Stocks Jump. Other Markets Sort of Meh, as Tariff Deal Unveiled.

Plus, a new trade on a financial sector Stock which won’t fly under the radar much longer.

Image courtesy of smallbizclub.com

As often happens, the buildup to an event is more interesting than the outcome of the event. That seems to be the reaction to the U.S.-China tariff deal, which is more of a postponement of a deal as the two sides figure out how to keep the global financial system from unraveling as the Federal Reserve just watches the proceedings.

The upside, however, is that until proven otherwise, both sides have bought themselves some time and have given the markets some breathing room. Whether this pause will induce the Federal Reserve to ease rates in June, which would be welcome from a liquidity standpoint, remains to be seen.

The big winners, at least in the early going seem to be the technology stocks, especially the semiconductors. On the other hand, there is a steady and very stealthy money flow into stocks into the financial sector. Today, I am adding one which is very much under the radar but has just cleared a major resistance level and looks poised to move higher.

Market Update

The New York Stock Exchange Advance Decline line (NYAD) is again teasing to make a new high, but so far has not delivered. A new high on NYAD, followed by a series of new highs is a “must happen” event to confirm a return to a long term uptrend.

The S&P 500 (SPX) is back above its 200-day moving average which now becomes key support. Much of the gain is in the megacap tech stocks. But, given the current market, we’ll take it.

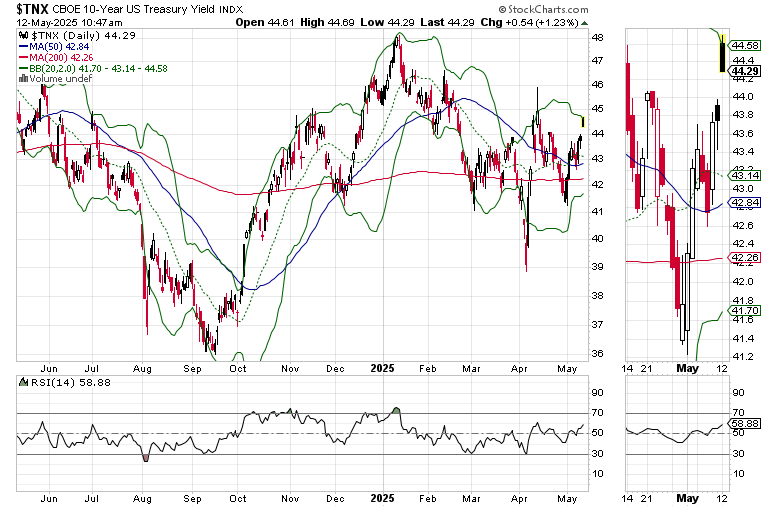

The U.S. Ten Year Note yield (TNX) is testing the upper end of its recent trading range. A move above 4.5% could be a negative for stocks.

Bitcoin (BTC) remained above $100,000, but mostly yawned after the details of the trade agreement were revealed. Our current BTC trade is in a good position.

If you’re an ETF trader, consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about starting a day trading career, my new book “Day Trading 101” will get you started on the right foot. For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better with extra energy, and vitality. Visit my Health Page.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.