Image courtesy of freepik.com

I’ll be appearing on the Prudent Money Radio Show on 91.3 KDKR in Dallas with host Bob Brooks this afternoon, June 4, 2025 at 3 PM Central time to discuss general investment topics and my latest book, The Everything Guide to Investing in Your 20s and 30s. You can catch the interview Live here.

Market Update

The stock market continues to climb the wall of worry as tariff headlines, geopolitical issues, and now signs of a slowing economy creep into the conversation.

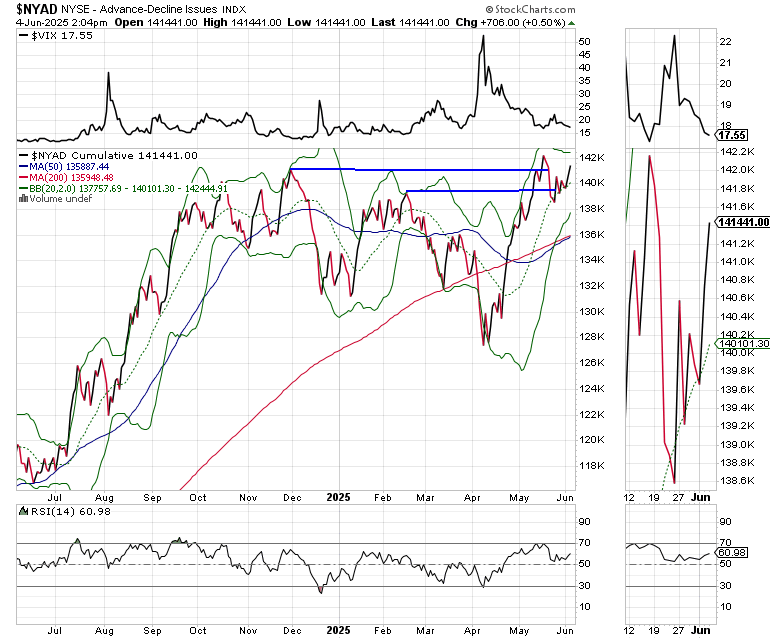

The New York Stock Exchange Advance Decline line (NYAD) is once again closing in on a potential new high. A new high on NYAD is likely to bring in more money into stocks as investors who’ve missed the rally from the April bottom, which we predicted here, will be forced to move in.

The S&P 500 (SPX) is closing in on 6000. As with NYAD a move above the 6000-6100 area is likely to bring in money from the sidelines, possibly extending the rally.

The U.S. Ten Year Note yield (TNX) has fallen dramatically today as the weaker than expected ADP private payrolls number came in weaker than expected. This raises the importance of this Friday’s employment numbers as pronounced weakness in that data set could move the Fed out of neutral and into easing mode.

The decline in TNX has boosted the housing sector with the iShares Home Construction ETF (ITB) testing the resistance of its 50-day moving average. Remember TNX is the benchmark for the 30-year mortgage rate, which means that a further decline in TNX could spur lower mortgage rates and at least a temporary boost in the housing sector.

We’re well positioned for a boost in the housing sector in our Weekender Portfolio.

Thank you all for your support. If you have a 401(k) plan that offers ETFs as investing vehicles, consider Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about tuning up your investment playbook, my new book “The Everything Guide to Investing in Your 20s & 30s” will get you started on the right foot – pre-order now. For those wishing to get started on day trading, consider “Day Trading 101.” For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better with extra energy, and vitality. Visit my Health Page.