Should We Stay or Should We Go? Homebuilders, the Bond Market and Economic Data are a Tangled Mess.

Non-Farm Payrolls will likely decide the next moves by the Fed and the Bond market.

The bond market is on the verge of a big move. All of which brings back the iconic chorus of one the 1980’s best known punk/new wave anthems.

The homebuilder stocks were taken out to the proverbial woodshed this week, after D.R. Horton (DHI) missed its earnings and revenues and Green Brick Partners’ (GRBK) record quarter and bullish guidance failed to impress.

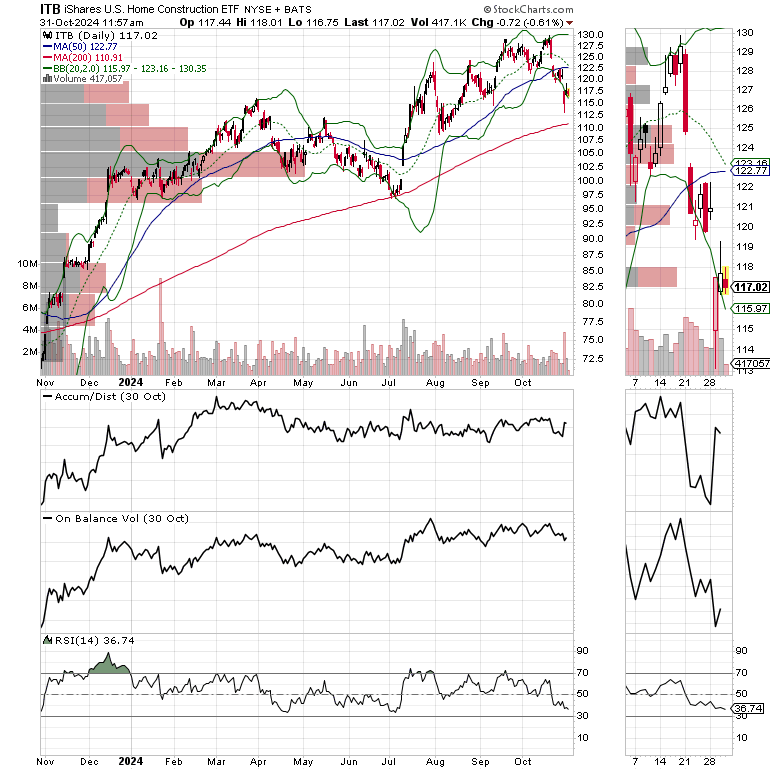

The sector now has the look of an unfolding panic, which, as I’m fond of saying, could well be yet another “BUY the dip opportunity,” or the end of a multi-year megatrend. We’ll know once bond yields peak and the sector responds.

Funkadelic Home Builders Roam the Land

First things first; the homebuilder stocks are in a funk, and the music has plenty of sour notes currently. Most of the confusion and the bearish trading pattern has to do with the fluctuating data, extraordinary events, an uneven economy, and the general anxiety of the moment. For one thing recent economic data remains inconclusive with GDP showing moderate growth but not meeting expectations while the jobs market data is mixed with job openings falling, fewer people quitting their jobs (a sign of insecurity) and private payrolls (ADP) coming in stronger than expected after crashing the prior month. All of which, of course, puts the onus on Friday’s NFP payroll number.

On the other hand, pending home sales came in stronger than expected as the recent, albeit brief, drop in mortgage rates moved plenty of potential buyers off the sidelines. But that just goes to show that the next set of data will likely show significant weakness as mortgage rates have once again moved higher.

Out Just in Time as Horton Misses on Everything

Last Thursday I suggested that buying homebuilder stocks on the recent dip might be a good idea. By the end of the week, however, after some further analysis on the current status of the financial system’s liquidity, I suggested that maybe giving the group some room was a better idea. In fact, by the end of last week, D.R. Horton (DHI), Lennar (LEN) and Green Brick Partners (GRBK) had hit their sell stops at Joe Duarte in the Money Options.com, albeit with hefty profits.

For the record, I sold a portion of my homebuilder shares but still have a moderate stake in several homebuilder and I’m waiting a bit longer before making a final decision given the potential for a top in bond yields at some point in the next few days or weeks.

Getting stopped out was fortuitous as the dismal performance after DHI’s most recent earnings miss proved. According to the earnings call:

· “Affordability challenges and competitive market conditions,” led to sales falling “below expectations;”

· Expect a new focus on more incentives and selling smaller houses;

· The average closing price was 1% below the prior year’s results;

· Q4 sales and orders were flat year over year;

· Gross margins were slightly below the prior year’s results;

· 2025 results will depend on the spring selling season; and finally.

· Revenues will be flat in 2025.

That’s not a very lively synopsis for sure, which is why the stock got clobbered. So, once again even though supply and demand are in favor of homebuilders, it’s all about interest rates and the strength of the economy and the jobs market.

So, is this a Horton isolated problem? Another of my recent favorites, Green Brick Partners (GRBK), in which I still own some shares delivered a much different earnings report which was more in line with what the rest of the homebuilders have been saying lately – Slightly smaller margins affected by incentives compensated by steady sales volume, allowing earnings beats. In fact, GRBK delivered record earnings and boosted its guidance for the rest of its fiscal year. Yet, the stock got clobbered.

Green Brick is well beyond oversold as it’s trading well outside its lower Bollinger Band with an RSI of 30. The next few days should tell an interesting story here.

This chart suggests that investors are starting to panic, which may be a bullish sign in the not too distant future, if interest rates reverse their current climb.

From a macro standpoint, you can cast the blame the bond market, which is not happy with the Fed’s rate cuts during a period when the economy is muddling along, and inflation is becoming structural.

Bond yields Are Near a Huge Decision Point

I could be wrong, but the bond market is so overbought that the longer yields rise, so will the odds of what could be meaningful reversal.

The U.S. Ten Year Note yield (TNX) is testing what could be the decision point between an upward acceleration or a meaningful reversal, the 4.3% area. Note that the RSI is well over 70 now, which means TNX is overextended. Meanwhile, the Bollinger Bands are starting to close in on prices, a classic sign that a big move is coming. That means that the NFP payrolls number, released tomorrow morning, could well tip the balance. A great way to prepare for a potential bond reversal is via an options trade which I’ve recently posted. You can check it out here.

Mortgage rates are now just below 7% once again. This is a negative in the short term, but we will see what happens if bond yields reverse.

Homebuilders and REITs – Big Moves are Setting Up.

The iShares U.S. Home Construction ETF (ITB) is holding up better than some of the individual homebuilders. It’s slowly nearing an oversold reading as the RSI level of 30 approaches.

REITs Are Still Hanging Around

The iShares U.S. Real Estate ETF (IYR) is trading just below its 50-day moving average and the ADI and OBV lines are diverging with ADI falling and OBV holding up. This suggests a potential short squeeze may be near.

Bottom Line

Homebuilder stocks have been sold aggressively on perceived earnings disappointments. What’s puzzling is that all of them are still making money and their margins are still healthy even though they are flattening out. A close review of the details suggests that some companies are in better shape than others. Nevertheless, the sector is nearing an important long term decision point.

Much of what happens next depends on how the bond market and mortgage rates respond to the economic data and the Federal Reserve’s next interest rate move.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101 – will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Ha! Love the P Funk reference!