the new highs in any consolidation.

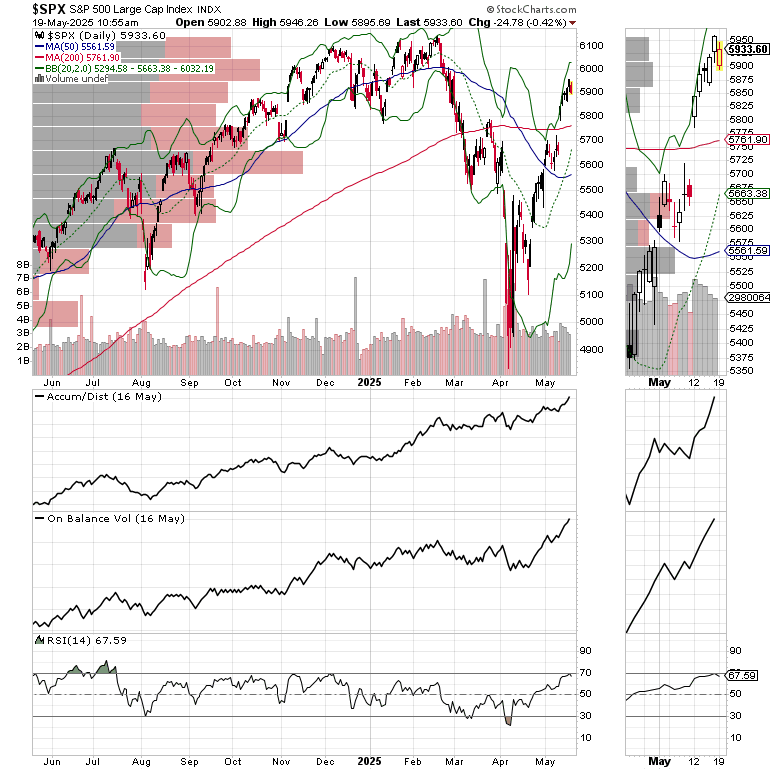

The S&P 500 (SPX) is holding near 5900 and may consolidate over the next few days before making an attempt at 6000.

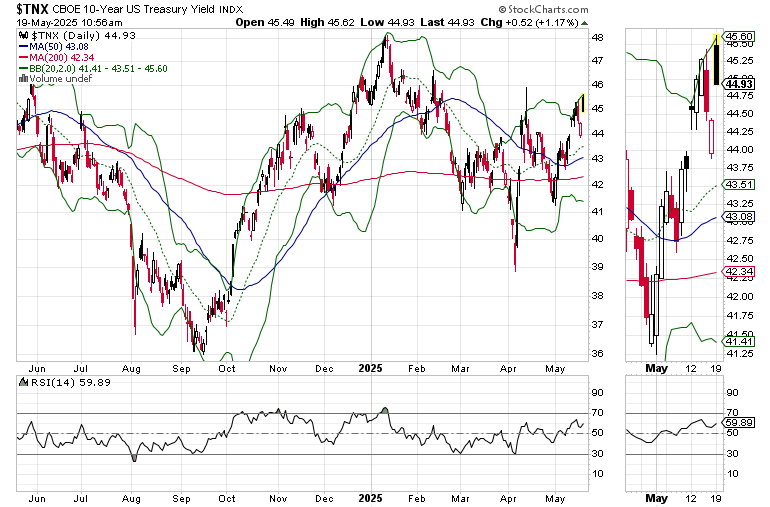

The U.S. Ten Year Note yield (TNX) is above 4.5%. This is a short term negative as traders fret over the Moody’s U.S. debt downgrade. Yields could push a bit higher before stabilizing or reversing. 4-6-4.7% looks like a reliable resistance zone. A move above that could cause some trouble.

If you’re an ETF trader, especially in your 401 (k) or your IRA consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about starting a day trading career, my new book “Day Trading 101” will get you started on the right foot. For steady gainers, and a good number of homebuilder stocks, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Take good care of yourself during these stressful times with excellent quality proven supplements. Visit my Health Page.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.