Stocks Find Support as Bitcoin Delivers a Very Bullish Setup and the Fed Shows Signs of Splintering on Rates

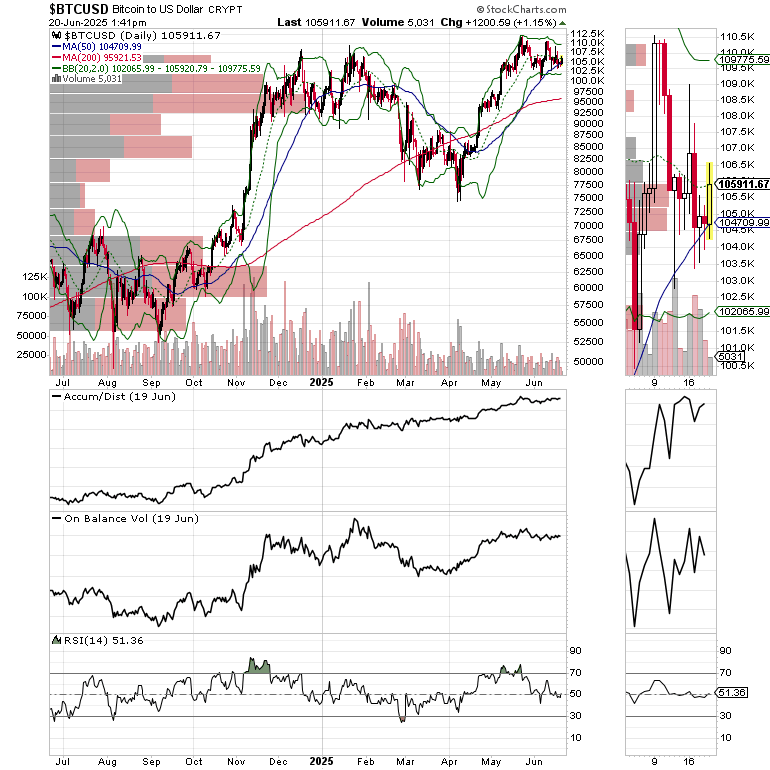

Bitcoin Model Turns Positive. New Trade Posted Today.

Image courtesy of storyblocks.com

The situation in the Middle East continues to develop as does the potential for market volatility as it progresses. Yet, closer to home, this morning’s remarks on CNBC by Fed Governor Christopher Wallace that he sees that inflation has slowed and the Fed could cut rates as early as July while keeping a close eye out for a resurgence. This suggests that the next Fed meeting might be a bit more contentious than the recent “agree fests” have been and that perhaps, Mr. Powell is starting to lose his grip on things. So again, here we go with more potential Washington drama. You fill in the blanks, I just trade.

That said, the Fed is clearly behind the eight ball as the Swiss central bank recently cut rates to zero while the EU has delivered eight consecutive cuts to its rates.

Liquidity rules the roost, as I’ve recently noted given the U.S. Treasury’s T-Bill sales and the Fed purchases of T-bonds, and our portfolios (Momentum Monday and ESP Tuesday) are well positioned for both up and down markets, although the odds of a move higher are increasing, barring something very negative developing. We are definitely compiling a shopping list in order to expand our stock holdings. But for now, given that we’re not completely out of the woods we continue to follow the central tenets of our trading plan:

Don’t fight the liquidity trend, which is positive – the Fed and the U.S. Treasury are sneaking money into the system

Stick with strength – some tech stocks are moving decidedly higher

Let the market stop you out of positions – so far, our portfolio has remained resilient

If a position does not get stopped out, it’s a sign of strength and it should remain in the portfolio – we have 11 such positions in the portfolio right now

Hedge when necessary – we have an insurance trade setup in place.

Moreover, our combined eleven positions, spread throughout our Momentum Monday and ESP Tuesday portfolios, updated today remain intact with several position delivering or setting up for a major breakout.

Market Update

The stock market remains resilient with the market’s breadth holding up despite a barrage of geopolitical headlines.

The New York Stock Exchange Advance Decline line (NYAD) remains above key support in the form of lateral trendlines along with important moving averages. Keep an eye on the 50 level on RSI, the support lines, and the 20 and 50-day moving averages. If NYAD holds above this support cluster, we are likely going to move higher. Also, keep an eye on the dip buyers. If they materialize as the news shifts, the bullish trend will have a chance.

The S&P 500 (SPX) remains above 6000 with increasingly important support still holding at the 5850-5950 and resistance at 6000-6100 area. A breach of the upper or lower end of this range will likely be very meaningful.

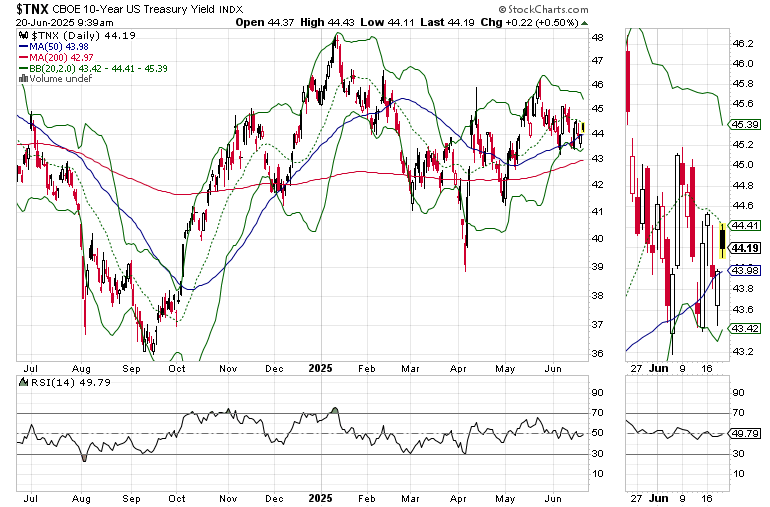

The U.S. Ten Year Note yield (TNX) is still trading between 4.3 and 4.6% but seems to be having trouble climbing above its 20-day moving average with support at the 50-day. Shrinking Bollinger Bands suggest that a big move is coming. A breakout above or below this range will likely have significant effects on stocks and other markets.

Bitcoin is coiling and could deliver a pleasant upside surprise. Bollinger bands squeezing along with prices holding at the 50-day moving average and the RSI finding support at 50 with the ADI and OBV lines holding up all line up as a bullish cluster of indicators. As a result, our Bitcoin Trading Model has turned positive and we are adding a new Bitcoin ETF trade this morning.

Thank you all for your support. If you have a 401(k) plan that offers ETFs as investing vehicles, consider Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about tuning up your investment playbook, my new book “The Everything Guide to Investing in Your 20s & 30s” will get you started on the right foot – pre-order now. For those wishing to get started on day trading, consider “Day Trading 101.” For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better with extra energy, and vitality. Visit my Health Products Page.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.