Stocks Play the Waiting Game on the Middle East and the Fed. Meanwhile Dip Buyers Selectively Nibble.

We are prepared for any contingency. Final Call on Special Offer.

Image courtesy of freepik.com

As the situation in the Middle East develops there is palpable anxiety in the air and in the trading world, which is understandable, as the potential for just about anything is rising. Yet, there are investors who are buying stocks selectively, especially in the technology sector, where we’ve recently added a semiconductor stock which is breaking out nicely and which has huge potential to keep climbing, barring extremely negative developments.

Meanwhile, the Federal Reserve is meeting with a rate announcement due out tomorrow. It’s a tough call given that inflation has cooled, employment is stable but seems to be slowing, and the White House is pressuring the central bank to lower rates while the Middle East conflict unfolds.

In addition, sentiment levels in the homebuilder sector are at pandemic lows, even as homebuilders continue to beat earnings estimates. This may signal a meaningful bottom for the sector, which is featured in our Weekender Portfolio and our Momentum Portfolio as updated here today.

Therefore, we continue to follow the central tenets of our trading plan:

Don’t fight the liquidity trend, which is positive – the Fed and the U.S. Treasury are sneaking money into the system

Stick with strength – some tech stocks are moving decidedly higher

Let the market stop you out of positions – so far, our portfolio has remained resilient

If a position does not get stopped out, it’s a sign of strength and it should remain in the portfolio – we have 11 such positions in the portfolio right now

Hedge when necessary – we have an insurance trade setup in place.

Moreover, our combined eleven positions, spread throughout our Momentum Monday and ESP Tuesday portfolios, updated today remain intact with several position delivering or setting up for a major breakout.

Here’s a brief update of what we’ve accomplished lately.

Last week we took profits on RTX Technologies as listed below:

SOLD Raytheon Technologies (RTX). Bought 5/21/25: $136.25. 6/13/25 intraday price: $144.50. Return for this trade: $825/100 shares (6.05%)

In this issue I am updating all Sell stops and pertinent portfolio positions and waiting for things to calm down before adding any new positions.

Important Announcement – Today is the Final Day for our discount offer!

Act now as time is running out on our 20% discount special offer to the Smart Money Passport, which you can access here. While some are panicking, we’re following our trading plan. If you’re an active pragmatic trader, this is your service.

Is it worth it?

If you’re wondering whether you’ll be spending your hard earned money wisely by subscribing to The Smart Money Passport, consider what the discounted price of $152/year will buy. First, we have 11 open positions which are holding up well in a volatile market and are poised to rally at any moment.

Moreover, our record of picking winners is well established. In addition to the $825 profit on RTX Technologies described above, your $152 subscription offers access to trades such as these:

SOLD - Walmart (WMT). Bought 4/8/25: Bought 4/8/25: $84. SOLD 5/15/25 intraday: $94. Return for this trade: $1000/100 shares (11.9%).

SOLD Argan Inc. (AGX). Bought 4/30/25: $152.05. SOLD 5/9/25: $171.27. Return for this trade $1922/100 shares (12.64%) and

SOLD - Dutch Bros (BROS). Bought 12/24/2024: $53.80. SOLD 02/13/25 intraday price: $83.45. Return for this trade: $2965/100 shares (35.5%%). Your results may differ.

Those three trades produced $5887 in profits. That’s almost a 40X multiple on your discount subscription price. There aren’t too many places these days where $1 turns into $40.

But those are only some of the outstanding results. Consider these whopper trades below:

Here are some more huge results, with these trades delivering over $10,000 in profits:

SOLD Palantir (PLTR)– Bought 4/7/25: 75.05. SOLD 5/5/25 intraday $125 when price target was hit. Return $5000/100 shares (67%).

SOLD Palantir (PLTR) Above $75 – Bought 4/7/25: 75.05. SOLD 5/6/25 intraday price: $118. Return $4300/100 shares (57%).

SOLD - Palantir (PLTR) Above $85 – Momentum Approach. Bought 4/9/25: $85.05. SOLD 4/14/25: $93.75. Return for this trade: $870/100 shares (9.28%).

SOLD - Palantir (PLTR). Bought 3/17/25: $85.75. SOLD 3/27/25: $91. Return for this trade: $625/100 shares (6.87%).

SOLD Advanced Microdevices above $171. Bought 7/5/24: $171.05. 7/11/24 intraday price: $174.43. Return for this trade: $1470 (8.59%).

Time’s ticking away on this offer. Subscribe now.

Market Update

The stock market is mixed as headlines continue to move prices.

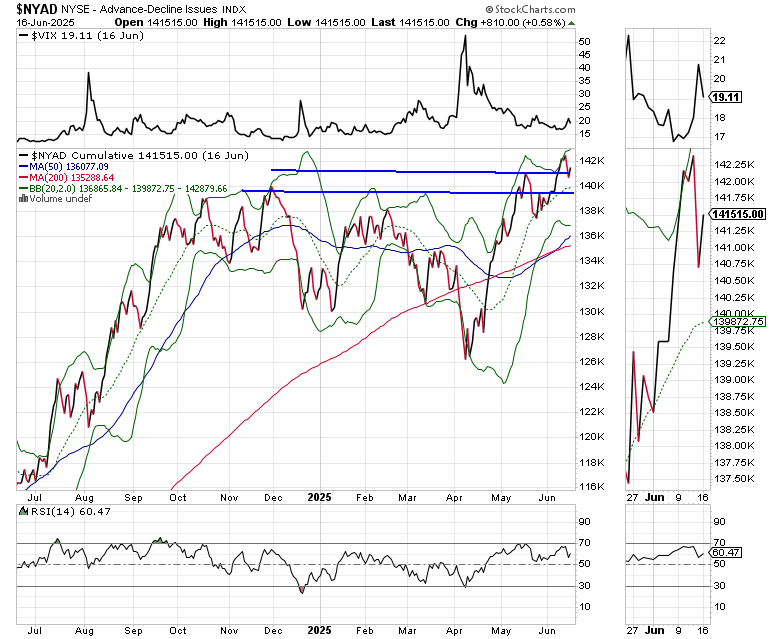

The New York Stock Exchange Advance Decline line (NYAD) recovered yesterday and is flat this morning, holding above its 20-day moving average. Keep an eye on the 50 level on RSI, the support lines, and the 20 and 50-day moving averages. If NYAD holds above this support cluster, we are likely going to move higher. Also, keep an eye on the dip buyers. If they materialize as the news shifts, the bullish trend will have a chance.

The S&P 500 (SPX) is still trading above 6000 with support still holding at the 5850-5950 support band and resistance at 6000-6100 area. A breach of the upper or lower end of this range will likely be very meaningful.

The U.S. Ten Year Note yield (TNX) is still trading between 4.3 and 4.6%. A breakout above or below this range will likely have significant effects on stocks and other markets.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.