Stocks Keep Up Momentum. Bonds Hold Steady. Plus, a New Double Barrel Trade.

Mixed Economic Data Persists

This morning’s PCE deflator, the Fed’s favorite inflation measure came in as expected. This follows an upward GDP revision to 3% growth. As a result, the market continues to price in a soft landing.

On the other hand, low end retailers are sounding the alarm, with Dollar General (DG) offering a very cautious forward guidance while the persistent rumors that Big Lots (BIG) is going to file for bankruptcy have taken their toll on the company’s stock. Just for the record, I’ve been to my neighborhood Big Lots a few times lately, and it is eerily empty – every time. And while I’ve found some bargains, it doesn’t look as if too many people are making the trek.

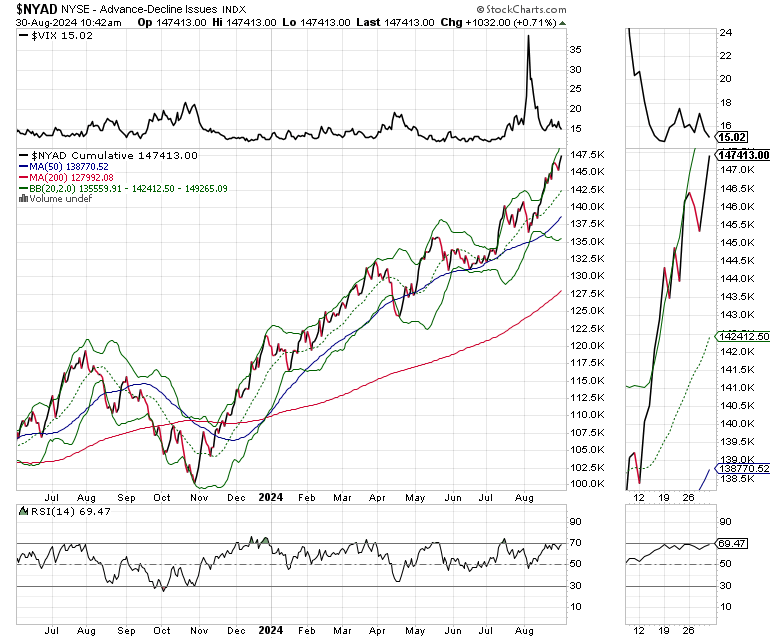

The New York Stock Exchange Advance Decline line (NYAD) continues to make new highs, a sign that the uptrend remains intact.

The U.S. Ten Year Note yield (TNX) continues to consolidate below 4% ahead of next week’s employment data barrage, and ahead of today’s PMI and ISM data, which I will discuss in this week’s Smart Money Trading Strategy Weekly.

Ahead of the Labor Day Holiday, I have a new trade with excellent potential and a low risk profile.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.