Image courtesy of freekpik.com

The tariff tantrum of the past few months has given way to a tariff blow off spurred by the pause between China and the U.S. Yet, the market’s breadth has not reached a new high. Certainly, the New York Stock Exchange Advance Decline line (NYAD) is within reach of the important milestone. But, it didn’t happen today.

Just, to be clear. In order for the “all clear” signal, NYAD has to close above the blue trend line and then hold above it for at least two days, even if only consolidation mode. Next, it needs to move steadily higher.

On the plus side, the S&P 500 (SPX) is back above its 200-day moving average. SPX needs to hold above this important support level and keep climbing, preferably as NYAD makes new highs.

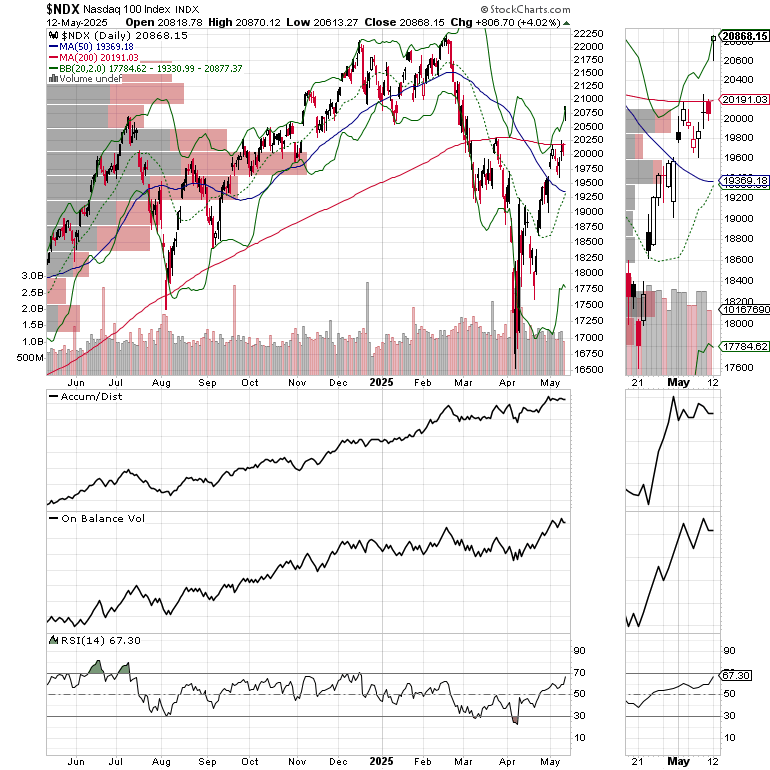

Another positive is the bullish reversal above the 200-day moving average by the Nasdaq 100 (NDX). This confirms that money is moving back into tech.

You can also see the bullish tone expressed in the semiconductor sector (SMH), which also closed above its 200-day moving average.

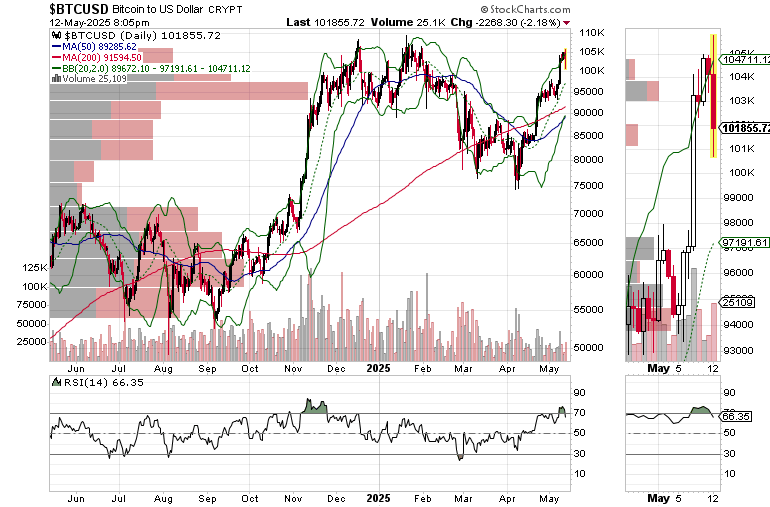

Bitcoin (BTCUSD) moved in the opposite direction suggesting that the allure of the stock market may take some of crypto’s recent luster away.

Finally, the U.S. Dollar (USD) may have put in a short term bottom.

Bottom Line

Lots of people got caught off guard with the U.S.-China tariff announcement. Money flows reversed away from crypto and foreign currencies and made their way back to U.S. Stocks. That’s a short term positive.

Still, this isn’t quite over. A lot can happen in the next few days, starting with the CPI and PPI numbers this week. But don’t worry I’ve got you covered. More details in tomorrow’s ESP portfolio update.

If you’re an ETF trader and trade ETFs in your 401(k) or self directed IRA, consider, Joe Duarte’s Sector Selector, which has been nibbling at tech and growth funds over the last few weeks, a strategy that’s been paying off. . It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about starting a day trading career, my new book “Day Trading 101” will get you started on the right foot. For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better with extra energy, and vitality. Visit my Health Page.