Standing Pat as we Wait for Earnings and the Fed

Plus, major adjustments on our PLTR trade to preserve our $4000-Plus gains

Traders are waiting for developments on a big earnings calendar, which starts with Palantir (PLTR) a stock which we own, while attention pivots toward Wednesday’s Fed announcement on rates.

Palantir is likely to beat estimates and to give upbeat guidance as the company is firing on all cylinders. But that’s not a guarantee that the shares will rise after the announcement. Thus, I’m updating our Sell stop and setting up an options trade to hedge for any surprises.

Image courtesy https://vos-droits.be/

This morning, the CNN Greed/Fear Index jumped to 54 a neutral reading after last week’s close of 42. That’s a big jump over the weekend, suggesting that there are fewer doubters in this market and that a consolidation, or a rebound in volatility is about to unfold. No one should be surprised after nine days of consecutive rallying off an index reading of 4.

Market Update

The New York Stock Exchange Advance Decline line (NYAD) made a marginal new high last week but has rolled over this morning. There is support at the 50 and 200-day moving averages.

The S&P 500 (SPX) is also pulling back and remains in the 5600-5750 area with support at the 50-day moving average. Let’s see if it holds.

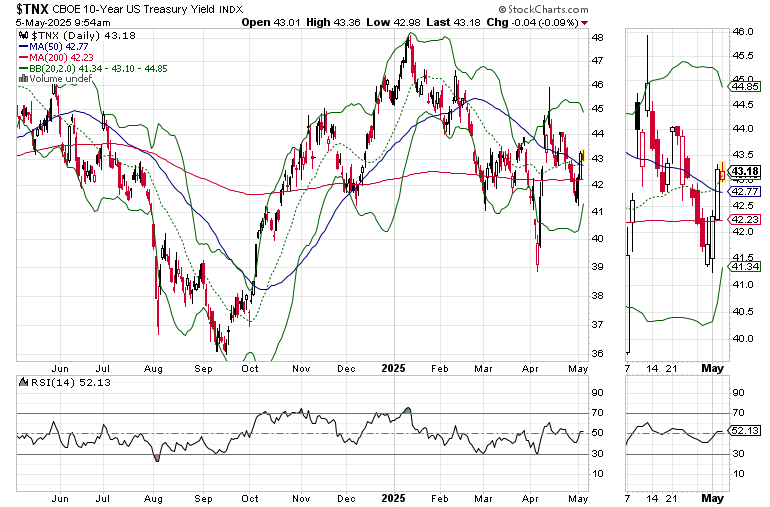

The U.S. Ten Year Note yield (TNX) is stuck in neutral trading between 4.2 and 4.5%. This type of action suggests that bond traders are not expecting any surprises from the Fed.

This morning, I am updating our PLTR strategy to preserve our nifty $4000/100 shares profit while adjusting Sell stops on the rest of the portfolio to preserve profits if volatility rises.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.