Short Term Occupancy – Sell CALM for $1328 (8%) Profit

This was supposed to be a long term holding, but it got in a hurry so we're taking the money and running.

In this morning’s Smart Money Passport Extended Stay Portfolio update, I am recommending selling shares in egg producer Cal-Maine Foods (CALM) for a $1328 (8%) profit as the stock’s current advance is unsustainable, and given market conditions, I don’t want to risk giving this profit back.

The Extended Stay Portfolio is designed for stocks which exhibit the potential for extended gains over several weeks. CALM has not followed the script since we’ve owned the stock for less than a month. But we’ll certainly take the gains and move on.

SELL - Cal-Maine Foods (CALM). Bought 9/20/24: $73.85. SOLD 10/8/24: $87.13. Return for this trade: $1328/100 shares (8%).

Along with yesterday’s $1500 profit on Generac Holdings (GNRC), that brings the total gains Smart Money for the week to over $2800. And it’s only Tuesday.

In this issue, I am also adding a new Extended Stay pick, featuring a company which is flying under the radar but which should profit from the extended rebuilding that will be required in the hurricane stricken Southeast U.S.

Market Update

This morning, the stock market is mixed with money flowing away from the energy sector back into technology.

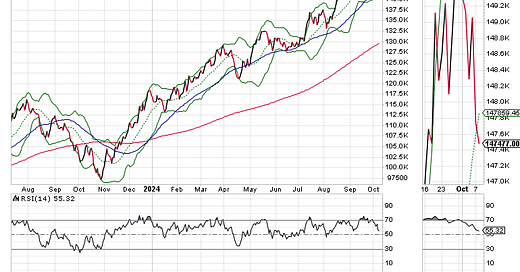

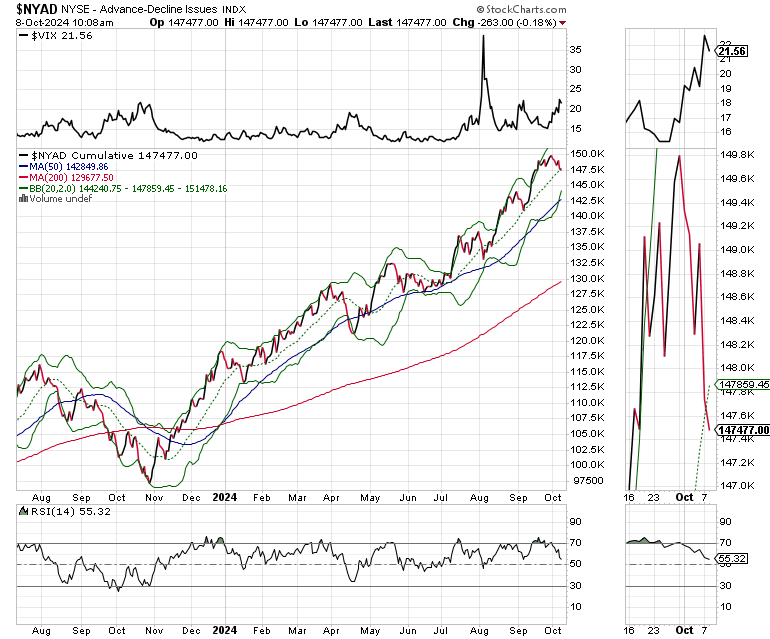

The New York Stock Exchange Advance Decline line (NYAD), the most accurate indicator of the market’s trend, is testing the support of its 20-day moving average. A failure will likely take NYAD to the 50-day moving average. Such a move would likely correspond to an RSI reading near 70. The combination of signals should offer an opportunity for the market to rebound.

The U.S. Ten Year Note yield (TNX)’s pesky move higher continues with the yield now moving toward an overbought reading with the RSI nearing 70. TNX is likely to respond to Thursday’s CPI dramatically. Thus, if CPI comes in stronger than expected, we should expect a move toward the 200-day moving average, bringing the yield close to 4.2%. That type of reading, in the current market, could prove to be enough to push stocks lower.

For now, the Nasdaq 100 Index (NDX), home of the big tech companies, is setting up for a big move, while remaining below 20,000. Note the Bollinger Bands are closing in toward prices. This signals that a big move is coming. For more on how to use Bollinger Bands check out this video.

Extended Stay Portfolio Update

In today’s issue, I am adding a new stock which should benefit from the ongoing hurricane related issues in the Southeast U.S.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport Momentum Portfolio.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.